Long Shadows Cast Over US Economy 2011

Economics / US Economy Jan 12, 2011 - 03:07 PM GMTBy: Jim_Willie_CB

Numerous are the threats to the USEconomy and US financial structures. Many are hidden threats, subtle challenges to undermine increasingly fragile support systems, planks, and cables that hold the system together. The year 2011 will be when the system breaks in open visible fashion, when the explanations that justify it sound silly and baseless, when the entire bond world endures major crashes. All thing financial are inter-related. Recall that in summer 2007, the professor occupying the US Federal Reserve claimed the subprime mortgage crisis was isolated.

Numerous are the threats to the USEconomy and US financial structures. Many are hidden threats, subtle challenges to undermine increasingly fragile support systems, planks, and cables that hold the system together. The year 2011 will be when the system breaks in open visible fashion, when the explanations that justify it sound silly and baseless, when the entire bond world endures major crashes. All thing financial are inter-related. Recall that in summer 2007, the professor occupying the US Federal Reserve claimed the subprime mortgage crisis was isolated.

The Jackass countered with a claim that the bond market was suffering a crisis in absolute terms, where all bond markets were on the verge of fracture, perhaps globally. In year 2008 the banking system in the Western world broke, fatally and irreparably in my view. In 2009, the solutions, the treatment, the official programs were all exaggerated for their effectiveness while banker welfare became a fixture. Neglect of the people on Main Street became policy. In 2010, the system revealed it is still broken. The global monetary system after all rests atop the sovereign bond market. This year, it must fight off a collapse. Many are the hidden points of vulnerability. Gold & Silver will continue to be the great beneficiaries.

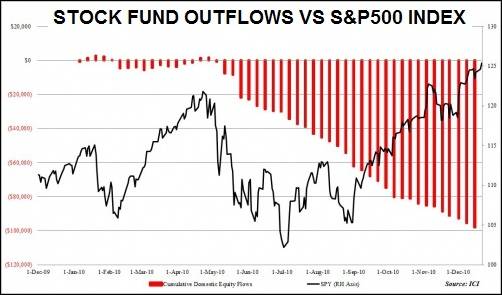

BOND OUTFLOWS

Huge outflows have struck from US-based bond funds, while the outflows continue for stock funds since may 2010. Even the flagship pimco bond fund saw net redemptions. The public is stepping aside as the usfed does its destructive work. No end is in sight for the stock fund outflows. A public boycott seems firmly in place. The new event is the largest bond fund outflow in almost 30 months. The Investment Company Institute reported that in the week ended December 15th, another massive outflow took place from domestic stock funds. It was the 33rd week in a row, amounting to an exit of $2.4 billion. Worse, taxable and municipal bonds saw a nasty shocker of $8.62 billion in outflows, which included another record $4.9 billion in muni bond outflows. Bond mutual funds had the biggest client withdrawals in more than two years, as a flight from fixed income investments has accelerated. The withdrawals were the largest since mid-October 2008, when investors pulled out $17.6 billion from bond funds. The US bond fund retreat showed acceleration signs, since the rise was from $1.66 billion the week before, according to the ICI report. So outflows are in progress for both US stocks and US bonds!! Year to date, investors have yanked $100 billion in funds from US-focused equity mutual funds, offset by a smaller $16 billion in comparable inflows into equity strategies via ETFunds. The $250 billion PIMCO Total Return Fund, managed by Bill Gross, had its first net withdrawals in two years in November as investors pulled $1.9 billion, according to Morningstar.

The public has grown jaded by stories of flash trading smears of the stock market, insider trading scandals, and incessant internal reports of stock support from the Working Group for Financial Markets. They sense stock prices are heavily manipulated and not a reflection of true value. They might on a wider basis believe that most US financial markets are either in ruins or corrupted. The vast record outflows accompany a rise in the S&P500 stock index, which is a clear signal of USGovt prop programs in a corrupt market. Ridiculous illogical and ludicrous interpretations continue to be disseminated about the USEconomy in recovery. The false story has become a billboard message of deception. We are told that investors are retreating from bond funds after signs of an economic recovery and a stock market rally, which have lifted interest rates broadly. The reality is something quite different. The selloff in USTreasurys happened exactly after the US Federal Reserve in November offered specific details on its pledge to purchase $600 billion in bond assets to revive the sluggish USEconomy. The 10-year USTreasury yields lie in the 3.2% to 3.4% range, much higher than the 2.49% in the first week of November. The bond market contradiction to the USFed monetization plan is without precedent in US bond market history, a grandiose insult.

