Stock Market Yearly Cycle Low Approaching

Stock-Markets / Stock Markets 2011 Jan 11, 2011 - 07:29 AM GMTBy: Toby_Connor

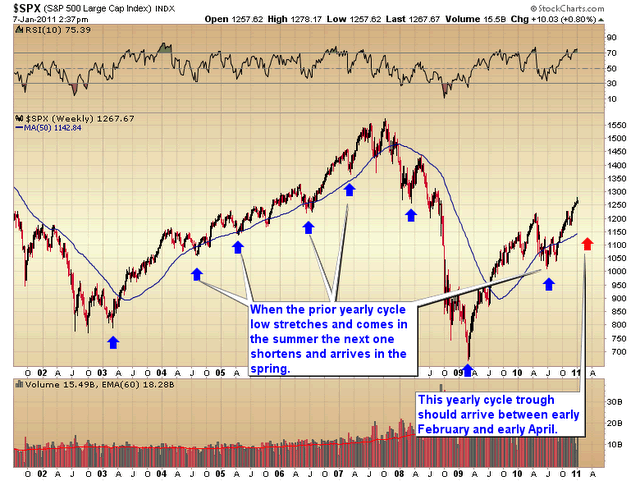

Sometime between early February and early April the market should drop down into a major yearly cycle low. Last year that cycle low came during the first week of February.

Sometime between early February and early April the market should drop down into a major yearly cycle low. Last year that cycle low came during the first week of February.

Since the current daily cycle is now in the timing band for a bottom we should see an intermediate top fairly soon.

Yearly cycle corrections are major corrections, only exceeded by the four year cycle low in severity. So once the correction begins it should be a dozy. The severity of the impending correction will tell us whether the cyclical bull is on its last legs or not.

If the correction retraces back to or maybe a little below the 200 DMA then it will be a normal intermediate correction within a cyclical bull market.

If, however, the market were to retrace the entire autumn rally and test the summer lows that will be a very strong sign that all the stimulus and money printing was for naught.

Keep in mind the next four year cycle low is due sometime in 2012. And since bear markets tend to last about a year and a half I strongly suspect this cyclical bull will top sometime this year.

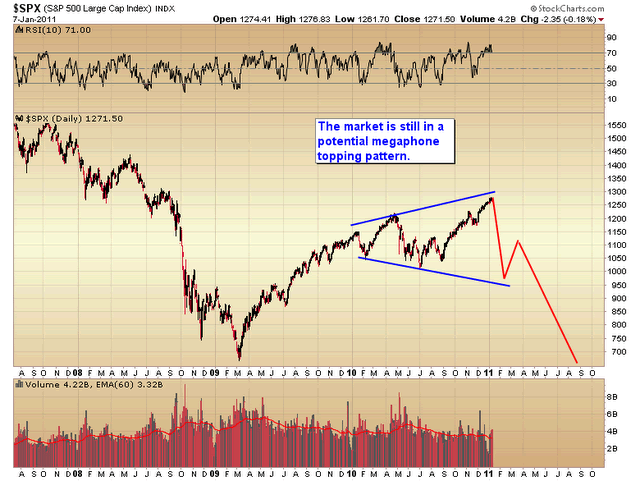

As a matter of fact the market is already potentially forming a megaphone topping pattern. This pattern of wildly expanding volatility is caused by the underlying debt cancer and inflation trying to pull the market down while at the same time the Fed tries to counter the bear market forces with ever larger monetary stimulus.

The result is a market being whipped back and forth in larger and larger swings.

In the end the Fed will fail and the next leg down in the secular bear will begin; only this time will be much worse than the last one. All the Fed will have succeeded in doing is making the problem bigger.

I would suggest if one has retirement funds still invested in the stock market they get them out and back into a money market at this time until we see just how far down the market drops as it moves into the yearly cycle trough.

I will reopen the 15 month subscription briefly for those that want to ride the bull and need a coach to keep them focused. And for those who want a voice of reason to get you out at the top when your emotions will urge you to stay at the party too long.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2010 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.