Fed POMO Plunge Protection Team Stock Market Manipulation?

Stock-Markets / Market Manipulation Nov 03, 2010 - 09:55 AM GMTBy: EWI

Rumors are, the U.S. government "is propping up the stock market."

Rumors are, the U.S. government "is propping up the stock market."

'By far, the most frequent question we've been asked recently at EWI's Message Board is this: "What is your take on the persistent internet chatter that the Federal Reserve is holding up the stock market via QE2, POMO, etc.? How can stocks ever decline again if the Fed is in control?" Here is an eye-opening chart that will help shed more light on this issue. Read more.

You will find many intriguing Q&As at EWI's Message Board. We offer it as a free way for our Club EWI members and subscribers to interact with EWI and the Socionomics Institute's experts. We strive to answer every Message Board reader, and publicly post the best Q&As. By far, the most frequent question we've been asked recently is:

"What is your take on the persistent internet chatter that the Federal Reserve is holding up the stock market via QE2, POMO, etc.? How can stocks ever decline again if the Fed is in control?"

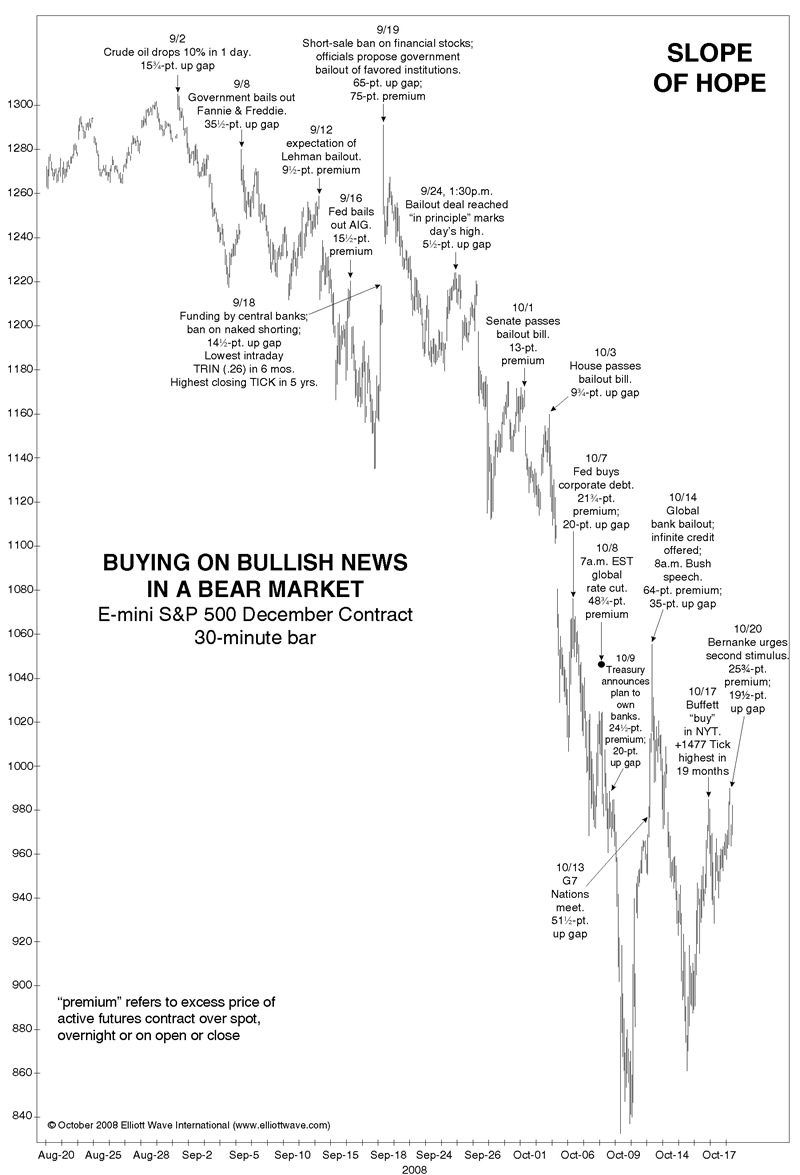

We have several active Message Board posts that touch on "market manipulation." But here is an eye-opening chart that will help shed more light on this issue.

EWI President Robert Prechter published this chart in his October 2008 Elliott Wave Theorist. Review this chart carefully. For too many investors, the crash of 2007-2009 is becoming a hazy memory. And almost no one in the mainstream financial media talks about the utter panic in the markets in September-October 2008, the worst part of the crash.

If you think back to that time, you may remember that the Federal Reserve and U.S. government took many aggressive steps to help stop the collapse. Every time they would announce a new intervention, the market would cheer. Result? Prechter's chart gives an unequivocal answer:

As you can see, announcements of bailouts, unlimited credit, bans on short sales, etc., were powerless against the biggest stock market collapse in 76 years. The DJIA kept sliding. It didn't stop until March 6, 2009 -- after it had slipped below 6,500.

So: Is the Fed and the "Plunge Protection Team" engaged in market manipulation? You can browse EWI's Message Board for some answers, but one thing is clear: When stocks were crashing two years ago, few dared to suggest that the Fed was in the saddle. Bob Prechter puts it best:

"When markets go up, the Fed seems to be in control; when they go down, it seems out of control. But the control aspect is an illusion."

Get the 33-page Market Myths Exposed eBook for FREE Learn why you should think independently rather than relying on misleading investment commentary and advice that passes as common wisdom. Just like the myth that government intervention can stop a stock market crash, Market Myths Exposed uncovers other important myths about diversifying your portfolio, the safety of your bank deposits, earnings reports, inflation and deflation, and more! Protect your financial future and change the way you view your investments forever! Learn more, and get your free eBook here.

This article was syndicated by Elliott Wave International and was originally published under the headline The Fed and "Plunge Protection Team": Are They Manipulating Stocks?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.