The QE2 team is buying $100 billion in USTBonds per month, taking up the slack, without producing any decline in bond yields. The USFed is running a dangerous desperate gambit. Attempts to hold together the ustreasury market during its QE2 strongarm episode are underway. Obviously the USFed is the USTreasury market, with outsized USTBond purchases as part of its QE2 program. An approved posse of market specialists is buying hundreds of $billions of USTreasury securities on the open market. They are filling a vacuum. They are offsetting global creditors in abandonment. They bought in 2011 a full 75% of all USGovt debt issuance, just like Banana Republics!! They must keep the interest rates low. They must prevent a credit derivative blowup event. The USFed is fast losing all credibility, exhausting its power, testing its limits, fighting off demands for independent audits. The QE2 team seeks the best price available. However, due the fully advertised initiative and the heavy volume, is destined to pay a premium price. They have tipped their hand, as they buy $100 billion per month in USTreasurys. It is not possible to be a known buyer with a schedule and agenda, and execute favorable prices. An unexpected backfire occurred on the way to the QE2 launch. Bond yields fell sharply between August and November as the markets anticipated the new program. Bond yields have defiantly risen since details on QE2 were formally announced in November, delivering losses to the frontrunners in the autumn months. Too much doubt was left lingering on the volume of the program, and furthermore, whether a QE3 would launch. Bernanke actually hinted of a third launch, foolishly. The states need several hundred $billion, another monetization object.

GOLD & SILVER PREPARE FOR ANOTHER BREAKOUT

A major consolidation is taking place in the Gold price. A near total disconnect has occurred between the physical Gold & Silver markets and the control strings from the paper futures market held by the maestros. Grotesque shortages exist in silver. Difficulties in gold delivery are commonplace. The central banks and Bank For Intl Settlements scramble to keep gold & silver supplied to the exchanges, in order to avert openly visible defaults. A strong uptrend with rising moving averages is evident in Gold. The breakout in October has been consolidating for three full months, while Europe experiences its open sores of sovereign debt distress. Its price will soon encounter the uptrend lines for likely ignition. When a European aid package is assembled, whether of substance or not, merely if it seems credible, the Euro currency will rebound and the Gold bull will resume. In year 2011, the global monetary system will fracture in visible fashion. Its broken debt foundation will be the proximal cause. Gold is widely regarded as a reserve asset, no longer a stodgy secure asset for Arab sheiks. The dirtiest little secret might be that private Wall Street firm accounts own vast Gold bullion accounts, while their corporate banking entities in South Manhattan own the short futures positions, soon to be dumped on the USGovt in formal fashion. The greatest propulsion force to the Gold price is obviously the USFed and its grandiose QE2 initiative. Their purchase of $100 billion in USTBonds per month signifies that they are the USTreasury Bond market. PIMCO is worried sick about the unbridled monetization. The USFed monetized 75% of USGovt debt in 2011. When the USFed is done with QE2, they will argue for a QE3, probably to cover state debt shortfalls. The precedent has been set. The global currency war is in full swing. Simply put, the Gold price will rise when China is prepared to pay a higher price, after exhausting supply at lower prices.

The greatest offender in currency manipulation and currency undermine is the United States. It is essential that the USGovt continue to make accusations against foreign central bankers, in order to deflect attention. The problem is QE2, and the likelihood of a followup QE3. The USGovt is without permission forcing a debt writedown on foreign USTreasury creditors by installing inflation engines. See the commodity prices, led by food & energy. The USFed and USDept Treasury will proclaim victory by mid-summer, as price inflation begins to rage much hotter. They will call it economic growth. Check import price inflation from the last three months of 2011. Import prices rose 3.7% during that brief time. Not just emerging economies like China and Brazil are contending with price inflation. The US does too, but it calls it growth, since its economic trackers are much more accomplished decepticons. When job losses mount in the second half of 2011, the lies will be unmasked. The USFed is the greatest destoyer of working capital in the history of the world. Their balance sheet is negative $1 trillion and growing worse, their highly appropriate report card. Their wretched financial condition matches their decaying reputation. They are the buyer of worthless toxic bonds, the buyer of last resort. The housing market will NOT recover to bail them out.

