Euro Currency New Year, New Challenges

Currencies / Euro Jan 06, 2011 - 01:30 AM GMTBy: Ashraf_Laidi

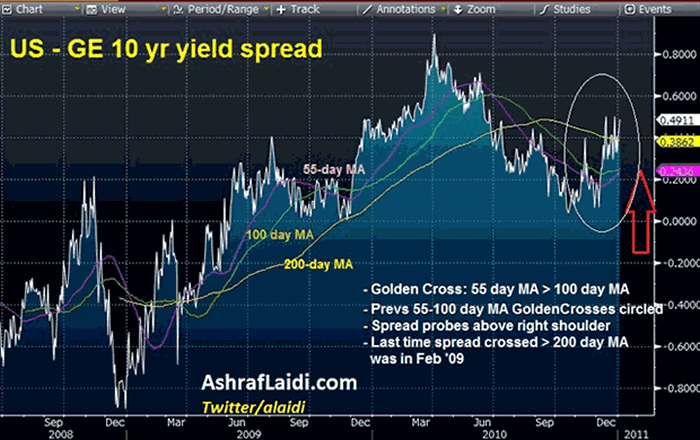

One interesting aspect of todays blow out +297K rise in Dec ADP is the cautious interpretations circulated for Fridays release of Dec Nonfarm payrolls. Recall the disappointing 39K increase in Nov payrolls from +172 in Oct despite the unexpectedly strong +92K ADP in Nov. Nonetheless, both the US dollar and 10 year yields are rallying across the board of further growth recovery in the US. Noting that Fed Chairman Bernanke will testify to Congress 1 hour after Friday's jobs report, we would expect the Chairman to reiterate the case for buying the entire $600 bln in QE2 even in the event that Dec payrolls show a blowout number with similar proportions to today's ADP (above 220K-250K). Yet despite those reiterations of QE2, bond yields will likely hold on to their upward trajectory eyeing 3.80% before ultimately regaining 4.10-15% in late Q1, which should help support USD vs. EUR, GBP and JPY.

One interesting aspect of todays blow out +297K rise in Dec ADP is the cautious interpretations circulated for Fridays release of Dec Nonfarm payrolls. Recall the disappointing 39K increase in Nov payrolls from +172 in Oct despite the unexpectedly strong +92K ADP in Nov. Nonetheless, both the US dollar and 10 year yields are rallying across the board of further growth recovery in the US. Noting that Fed Chairman Bernanke will testify to Congress 1 hour after Friday's jobs report, we would expect the Chairman to reiterate the case for buying the entire $600 bln in QE2 even in the event that Dec payrolls show a blowout number with similar proportions to today's ADP (above 220K-250K). Yet despite those reiterations of QE2, bond yields will likely hold on to their upward trajectory eyeing 3.80% before ultimately regaining 4.10-15% in late Q1, which should help support USD vs. EUR, GBP and JPY.

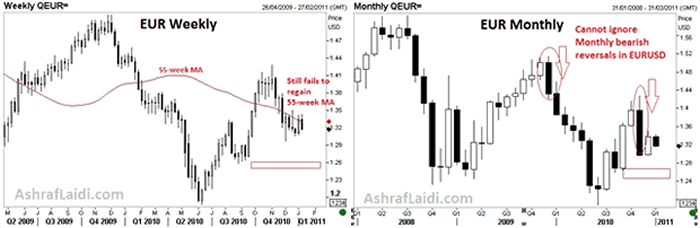

Before we get to the fundamental arguments hampering the euro, see below the key technical charts making the case against the single currency. The first two charts are a reiteration of my November analysis calling for $1.27 in EURUSD. The weekly chart (left) highlights the fact that a sustainable close below the 55-week MA will likely call up a 12-15% decline, as was the case in the break of August 2008 and January 2010. Since having broken below its 55-week MA in late November, EURUSD never could regain this important measure of trend.

Euro Bearishness: No Change The Eurozone debt problem is no longer limited to rising borrowing costs and maturing debt of sovereign nations. The rise of Spanish municipal and private bank debt (accounting for over 40% of total new issuance in 2011) will further complicate any future debt resolution as far as priorities to creditors.

The diversity of the Eurozone debt problem should also continue to weigh on the euro. Ireland is dragged by undercapitalised banks (solvency and liquidity problem), while Spain and Portugal sovereigns and banks are primarily suffering from a liquidity shortage. The liquidity problem is most punishing when bond yields are easily propped by event risk that is unrelated to the Eurozone (China rate hike, negative US earnings or emerging market-related events). Meanwhile, Portugal is increasingly seen likely to receive a bailout about (about 60 bln) after Greece received 110 bln and Ireland 85 bln

To Reschedule or not to Reschedule

The growing dissent between the ECB and Eurozone politicians (primarily Merkel & Sarkozy) regarding the need for debt restructuring should emerge at the expense of the single currency. The main reason the ECB is against the notion of bondholders bearing the brunt of debt rescheduling is the escalating debt costs to sovereign and private borrowers as well as the consequences on local citizens. Unlike in the case of Latin American and Asian debt crises when debt reschedulings impacted mainly foreign creditors, a Eurozone rescheduling would have considerable consequences on local finances due to the involvement of local players (banks, brokerages and local investors) in these public debt. As a result, local citizens would fall victim in all facets of the spectrum (small bank accounts, small and first time home buyers and those who are already unemployed.

Here is my CNBC interview yesterday with Erin Burnett discussing the euro's challenges on its 12 year anniversary.

Euro Outlook ahead

Despite robust business surveys in the Eurozone and strong recovery in Germany, the euro remains unable to stage any meaningful recovery even against the weak USD -- While the euro is expected to find its way towards $1.27 and potentially to as low as 1.22, The trades of higher confidence remain that of selling euro against the Canadian dollar (robust energy prices, stable US demand), Norwegian Krona (tightening cycle not yet over, sturdy exports and improving Baltics) as well as the Singapore dollar (tightening policy geared at containing price and real estate inflation).

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.