Gold Stocks Big Picture Investing The Only Way to Go!

Commodities / Gold & Silver Stocks Dec 03, 2010 - 12:53 PM GMTBy: Jeff_Clark

By Jeff Clark, Senior Editor, BIG GOLD writes: Wanna know how to make a small fortune in the stock market? Start with a large fortune and buy stocks based on your emotions. Wickedly funny. Disastrously true. Letting your emotions determine the timing of stock purchases means buying when everyone around you is buying – that’s why you feel so certain – and ensures you will enter near an interim top.

By Jeff Clark, Senior Editor, BIG GOLD writes: Wanna know how to make a small fortune in the stock market? Start with a large fortune and buy stocks based on your emotions. Wickedly funny. Disastrously true. Letting your emotions determine the timing of stock purchases means buying when everyone around you is buying – that’s why you feel so certain – and ensures you will enter near an interim top.

We prefer a “BP” (Big Picture) approach to buying. As an example, at the height of the recent Gulf oil disaster, wild speculation of British Petroleum’s ultimate demise drove the stock price down in a wave of panicked selling. To use a classic Doug Casey idiom: there was blood in the streets on this stock. That is the time to buy, and those that kept the big picture in mind have profited nicely.

If you were peeking over my shoulder as I reviewed reader email, you'd eventually notice that when it comes to complaints, most center on one thing: losses on stock positions. And the circumstances for the losses consistently boil down to these: bought just before a downturn; panicked in a correction and sold for a loss; bought too much; or expected prices to head for the moon by Tuesday.

Emotional buying and impatient owning. These unfortunate patterns of investor behavior are all too common and underscore the importance of following a disciplined plan of accumulation.

Which leads to this: understanding my philosophy, and that of Casey Research in general, will help you interpret our buying recommendations and stick with the plan. It's actually very simple:

We're investing in the big picture and for the long haul.

Although we monitor the precious metals markets daily, when it comes to putting our money on the table, it's done with the big picture in mind. What are these major themes? Our research points to massive and ongoing economic, fiscal, and monetary forces that are not only positive for gold but make owning it essential. So that's where we're placing a large chunk of our chips at this point in the cycle.

How do you make the highest returns with gold stocks? Don’t panic and sell if they drop. Maintain an appropriate level of exposure to them – enough to make a difference in your life if we’re right, but not so much that you are wiped out if we're wrong. And don’t let short-term market noise sabotage your plan; stay focused on the long-term trend.

Why the reminders? Because after watching our positions run higher over the past few months, it's perfectly normal to expect them to take a breather. And we want to buy when they're tired from running, not when they’re in the middle of a sprint.

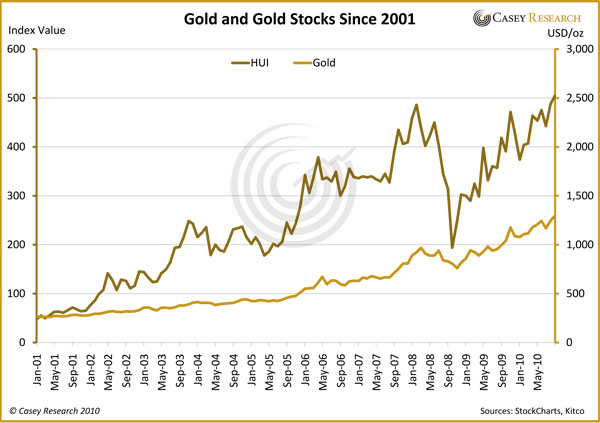

Here's some big-picture perspective. This chart shows the percentage gain in gold and gold stocks since the bull market began in 2001 (based on beginning-of-month prices).

You can see two obvious takeaways. From 2001 through 2007, gold gained 220% while gold stocks, represented by the HUI index, returned 945%. Think about that… gold producers, as a group, returned over ten times your money in six years. That represents more than 4-to-1 leverage to gold.

Conversely, in the 2008 meltdown, gold stocks lost roughly a third more than gold itself. And if you study the chart, you'll see plenty of other times where gold fell and gold stocks fell further.

The point: spotting a bargain means understanding prices within the context of the overall trend. Gold stocks are trending up, and will continue to do so, but there will always be corrections along the way. And the investment advice that flows from this outlook is:

Buy gold stocks when they're correcting, not when they're advancing. And be patient. There’s no rush, as the mania still lies ahead.

[Jeff Clark keeps his finger on the pulse of the gold and silver sectors, resulting in handsome profits for his BIG GOLD subscribers: returns of 43.1%... 56.8%... even 187.9%. Read all about Jeff’s secrets for picking the best stocks at the right time – click here for details.]

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.