USGOVT BUDGET BATTLES

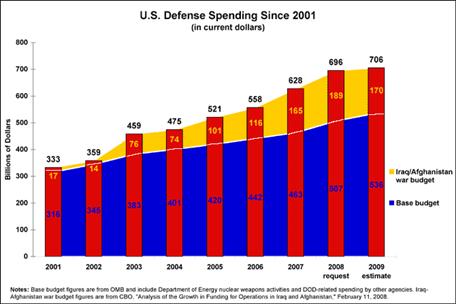

Budget battles are sure to reveal the true fascist motives of those in power. The people will be denied while the war machine is preserved, guns & bombs over bread & butter, big banks over households. In fact, the defense budgets will not be reduced. Rather, defense contractors will be forced to eat cost overruns without volume cutbacks in weapon units at all. The war is sacred, the signature mark of the fascist state. The USGovt seems to have suddenly found religion in reducing the budget and its deeply engrained deficit. It is more superficial than from the heart with conviction. The new wave is all about perceptions. To be sure, some in the USCongress are worried sick and scared pale over the prospects of a structural $trillion deficit. A decade ago such a deficit magnitude would be considered a telltale signature of a Banana Republic nation sliding toward the Third World perilously. The budget battle with the new USCongress will be extremely revealing of the priorities for the Syndicate in full control of the USGovt and press networks. The budget process will in my view continue to place the war as a sacred priority not to be touched, not to be altered, not to be disrupted. In rough terms, the USGovt budget contains components 20.0% Defense, 21.0% Social Security & Medicare, and 14.0% Safety Net System.

In my view, the budget cuts will come exclusively from the people and their homes and work centers, their pensions, their Social Security & Medicare. Tax deduction removals and phaseouts will be a centerpiece. The war machine has given stress to the defense contractors, who will be expected to absorb cost overruns in weapons programs, according to recent Pentagon pronouncements. Enormous costs are involved with the war machine support. The base military budget is $536 billion. The extended budget for the wars adds another $170 billion in supplemental spending, which officials prefer to call Overseas Contingency Operations since it sounds more sophisticated.

The total sum, over $700 billion per year, is the sacred cost of the USMilitary. It includes hundreds of overseas bases, lavish embassies, and endless weapon systems, of types conventional, nuclear, and drones. The United States spends as much on annual military investment as the rest of the world combined, according to the Stockholm Intl Peace Research Institute. One must wonder if the wars are to produce enemies. The United States maintains troops at more than 560 bases and other sites abroad. The outsized yawning Defense spending is a primary cause for USGovt insolvency. It has a staggering deficit impact on the budget and the negative international image of the nation. Watch the unfolding events as the USGovt and USCongress grapple with spending cuts. They will avoid Pentagon and defense budget cuts with fierce opposition. This is a key part of the Fascist Business Model, as sacred as Wall Street largesse.

Harken back to the 1950 decade, during the post-WW2 glow. President Dwight Eisenhower once said, "Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and are not clothed." The words from Ike fell on deaf ears. Not until the last decade have his words rung shrill. He never met the current crowd in control, but he could see a path to their evolution, which he called the Military Industrial Complex. No disrespect is meant to soldiers who have sacrificed. One must wonder for what cause their sacrifice has been, and toward what outsized profits to defense and service contractors, even Syndicate bank accounts. Talk has already begun, that "out of respect for our fighting soldiers and veterans" who have served in active duty, the defense budget will be spared of cuts. Watch the priorities be revealed as the battle unfolds over the budget. In my view, the potential for defense cuts and huge savings is great but it will not be tapped. Instead the people will be asked to expect less aid, to rely upon less, to eat less, to expect less federal help, and endure poverty more.

