Gold, Silver and the Dollar’s Next Big Move Update

Commodities / Gold and Silver 2011 Jan 31, 2011 - 03:48 AM GMTBy: Chris_Vermeulen

We have seen some exciting moves in the market and with the market sentiment so bullish it should make for a sharp selloff in the coming weeks. Meaning everyone is overly bullish and owns a lot of stocks and commodities; therefore the market should top and leave them holding the bag while the smart money runs for the door. The market will not bottom until all of these individuals holding the bag finally cannot take the pain of losing any more money and once we see them panic and sell them all at once only then will we be looking to go long again.

We have seen some exciting moves in the market and with the market sentiment so bullish it should make for a sharp selloff in the coming weeks. Meaning everyone is overly bullish and owns a lot of stocks and commodities; therefore the market should top and leave them holding the bag while the smart money runs for the door. The market will not bottom until all of these individuals holding the bag finally cannot take the pain of losing any more money and once we see them panic and sell them all at once only then will we be looking to go long again.

The past couple weeks I have been bombarded with emails asking if gold and silver have bottomed and if they should be buying more on these pullbacks. Those of you reading my work for the past few months know that my analysis clearly has shown how both gold and silver have been topping out. There have been strong distribution selling and price patterns on the charts are also clearly signaling a top was near.

A couple weeks ago I posted an important report covering gold, silver and the US Dollar and where the next big moves will be. Well it’s time for another update on Gold, Silver and the Dollar as they have come a long way from my last report.

Take a quick look at my previous charts here for 15 second recap from where we were and are now: Gold, Silver and the Dollar’s Next Big Move

Ok let’s move on to today’s charts….

Silver Daily Chart

Silver has formed a very nice looking top and it is now trading under its key moving averages. It is also currently testing a key resistance level after Friday’s bounce on the back of fears in Egypt. Unless something happens internationally I figure silver sill continue its trend down.

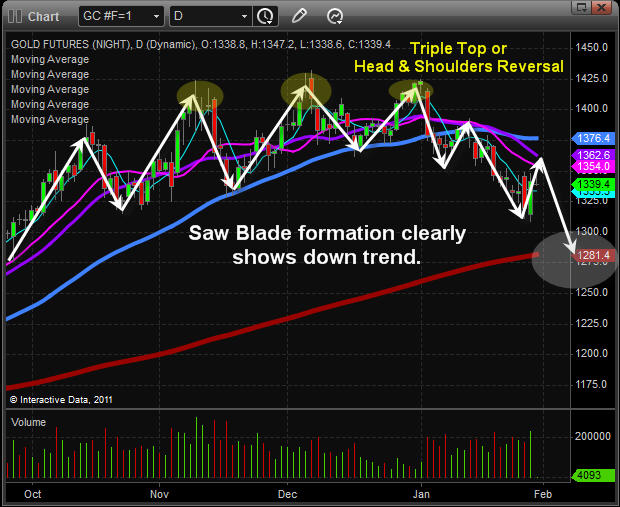

Gold Daily Chart

Gold is doing the same as its little sister (silver). I feel the general public is still very bullish on metals and before we see higher prices (new highs) the market will have to shake the majority out of their positions first. At this time gold looks like it should test the $1285 level. Depending on how long it takes to get there and the price action it forms in the following days that outlook could change but expect sellers to step in at the $1350-1355 area.

US Dollar 2 Hour Chart

The dollar has been grinding lower the past two weeks forming a falling wedge reversal pattern. It’s also important to note that on the daily chart the dollar tested a key support level last week. This should be an interesting week for the dollar and the rest of the market simple simply because when the dollar makes sharp movements it pushes the price of stocks and commodities around in a big way.

I am looking for a multi week rally in the dollar possibly longer but with small pauses or corrections along the way.

Pre-Week Metals and Dollar Trend Analysis:

In short, I feel gold and silver are nearing a short term resistance level and will find selling pressure in the coming days only to continue on their journey down for a few weeks. The dollar on the other hand broke out of its falling wedge on Friday and could have a strong rally for 2-3 days. I feel most traders and investors have been shorting the dollar for two weeks straight, so once they realize it’s going higher there will be a ton of short covering and the dollar should rip higher.

This shift in the Dollar from down to up has a direct effect on the SP500 and subscribers of my newsletter are going to take full advantage of these next big moves in the market.

If you would like to get more of my daily analysis to join my newsletter at www.GoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.