More Signs of a Stock Market Top

Stock-Markets / Financial Markets 2010 Oct 23, 2010 - 08:47 AM GMT

As Freddie Mac Reports An Uptick In The 30 Year Mortgage Rate, Have Mortgage Rates Hit A Floor?

As Freddie Mac Reports An Uptick In The 30 Year Mortgage Rate, Have Mortgage Rates Hit A Floor?

(ZeroHedge) Is the floor in mortgage rates in? After hitting a record all time low of 4.19% in the week ended October 14, the Freddie 30 Year Fixed mortgage rate has risen slightly but appreciatively to 4.21% (chart below). This is not all that surprising considering the 10 Year UST has been meandering around the 2.5% spot for a while now. What it does indicate, however, is that absent QE2 mortgages may have just hit their floor for the current regime. As it is no secret the Fed is intent on lowering mortgage rates as low as possible the question becomes whether a level in the low 4%'s is enough for mortgage activity to finally pick up.

Jobless Claims Fall From Another Upwardly Revised Number

(ZeroHedge) Jobless claims "fell" to 452k with the story as usual being in the revision. Last week's 462K number which was originally expected to be 445K is now revised to 475K! But of course it is so much more palatable to get the BLS lie piecemeal instead of in one place. We are now on 25 out of 26 sequential upward revisions, and up to just under 250k Year to Date on initial claims. With this week's number beating expectations of 455k, only means the revised miss will be announced next week, when this week's number is revised to north of the expectation.

State Job Loss Statistics Reveal More than the 95,000 Jobs Lost in September.

The Bureau of Labor Statistics report on state unemployment figures reveals a total loss of jobs in September was 223,800 instead of the 95,000 jobs reported lost last week. The 136% discrepancy in reported losses seems to be a little more than a rounding error.

More Signs of a Top.

-- The Investment Company Institute has just reported inflows of cash into just about everything…except domestic stock funds. This is the 24th sequential outflow from domestic equity mutual funds, this time the smallest outflow since the Flash Crash. And that brings the total YTD mutual fund redemptions to a mere $80 billion. To offset this, the Fed has increased its liquidity injections to nearly $10 billion this week alone.

-- The Investment Company Institute has just reported inflows of cash into just about everything…except domestic stock funds. This is the 24th sequential outflow from domestic equity mutual funds, this time the smallest outflow since the Flash Crash. And that brings the total YTD mutual fund redemptions to a mere $80 billion. To offset this, the Fed has increased its liquidity injections to nearly $10 billion this week alone.

Treasuries Testing its Trend Line.

-- Treasuries fluctuated amid speculation about how much U.S. debt the Federal Reserve may buy if it resumes asset purchases to spur the economy. U.S. government securities rose earlier after Fed Bank of St. Louis President James Bullard said yesterday the size of asset purchases should be based on economic conditions, starting with $100 billion next month. Citigroup Global Markets Inc. said it expects the Fed to announce $500 billion to $700 billion in purchases. Policy makers meet Nov. 2-3.

-- Treasuries fluctuated amid speculation about how much U.S. debt the Federal Reserve may buy if it resumes asset purchases to spur the economy. U.S. government securities rose earlier after Fed Bank of St. Louis President James Bullard said yesterday the size of asset purchases should be based on economic conditions, starting with $100 billion next month. Citigroup Global Markets Inc. said it expects the Fed to announce $500 billion to $700 billion in purchases. Policy makers meet Nov. 2-3.

Gold Slipped This Week. It May Decline More Than Expected.

--Gold futures fell in New York, heading for the biggest weekly loss since July, as a stronger dollar boosted speculation that the precious metal’s rally to a record this month was overdone.

--Gold futures fell in New York, heading for the biggest weekly loss since July, as a stronger dollar boosted speculation that the precious metal’s rally to a record this month was overdone.

“Gold is in the midst of a long-awaited correction,” said Frank McGhee, the head dealer at Integrated Brokerage Services in Chicago. “From a technical point, there’s really nothing between here and $1,260 for gold to hang its hat on.”

Japan’s Stocks Are Fading...

-- Japanese stocks gained for the first time in three days as higher-than-estimated company earnings and a drop in U.S. jobless claims boosted confidence in a global economic recovery.