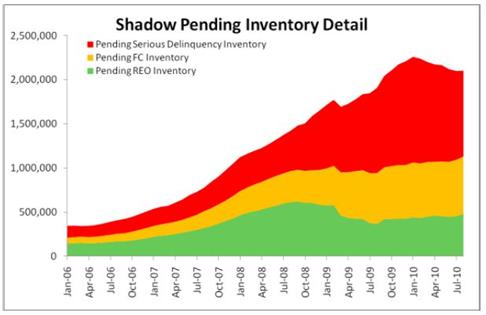

SHADOW HOME INVENTORY

The standard inventory of homes comes from brokers and multilists. The hidden inventory of homes adds another 50% to 80% to the working supply, half of that from pending seizures, half from bank owned units festering on their balance sheets. Home prices cannot rise in such a deeply distressed climate. The unofficial shadow inventory is another one million homes. Any economist who overlooks the hidden supply of homes is a hack. The housing market cannot recovery for another two years, until it works off the hidden inventory. The problem is that the ongoing home foreclosures results in more bank seizures, and a steady source of renewed hidden inventory. Housing is a crippled market, one that acts like a gigantic millstone around the USEconomy. Housing prices will descend further in 2011, as the shadow inventory acts with powerful forces upon the Supply & Demand equation. It still applies despite any messianic proclamations from banking high priests or Wall Street marketing agents. The mainstream has finally begun to grasp the wreckage and ruin, but not that the housing sector will cause a systemic failure for the nation. It is most assuredly coming. The contradictions and shallow work of Roubini are worth a pass. His work has been ridiculed in the past by the Jackass, like a few months ago when he expected the gold market to turn down. Instead, it rose another 10% to 15% in a string of breakouts. Yet he is still revered, and sought as a guest on the financial networks.

Nouriel Roubini offers some obvious commentary, followed by contradictory nonsense about a USEconomic recovery. His inconsistency earns him a 'C Minus' grade in his own class. The professor is a fool once again. Roubini acknowledges that the housing market is in a double dip, as prices can only go down. He brought attention to what he called below trend economic growth as baseline, but also two negative factors specific to the housing market. The first factor is the expiration of federal home buyer tax credits for first-time home buyers. The housing prices have been falling every month since the tax credit expired last May. He correctly identified the stolen demand from the future to take advantage of the home buyer credit. So he makes an obvious point. The second factor putting downward pressure on home prices is the ongoing chaos with mortgage documentation, and the related temporary moratorium by banks for mortgage foreclosure proceedings. The suspension appears to be ending. Aware of an imminent flood of housing supply, Roubini said "There has been an effective moratorium on foreclosures. The shadow inventory of not-yet-foreclosed homes, due to the moratorium, will surge in the next year. Supply will increase, demand will drop." Obvious points, enough to force a USEconomic recession without a remote chance otherwise.

Roubini remains a shallow economist without strong basis for his opinions, even plain contradictions. He does not expect a double dip recession, since he believes the USGovt kool-aid on doctored statistics. The dull blade Roubini said, "The rest of the economy is recovering. Most of the numbers are consistent with a growth rate of 2.7%, still below trend. So unemployment will likely remain above 9%. The EuroZone shock, long-term structural deficits, and state & local governments operating near bankruptcy are other ominous economic signs on the horizon. The 12 million households are already in negative equity and 8 million more have an Loan-to-Value between 95% and 100%. Thus even a 5% fall in home price will push an extra 8 million in negative equity with risk of millions walking away from their home, i.e. jingle mail." Without realization, he undermines his own assessment of slow USEconomic growth, and provides ample justification for a worse recession than already is in progress. His housing market observations contradict his economic outlook. He does not realize (or admit) that price inflation is running at over 7% right here, right now. Therefore the GDP estimates are all way high, exaggerated by 5% or more. The USEconomy is mired in a deep recession. Sadly, Roubini is a victim of the establishment, which ordered him to compromise his work in order to continue to occupy an important post. See the CNBC article (CLICK HERE).

