How You Can Profit From the Return of the American Consumer

Companies / Sector Analysis Dec 05, 2010 - 05:49 AM GMTBy: Investment_U

David Fessler writes: It didn’t take a genius to see how the situation would unfold…

David Fessler writes: It didn’t take a genius to see how the situation would unfold…

Towards the end of 2009, with the U.S. economy mired in a deep recession, hundreds of thousands of people losing their jobs, and many consumers counting the cost of excessive spending, the shift began.

Americans collectively sucked in their fat bellies and tightened their financial belts.

It was a good move for them… but disastrous for the U.S. economy.

I detailed this change in September 2009, with an article entitled: “The Paradox of Thrift: How a Better Savings Rate is Fueling the Recession.”

To combat the spending slowdown, the Federal Reserve swung into action. It suggested that the only way to kickstart the economy was to fill the money “vacuum” by replacing it with some other money source.

We all know what happened next. The Fed printed trillions of dollars and gave birth to “Quantitative Easing.” And it’s since had an offspring – “QE2.”

And throughout it all, Americans have quietly saved more money and paid down credit card and mortgage debt.

The question is: What does this mean for the U.S. economy, now that we’re into one of the most crucial periods of the year?

Consumers Stash the Cash

I recently spoke with a friend of mine, who’s the president of a local bank. She said that for the past two years, consumers have shuffled their cash into savings and lowered their debts. She told me that her bank is seeing fewer loan defaults, too.

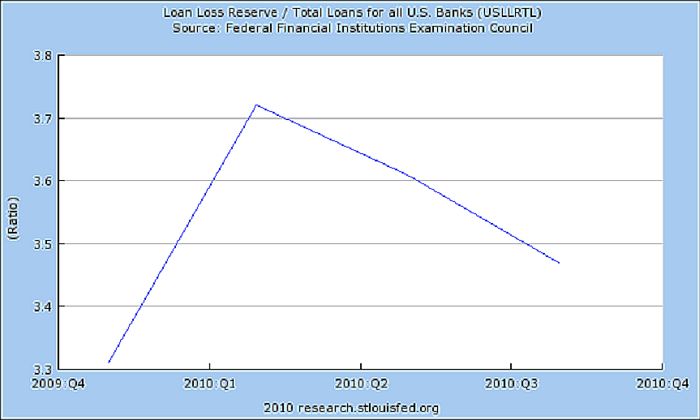

But has nearly three years of consumer thrift made a meaningful difference? The current figures on loan loss reserves would seem to indicate so.

As you can see in the data from the St. Louis Federal Reserve Bank, loss reserves peaked at $3.73 billion in late 2009 and early 2010 and have dropped steadily ever since. They currently sit at around $3.46 billion, down just over 7%.

Translation? Americans are faring better financially. According to the Federal Reserve Bank of New York, total consumer debt has fallen by nearly $1 trillion since late 2009 to $11.58 trillion.

Consumer confidence is slowly returning, too. People are starting to spend again, providing a much-needed boost for the economy. And that’s good news for one sector in particular…

Holiday Season Cheer for America’s Retailers

It’s widely accepted that consumer spending accounts for over 70% of U.S. GDP. And with the holiday spending season upon us, news of Americans’ improved financial health couldn’t come at a better time for the nation’s retailers.

Speaking to Time, Kathy Grannis of the National Retail Federation commented on the recent Black Friday sales: “There were bargain-hungry shoppers and retailers really did pull out all the stops for people.”

Initial results seem to indicate shoppers were out in force and that the overall numbers were up from last year.

While some of the big box stores like Wal-Mart (NYSE: WMT) were open earlier than last year, online shopping was also up, which bodes well for companies like Amazon (Nasdaq: AMZN) and eBay (Nasdaq: EBAY).

These stocks offer a way to play a potential uptick in consumer spending this holiday season and the fact that consumers are improving their finances is cause for cautious optimism as we head into what could be a more robust 2011.

Good investing,

Source: http://www.investmentu.com/2010/December/profit-from-the-return-of-the-american-consumer.html

by David Fessler, Advisory Panelist, Investment U

Copyright © 1999 - 2008 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.