-- Japanese stocks gained for the first time in three days as higher-than-estimated company earnings and a drop in U.S. jobless claims boosted confidence in a global economic recovery.

The Nikkei 225 Stock Average rose 0.5 percent to 9,426.71 at the close in Tokyo. For the week, the Nikkei 225 lost 0.8 percent, while the Topix dropped 0.2 percent. Stocks also climbed after some U.S. earnings reports beat estimates.

China’s Gains Get Shaved At the End of the Week.

-- China’s stock index fell for a second day, narrowing this week’s gains, as banks and brokerages dropped on concern quickening inflation may push policy makers to boost interest rates further. Industrial & Commercial Bank of China Ltd. led a gauge of financial stocks lower for a second day after data showed the fastest inflation in 23 months.

-- China’s stock index fell for a second day, narrowing this week’s gains, as banks and brokerages dropped on concern quickening inflation may push policy makers to boost interest rates further. Industrial & Commercial Bank of China Ltd. led a gauge of financial stocks lower for a second day after data showed the fastest inflation in 23 months.

The Dollar Has Broken Out Of Its Decline.

-- The dollar was poised for its first weekly advance in six weeks versus currencies including the euro and yen as Treasury Secretary Timothy F. Geithner suggested that Group of 20 members set targets for reducing trade deficits.Geithner proposed in a letter that G-20 members meeting in South Korea try to reduce trade surpluses and deficits “below a specified share” of their economies.

-- The dollar was poised for its first weekly advance in six weeks versus currencies including the euro and yen as Treasury Secretary Timothy F. Geithner suggested that Group of 20 members set targets for reducing trade deficits.Geithner proposed in a letter that G-20 members meeting in South Korea try to reduce trade surpluses and deficits “below a specified share” of their economies.

Many of the G-20 countries want to protect their export economies. That will clash with the U.S. point of view. I don’t expect the G-20 meeting to be fruitful.

The Largest Financial Swindle in World HIstory.

-- The tidal wave of evidence showing that the giant banks have engaged in fraudulent foreclosure practices is so large that the attorneys general of up to 40 states are launching investigations.

-- The tidal wave of evidence showing that the giant banks have engaged in fraudulent foreclosure practices is so large that the attorneys general of up to 40 states are launching investigations.

People's homes are being taken when they didn't even hold a mortgage, and the big banks have been using "robo signers" to forge mortgage related documents. Indeed, even president Obama has been hit by robo signers .

Retail Gasoline Prices Are Not Showing a Strong Upturn.

--The Energy Information Agency weekly report observes, “The bulk of U.S. middle distillate consumption comes from heavy duty trucking and air travel, which are both affected strongly by economic activity. Gasoline consumption, on the other hand, is more sensitive to changes in personal income, which fared better than economic activity during the downturn. Once the economy began to recover, middle distillate fuels exhibited stronger growth than gasoline.”

--The Energy Information Agency weekly report observes, “The bulk of U.S. middle distillate consumption comes from heavy duty trucking and air travel, which are both affected strongly by economic activity. Gasoline consumption, on the other hand, is more sensitive to changes in personal income, which fared better than economic activity during the downturn. Once the economy began to recover, middle distillate fuels exhibited stronger growth than gasoline.”

Natural Gas Consumption Spiked Higher. Will Prices Follow?

-- The U.S. Energy Information Administration reports, “This week’s price declines occurred despite increases in consumption from the previous week. Natural gas consumption is estimated by BENTEK Energy Services, LLC, to have increased 4.7 percent during the week, as increases in residential and commercial natural gas use more than offset declines in the use of natural gas for power generation.”

-- The U.S. Energy Information Administration reports, “This week’s price declines occurred despite increases in consumption from the previous week. Natural gas consumption is estimated by BENTEK Energy Services, LLC, to have increased 4.7 percent during the week, as increases in residential and commercial natural gas use more than offset declines in the use of natural gas for power generation.”

The REAL Big Story for Financial Markets Today… Which No One is Talking About

(ZeroHedge) Few commentators realize what the BIG story is for the financial markets today. The BIG story is not the mortgage fraud, the corruption, or the computerized trading (although the last one dominates US stock markets’ daily action).

No, the big story is the monetary actions of the massively indebted US vs. the credit cooling China.

