UK House Prices Remain stubbornly Robust Despite Weakening Demand

Housing-Market / UK Housing Oct 31, 2007 - 03:56 PM GMTBy: Nationwide

House prices rose strongly in October, but underlying market activity is clearly slowing

House prices rose strongly in October, but underlying market activity is clearly slowing- Although demand is weakening, existing homeowners appear in no rush to sell

- New buy-to-let landlords will need a long investment horizon to realise good returns

| Headlines | October 2007 | September 2007 |

|---|---|---|

| Monthly index * Q1 '93 = 100 | 372.7 | 368.7 |

| Monthly change* | 1.1 | 0.7% |

| Annual change | 9.7% | 9.0% |

| Average price | £186,044 | £184,723 |

* seasonally adjusted

Commenting on the figures Fionnuala Earley, Nationwide's Chief Economist, said: “House prices recorded a surprisingly strong increase of 1.1% in October, tying it with June for the highest month-on-month growth rate so far in 2007. The average price of a typical UK property was £186,044 in October, £16,421 more than the same month last year. The annual rate of price growth picked up from 9.0% in September to 9.7%, but this is still down from a peak of 11.1% in June and was partly driven by base effects. The rise in the annual rate temporarily breaks the slowing in price growth we have seen since June, but is unlikely to mark the start of a new upward trend. November and December saw particularly robust gains in 2006, and unless prices perform very strongly for the rest of this year, the annual rate of price growth will resume a downward path. The 3-month on 3-month rate of price growth – which helps smooth monthly volatility – edged up only modestly from 1.7% to 1.9%, which is still below the average of 2.2% seen so far in 2007."

Strength of house prices masks weakening of market activity

Strength of house prices masks weakening of market activity

“While some may be tempted to interpret October’s numbers as a sign that house prices are immune to deteriorating affordability and tightening credit conditions, such a conclusion would be misguided. Most leading indicators of housing market activity are continuing to weaken. Surveyors are reporting the weakest levels of new buyer inquiries in many years and mortgage approvals are falling from recent highs amid weaker demand and tighter lending criteria for riskier borrowers. Slowing demand, however, will not have an immediate impact on prices if homeowners are in no rush to sell.

New instructions to sell have in fact been falling since May, when there had been a temporary surge of property onto the market. Different factors could be driving the low level of instructions, including a reluctance to trade up amid current uncertainties and the fact that low unemployment is limiting the number of forced sales. The overall result is that the stock of unsold homes is still relatively low, and this is providing some residual support to prices. The underlying dynamics of the market, however, are clearly not as strong as this time last year.

IMF report on overvaluation raises important issues, but undersupply cannot be ignored

“Recent analysis from the IMF on housing markets in the industrialised world has added to the debate about

housing overvaluation. In its latest World Economic Outlook, the IMF concluded that a substantial proportion

of UK house price gains over the last decade could not be entirely explained by income growth, interest rates,

“Recent analysis from the IMF on housing markets in the industrialised world has added to the debate about

housing overvaluation. In its latest World Economic Outlook, the IMF concluded that a substantial proportion

of UK house price gains over the last decade could not be entirely explained by income growth, interest rates,

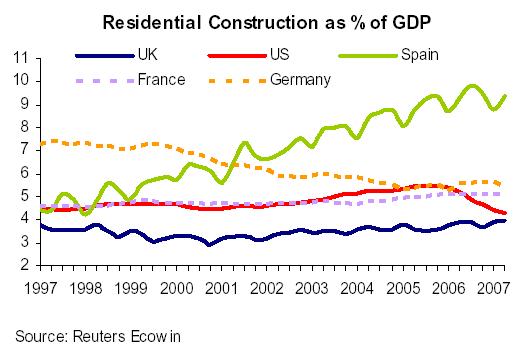

credit growth and the working-age population. However, this estimate of overvaluation will not account forother key drivers such as the housing supply. A simple comparison shows that investment in residential

construction accounts for a much smaller share of the economy in the UK than elsewhere, despite the fact

that the population has been growing strongly and is projected to continue doing so. As the NHPAU reminds

us, the UK’s unresponsive housing supply has been instrumental in driving house prices and affordability ratios

to current levels.1

“Nonetheless, the IMF findings serve as a

reminder that UK house prices have risen

ahead of certain key fundamentals – particularly earnings. This finding is

indisputable, but it does not mean that house

prices are destined to fall. In fact, in the

absence of an early 1990s-style shock to

unemployment or interest rates, they are

unlikely to do so. Yet, unless interest rates fall

back to the lows of 2003, house prices will

need to rise at a slower pace than earnings

over the medium-term in order to bring

housing affordability back to historical norms.

As a result, homeowners may well need to

content themselves with less spectacular returns on their houses over the next decade.

New buy-to-let investors may need more patience to realise good returns

“Lower house price inflation may have especially strong implications for aspiring buy-to-let investors.

Landlords who entered the buy-to-let sector near the start of the decade have made enormous returns. But

strong house price growth relative to rents has pushed net rental yields well below the current cost of a

mortgage. This implies that without very strong capital gains, a new entrant into the market would make

negative total returns in the short term until rents caught up sufficiently to cover operating and mortgage

expenses. There is now evidence that after several years of weakness, private sector rents are growing more

robustly. Even so, rents would have to rise very strongly relative to house prices to make short-term buy-tolet

investments profitable at current

“Lower house price inflation may have especially strong implications for aspiring buy-to-let investors.

Landlords who entered the buy-to-let sector near the start of the decade have made enormous returns. But

strong house price growth relative to rents has pushed net rental yields well below the current cost of a

mortgage. This implies that without very strong capital gains, a new entrant into the market would make

negative total returns in the short term until rents caught up sufficiently to cover operating and mortgage

expenses. There is now evidence that after several years of weakness, private sector rents are growing more

robustly. Even so, rents would have to rise very strongly relative to house prices to make short-term buy-tolet

investments profitable at current

interest rates.

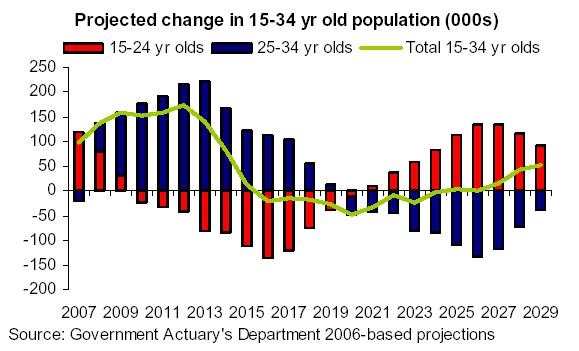

“That being said, investors with long

horizons can still make satisfactory returns

if long-term historical trends for house

prices and rents hold up. The

government’s latest projections show that

the 15-34 year old population will be

increasing until the middle of the next

decade, and this should be supportive of

both tenant demand and rents. Even with

only modest house price inflation, these

conditions would produce relatively

healthy returns over a 10-15 year horizon.

| Fionnuala Earley Chief Economist Tel: 01793 656370 Mobile: 07985 928029 fionnuala.earley@nationwide.co.uk |

Kate Cremin Press Officer Tel: 01793 656517 kate.cremin@nationwide.co.uk |

1 Based on officially published average mortgage rates in August, an owner of a typical semi-detached property who took out a 75% LTV 2-year fixed rate loan in 2005 would have faced a payment shock of approximately £100. If one assumes that only half the decrease in swap rates between the end of August and today is passed on, the payment shock for this borrower would fall to £90.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.