The Great Roubini is awakening to the disaster in housing, but he does not yet grasp how it will result in a systemic USEconomic failure. He begins with a slow growth scenario, then cannot justify it, even to contradict it while discussing relevant factors. He will be one of the first shoddy economists to claim the USEconomy is in recovery, as price inflation accelerates, which will incorrectly be labeled it growth. My theory is simple. If the entire USEconomy depended upon the housing boom to expand from 2003 to 2007, then it will be capable of collapsing the same structures given the extreme vulnerability to debt. The vicious cycle will be powerful, unstoppable, and deadly. It has been game over since the September 2008 events when the US banking system collapsed and died, led by Lehman Brothers, Fannie Mae, and AIG. The weight of the continuing housing market decline, combined with strangulation in the banks with toxic debt paper and a surplus of home inventory, is easily sufficient to cause a systemic failure to the entire USEconomy. The big banks are stuck in mud at the cemetery gate. That failure is in progress with momentum. Guys like Roubini and Krugman will be the last to realize the collapse. They are celebrated cheerleaders within the system, compromised souls.

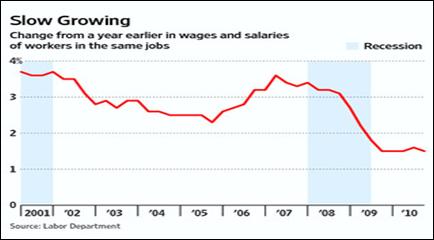

LABOR MARKET STEP-DOWN

The economic step-down is a hidden powerful effect in the de-industrialization of America. The job growth is not a sufficient condition for the USEconomy recovery. People are taking lesser jobs, with huge declines in income. Fewer opportunities exist, while survival demands tough decisions. The endless USEconomic recession has an ugly trademark. People are taking steep pay cuts, enduring lasting reductions in wages. People are taking jobs far below their skill levels. Between 2007 and 2009, more than half the full-time workers who lost jobs (held for at least three years) and found new jobs later reported wage declines, according to the USDept Labor. The detail is 36% of them reported the new job paid 20% less than the previous lost job. An effect rarely seen in recessions since the Great Depression, wages have taken a sharp and swift decline for a significant slice of the labor market. THIS IS A THIRD WORLD HARBINGER. It is worse for many others. The unemployment rolls include 14.5 million people, even 6.4 million stuck jobless for more than six months. A key part of earnings losses, according to the survey, is that workers skills acquired over the last two decades that are fast becoming outdated and obsolete. Then instead of gaining new skills for a higher paying job, they often settle for a lower wage and stop their job hunts, unable to benefit from training. Lack of retraining programs is a huge dropped ball by the USGovt, whose economists cannot find their hind parts with their hands. Research shows that children of displaced workers also suffer in a domino effect. Even those fortunate to remain on the same jobs have seen wage cuts. Many assume more duties too.

RETAIL LEADERS ON THE ROPES

Howard Davidowitz screams his case on the broad retail distress, with details. He warns of huge unresolved problems with commercial property loans, with great stress for landlords. A Paradigm Shift is underway, for smaller footprint shopping centers, as the United States footprint is double anything reasonable. The consumer model is fast breaking down. Davidowitz does not mince words, as he destroyed the illusion of a USEconomic recovery, pointing out absolutely no consumer renaissance. During a recent Bloomberg interview, retail expert Howard Davidowitz shattered the consensus klapptrapp, with quality content and logical thought. He said, "I am not surprised by the strength of retail sales, because I knew that 30% of consumers are responsible for retail sales, and these 30% did much better because of the performance of capital markets. I do not think it is indicative of anything going forward. I do not think the economy is going to get any better. If you look at our fiscal and monetary policy, we went two trillion dollars in the hole last year. Two trillion, to produce this, and unemployment went up to 9.8%! We have spent two trillion dollars. We are printing money. We are going bananas. Our the balance sheet, we have $2.6 trillion on there, and for what? Look at government securities, and mortgage backed securities. If interest rates go up a point Bernanke's bankrupt. Everything he has bought is underwater. All the mortgage bonds are underwater, the whole country is underwater. Does anyone see the issue now with why rising interest rates, aside from predicting a supposed recovery, may also, courtesy of its [greatly increased wrecked bond investments], actually predicts the insolvency of the Federal Reserve?" His comments are not a breath of fresh air, strewn with honesty.