Indeed, while Bailout Ben Bernanke and several his cronies at the Federal Reserve have been braying for additional QE and currency weakness, China has been aggressively restricting credit lending, raising interest rates, and generally making moves to cool its overheated system.

In plain terms, this is a conflict between the world’s old superpower (its largest debtor nation) and its rising new superpower (its largest creditor nation). It represents the largest conflict in global financial markets as well as THE most significant development to watch for those looking to successfully trade the markets.

Taxpayers To Fund Up To $363 Billion In GSE Losses By 2013

(ZeroHedge) The FHFA has just released it revised "draw" projections for the GSEs, i.e., money which US taxpayers will have to spend to keep the nationalized securitization monsters alive. The reality: after already receiving $148 billion from Tim Geithner's US Treasury, the FHFA now estimates that its downside case will result in additional $220 billion over the next 2 years, for a total of $363 billion through 2013.

Mortgage Mess: Shredding the Dream

(Bloomberg) In 2002, a Boca Raton (Fla.) accountant named Joseph Lents was accused of securities law violations by the Securities and Exchange Commission. Lents, who was chief executive officer of a now-defunct voice-recognition software company, had sold shares in the publicly traded company without filing the proper forms. Facing a little over $100,000 in fines and fees, and with his assets frozen by the SEC, Lents stopped making payments on his $1.5 million mortgage.

The loan servicer, Washington Mutual, tried to foreclose on his home in 2003 but was never able to produce Lents' promissory note, so the state circuit court for Palm Beach County dismissed the case. Next, the buyer of the loan, DLJ Mortgage Capital, stepped in with another foreclosure proceeding. DLJ claimed to have lost the promissory note in interoffice mail. Lents was dubious: "When you say you lose a $1.5 million negotiable instrument—that doesn't happen." DLJ claimed that its word was as good as paper. But at least in Palm Beach County, paper still rules. If his mortgage holder couldn't prove it held his mortgage, it couldn't foreclose.

Europe Seen Avoiding Keynes’s Cure for Recession

(New York Times) The British economist John Maynard Keynes may live on in popular legend as the world’s most influential economist. But in much of Europe, and most acutely here in the land of his birth, his view that deficit spending by governments is crucial to avoiding a long recession has lately been willfully ignored.

In Britain, George Osborne, chancellor of the Exchequer, delivered a speech on Wednesday that would have made Keynes — who himself worked in the British Treasury — blanch.

He argued forcefully that Britons, despite slowing growth and negligible bank lending, must accept a rise in the retirement age to 66 from 65 and $130 billion in spending cuts that would eliminate nearly 500,000 public sector jobs and hit pensioners, the poor, the military and the middle class because of what he insisted was the overwhelming need to reduce the country’s huge budget deficit.

He argued forcefully that Britons, despite slowing growth and negligible bank lending, must accept a rise in the retirement age to 66 from 65 and $130 billion in spending cuts that would eliminate nearly 500,000 public sector jobs and hit pensioners, the poor, the military and the middle class because of what he insisted was the overwhelming need to reduce the country’s huge budget deficit.

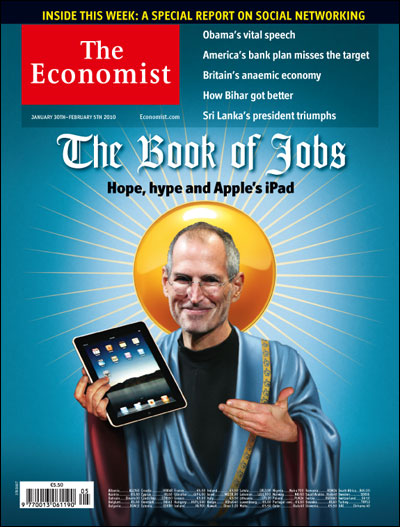

A Sign of a Top.

The front cover of this week's Economist features a picture of Apple CEO Steve Jobs dressed as an Old Testament prophet. However, whereas Moses carried stone tablets, Jobs is carrying an iPad. 'The Book of Jobs' is a play on the Book of Job, one of the books of the Hebrew bible.

You can read the iPad article here. The current issue also features a special report on social networking(also available as a PDF download).

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.