Fed’s Bullard Defence of QE2 is Full of Contradictions

Interest-Rates / Quantitative Easing Dec 22, 2010 - 07:19 AM GMTBy: Dian_L_Chu

James Bullard, President of the Federal Reserve Bank of St. Louis was on CNBC Monday, December 20, 2010 mostly defending the Fed’s controversial $600 billion Treasury purchasing program (QE2) announced in Nov.

James Bullard, President of the Federal Reserve Bank of St. Louis was on CNBC Monday, December 20, 2010 mostly defending the Fed’s controversial $600 billion Treasury purchasing program (QE2) announced in Nov.

What struck me as totally self-contradictory were Bullard’s statements regarding the QE2, treasury yield, inflation expectations, and inflation, which I will outline and rebuff below.

Bullard – Higher Treasury Yield = QE2 Success

During the interview, aside from the usual Fed PR spin that QE2 has been 'modestly successful so far', he also states:

“People who see the rise in Treasury yields as a sign the Fed's purchases were not having their desired effect should look at other measures, especially the improvement in the economic outlook and the rise in inflation expectations in the market for Treasury Inflation-Protected Securities (TIPS). These are the ultimate goals of the Fed's policy.”

Bullard – QE2 Unrelated to Rising Commodity Prices

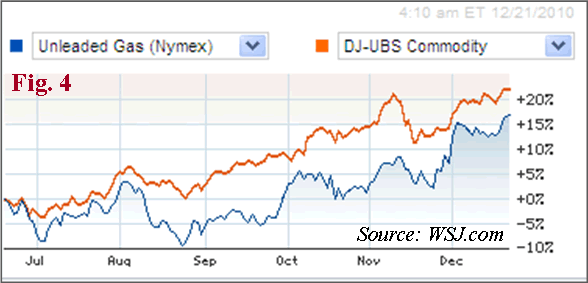

But when Fred Smith, Chairman, President and CEO of FedEx asked whether QE2 was related to the run-up in commodity prices, fuel prices in particular, which has been up 15% in the last 90 days and acted as a tax on American consumers, Bullard had this to say:

“…Is there some independent effect coming from monetary policy other than supply and demand conditions globally…I haven’t seen very much evidence of that, but would like to keep an eye on that.”

So, basically Bullard touts QE2 as building up inflation expectations, driving up treasury yields (thus averting a potential deflationary cycle), which was the goal of the Fed QE2 initiative. Furthermore, Bullard contends that global demand and supply factors are behind the record high prices across almost all commodities, which he believes is unrelated to QE2.

Higher Treasury Yields– Kills Housing et al

First of all, the ultimate goal of the Fed’s securities purchases (QE2), as outlined by Chairman Bernanke in his speech at Frankfurt, Germany on Nov. 19, is to “lower interest rates on securities of longer maturities” to support household and business spending.

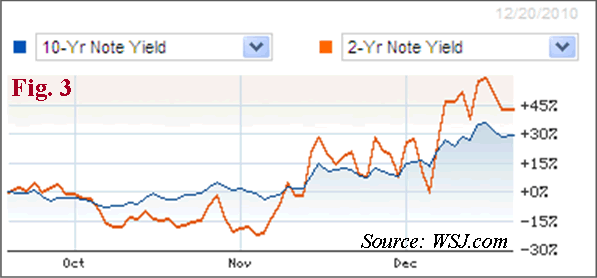

On that measure, QE2 has failed miserably. Interest rates, instead of declining, are rising rapidly driven by the bond markets and the bond vigilantes. The 10-year yield was at a low for the year of 2.4% in early October, and has shot up to a seven-month high of 3.56% the week of Dec. 12, before easing back to around 3.34% on Monday Dec. 20. (Fig. 1)

The yield on the U.S. Treasury is used as a benchmark to set interest rates on many kinds of loans including mortgages, and business borrowing rates in the capital market. So, the sharp rise in yields on Treasurys since the QE2 announcement in early November not only kills any flickering recovery sparks in the housing and other related sectors, but also raises the borrowing costs and interest payments of Uncle Sam.