Davidowitz provided several key observations on the supposed retail renaissance. Wal-Mart makes for 10% of US retail sales, has 150 million customers, and its stock it is down six consecutive quarters, not a good sign. Sears is the largest department store in America, but their stock is in terrible shape. Best Buy suffered a huge earnings miss. The financial loss recorded by ToysRUs increased last quarter. Supermarket chain A&P recently filed for bankruptcy. Department store chain Loehmanns just filed for bankruptcy. Charming Shoppes announced plans to close 100 stores. TJMaxx just liquidated AJRight. Davidowitz honed in on Sears for crucifixion. Sears is in the tank, ready to fold its tents in his opinion. Eddie Lampert took over the company recently from his hedge fund position, lacking any conceivable operational experience. He has engrained a policy that departs from price competition. He has not invested in capital equipment upgrades. He has sold his best stores. His online investment has not succeeded. The corporation is gutted, heading for the dumpster, then cemetery. If Lampert were smart, he would sell the company to a greater fool. A joke has surfaced, that A&P might merge with Stop & Shop, with a new corporate name of Stop & Pee, which would open enormous marketing potential.

In addition to dissecting the collapse of Sears, analyst Davidowitz observed what should be a loud glaring alarm signal for guys like Ackman and all those who are betting on the resurgence of the US mall storefront with vehicles like General Growth. The bulk of retail store traffic is moving online, where incidentally the only jobs created are those of packagers and quality control line people either in China or in some warehouse in Texas, California, or Florida. Davidowitz said, "Online sales have to lead you to question the whole retail selling strategy. We have 21 square feet of selling space for every man woman and child in this country. We already have double of what we need. With the explosion of online sales, what happens to all these retail malls and shopping centers which are marginals? Huge changes are going to be taking place as people continue shopping online. A revolution in retail is coming in both size and location of stores, a trend starting with the advent of much smaller Wal-Mart stores. In the end what to do with the retail space is going to be a huge question for retail in the next ten years. That is why Wal-Mart is starting to build smaller stores. That is why Wal-Mart is building more overseas than they are building here. It is going to be the biggest retail change that we have ever seen." The bulldozing of half the US retail malls will be a positive move for economic progress, but extremely disruptive.

The biggest losers in the maverick analyst's estimation will be commercial real estate landlords. Expect great pain for the REIT investments (stock trusts). Howard continues in his railing, making the point of commercial loans next collapsing, a point made by the Jackass for the last 18 months or more. He said "Landlords better start figuring it out pretty quick because they already have occupancy problems, rent problems, and everything else right now. I do not think the Commercial Real Estate (CRE) problems are fixed by any means. That is why we are going to close hundreds of community banks going forward. We are going to close hundreds more. Those CRE debts are coming due and they will not be able to be rolled over. We have lots of problems still coming up in the banking system, and the problems in the real estate issue is here for a long time. In other news, Kool Aid to be served in aisle 5 of the next door Sears box from now until permanent closing time." The man is solid as a rock in his retail analysis, accurate as a sharp knife, with no nonsense.

COMPLEX SOCIETIES & SYSTEMS

Complex societies do not last forever. They break down from internal stresses as often as from external. A society must maintain its system, with more energy expended when more complex. The reserves can be tapped repeatedly if crisis is not averted from regulatory machinery. In time, neglect enters the picture, as stresses break the fabric. Joseph Tainter is well-known for his classic book entitled "The Collapse of Complex Societies" despite his expertise as an archeologist. He must have done much thinking about the collapse of societies whose ruins he unearthed in massive digs. Tainter is on record with his developed thesis, born out of his dissatisfaction with prevailing collapse theories. His argument is straightforward. Human societies are problem solving organizations, which supply the necessities along with entertainment, as well as training to ensure continuation. The over-arching Sociopolitical systems require energy for their maintenance. If left without proper tending, they fall apart like a garden without attention. Increasing complexity carries with it increased cost per capita. Simple monarchies need much less maintenance than democracies, as voices are heard and justice grinds slowly. Investment in sociopolitical complexity often reaches a point of declining marginal returns, as time passes, interest wanes, justice disappoints. When debt saturation occurs, like today, the cost of maintenance and decline can be overwhelming. The complex system becomes vulnerable to collapse after great stresses and what Tainter calls perturbations, better thought of as disruptions or disturbances.