Higher Borrowing Costs for Uncle Sam

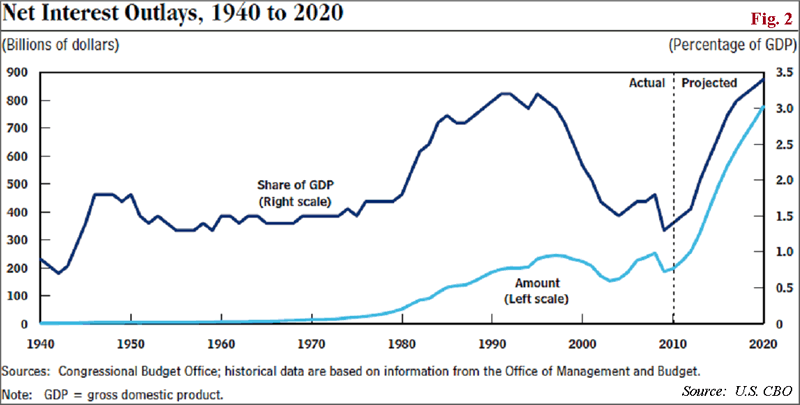

The Congressional Budget Office (CBO) on Dec. 14 projects that under current law, debt held by the public will exceed $16 trillion by 2020, reaching nearly 70% of GDP. The CBO also projects the combination of rising debt and rising interest rates to cause net interest payments to balloon to nearly $800 billion, or 3.4% of GDP, by 2020 (Fig. 2).

U.S. Debt Downgrade - More Than a Warning

Now, the U.S. is at a stage where the downgrade of U.S. sovereign debt rating seems closer to reality than ever before. Although most have dismissed the downgrade initiated by China’s Dagong Credit Agency back in July, CNBC reported that this time around the U.S. Treasury Dept. is going to meet with Moody’s and other agencies in January, 2011 to make its case to prevent a downgrade from the current AAA status.

CBO’s debt and interest payment projection assumes that US borrowing cost will remain reasonable. However, a credit downgrade and/or further loose monetary policies along with continued over-spending will only prompt bond markets and bond vigilantes to demand even higher interest rates resulting in much higher interest payment than the current projections, reminiscent of the 80’s when bond yields were in double-digit.

Expectation Drives Inflation

When it comes to inflation expectations, I’m actually in agreement with Bullard that the Fed has been successful in driving it up, which is reflected in the TIPS yield as well as the steepening yield curve (Fig. 3). However, as Bernanke himself puts it:

“The state of inflation expectations greatly influences actual inflation and thus the central bank's ability to achieve price stability.”

Since the Fed hinted at QE2, commodity price inflation has surged at a record pace during the past six months (Fig. 4) The manifestation of inflation is a combination of many factors including but not limited to expectations, which drives behavior, as well as supply and demand factors.

So, for Bullard to “take credit” for driving up inflation expectations, but ignore its inflationary effect on commodity prices is illogical as well as self-contradictory.

QEs Not Flowing Where It’s Needed Most

The bottom line is this: Unlike China where its central government can mandate banks to actually lend to business and individuals, Fed’s two rounds of QE liquidity did not go to where it’s intended; it is instead trapped on banks, and corporations’ balance sheets.

U.S. banks have been holding about $1 trillion of excess reserves for the last two years, while American corporations are flush with $3 trillion in cash.

What do they use this money for? Banks and institutions with access to the Fed’s cheap money are pumping up commodities and stocks to make their quarters, while corporations, facing higher input costs in the form of runaway commodity prices, are busy engaging in M&A’s (which typically means “job rationalization”), and share buybacks to juice up earnings per share.

Meanwhile, stagnant wage and hiring trends failing to keep pace with skyrocketing food and energy costs for consumers, coupled with higher input costs, such as fuel, hitting companies' bottomline, will only further cut into growth prospects, and the purchasing power of consumers and even their overall standard of living.

QEs = Wealth Redistribution

The concern of deflation is entirely overblown (thanks to Bullard’s research paper warning of a Japanese-style deflation in the U.S.) and the Fed jumped the gun. In a way, the Fed’s QEs are a form of wealth redistribution from taxpayers to banks, institutions and corporations.

The liquidity has created an artificial financial market where a disproportionate minority is benefitting through higher stock and commodity prices (without producing much output and benefit to the real economy); while the majority suffers higher input costs for essential items like food and energy.

Food and energy are some of the things that affect every consumer's daily life and pocket book, but are excluded from the core inflation calculation, a key measure on Fed's watch list. This bias would only further misrepresent true inflation pressures, misguiding Fed's future policies, and result in a net loss for the economy over the long haul.Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.