Stress and perturbation are a constant feature of any complex society, always occurring somewhere in its territory. The developed operating regulatory machinery is designed to deal with unplanned changes. Imagine spotty agricultural failures, border conflicts, large scale accidents, social eruptions, and disease outbreaks. Such localized stress tends to recur with regularity, and thus can be anticipated with preparations. To meet major unexpected stress surges, the society must have some form of net reserve. It can take the form of excess productive capacities in farm output, stored energy, or stockpiled minerals, or hoarded surpluses from past production, even reserve savings. Stress surges of great magnitude cannot be accommodated without such a reserve. A society beset by regular self-inflicted crises will be forced to draw upon its stored reserves too quickly. As declining marginal returns are experienced, the society must contend with rising systemic risk. The costs outweigh the yield put in reserve. Excess productive capacity will at some point be exhausted, and accumulated surpluses allocated to current operating needs will be used up. Even when the adversities are met and the surges are dealt with, a detriment to the system as a whole occurs. The society is weakened in the process, and made more vulnerable to the next crisis. Once a complex society develops the vulnerabilities of declining marginal returns, collapse might require the sufficient passage of time to render probable the occurrence of an insurmountable calamity.

More importantly, declining marginal returns make complexity a less attractive goal to maintain. The problem solving strategy takes a secondary role to instituting simpler systems. The society tends to accept the option for less costly and less sophisticated social forms. The alternative embraced eventually is an endorsed level of disintegration. This has occurred to the United States in grand style. As marginal returns deteriorate, tax rates rise with less benefit to the local level. Irrigation systems go untended, bridges and roads are not maintained, the frontier is not adequately defended, product liability is not protected, and fraud prevention is compromised. Notice in the US how cities exhaust their funds with pension programs, unable to provide proper services like police protection. Notice how the US has countless bridges and pipelines (water, sewer, energy) that have gone without proper care. The nation has turned too much attention to war.

As the process degrades, many of the social units that comprise a complex society no longer pursue the increased general advantage, and instead pursue a strategy of personal independence. Then begins a different pursuit of their own immediate goals rather than long-term goals of the networked hierarchy. They see little benefit coming from systemic contributions. Behavioral interdependence (constructive groups) yields way to broader independence (working on one's own). Shrinking resources are strained even more, as control slides away and is lost. The investment in regulatory systems is crucial, as efficiency devices. When they degrade into support systems for corruption, the system falters from its own rotten moral fabric and invites the seeds of rebellion. Eventually, perturbation occurs from within, as civil disobedience takes root. The lack of justice, the apparent predation by the upper hierarchy levels (bankers), and public frustration breeds anarchy like thousands of microdots within the society. See the home mortgage voluntary defaults. Justice is a delicate factor within a society. When justice is dealt, order tends to be preserved. When justice is absent, like for the big US banks, like for military aggression, the people object and depart from norms. The presence in the last two decades of bigger amplitudes in the crisis pain and cost, together with greater frequency of events in cycles, has combined to deplete the reserves of the nation. The Rubin Doctrine of surviving today even if taking aware reserves from tomorrow has assured much greater risk of systemic ruin. In my view, it has guaranteed ruin and collapse. See the Naked Capitalism for a thought provoking article (CLICK HERE). Complex systems are fascinating, especially when they enter a period of dysfunction.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts such as the Lehman Brothers failure, numerous nationalization deals such as for Fannie Mae, grand Mortgage Rescue, and General Motors.

“You freakin rock! I just wanted to say how much I love your newsletter. I have subscribed to Russell, Faber, Minyanville, Richebacher, Mauldin, and a few others, and yours is by far my all time favorite! You should have taken over for the Richebacher Letter as you take his analysis just a bit further and with more of an edge.” - (DavidL in Michigan)

“I used to read your public articles, and listen to you, but never realized until I joined what extra and detailed analysis you give to subscription clients. You always seem to be far ahead of everyone else. It is useful to ‘see’ what is happening, and you do this far better than the economists! I can think of many areas in life now where the best exponent is somebody not trained academically in that area.” - (JamesA in England)

“A few years ago, I was amazed at some of the stuff you were writing. Over time your calls have proved to be correct, on the money and frighteningly true. The information you report is provocative and prime time that we are not getting in the news. I was shocked when I read that the banks were going to fail in one of your prescient newsletters.” - (DorisR in Pennsylvania)

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” - (ShawnU in Ontario)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces’ approach into an awesome intellectual tool.” - (RobertN in Texas)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.