U.S. National Debt, Pump It Up

Politics / US Politics Feb 19, 2011 - 04:37 AM GMTBy: James_Quinn

Down in the pleasure centre,

Down in the pleasure centre,

hell bent or heaven sent,

listen to the propaganda,

listen to the latest slander.

There's nothing underhand

that she wouldn't understand.

Pump it up until you can feel it.

Pump it up when you don't really need it. Elvis Costello - Pump It Up

I had been planning an article based on the Green Day song - Static Age - about the propaganda, lies and misinformation that are endlessly directed at the American people by the government, the mainstream corporate media, and the wealthy elite that control the levers of our society. Then Barack Obama presented his 2012 Budget proposal, including his 10 year projection for our country. I know you've heard the term Peak Oil, but the term that came to my mind when I saw Obama's budget was Peak Bullshit. I thought that would be a great article name, but some sites wouldn't like the foul language. I was in a quandary until the Elvis Costello song Pump It Up came on the radio while I was driving to work. Down in the pleasure center of Washington DC, the propaganda, slander and most blatant lies are spoken without a hint of guilt or even the faintest whiff of shame. The politicians in Washington DC on both sides of the aisle believe the American people are stupid, gullible, apathetic and easily manipulated. They may be right, but there are a few people out there who can cut through their bullshit and find the truth.

I had been planning an article based on the Green Day song - Static Age - about the propaganda, lies and misinformation that are endlessly directed at the American people by the government, the mainstream corporate media, and the wealthy elite that control the levers of our society. Then Barack Obama presented his 2012 Budget proposal, including his 10 year projection for our country. I know you've heard the term Peak Oil, but the term that came to my mind when I saw Obama's budget was Peak Bullshit. I thought that would be a great article name, but some sites wouldn't like the foul language. I was in a quandary until the Elvis Costello song Pump It Up came on the radio while I was driving to work. Down in the pleasure center of Washington DC, the propaganda, slander and most blatant lies are spoken without a hint of guilt or even the faintest whiff of shame. The politicians in Washington DC on both sides of the aisle believe the American people are stupid, gullible, apathetic and easily manipulated. They may be right, but there are a few people out there who can cut through their bullshit and find the truth.

Obama, Wall Street, and the corporate mouthpieces in the mainstream media have been pumping up the American people for months with false data, unwarranted optimism, bank profits created out of thin air by accounting fraud, and attempting to create an economic recovery built on a foundation of sand, supported only by lies. The Obama budget is worse than a joke. It is a tragic joke. It amazes me that he can stand in front of the American people and present such a lie. The liberal media then unquestioningly presents the budget as a frugal cost cutting proposal that will reduce deficits and inflict painful cuts upon the poor American people. It would be laughable, if it wasn't so sad. One look at Obama's deficit projections for FY11 and FY12, presented one year ago, should be enough to convince you that no one in Washington DC has a clue what they are doing.

|

Federal |

(Deficit) |

Year |

Spending |

Surplus |

2011 |

$3,834 |

-$1,267 |

2012 |

$3,755 |

-$828 |

Obama projected a two year deficit of $2.1 trillion. His current projection, just one year later, is $2.75 trillion. He missed it by this much.

The rocket scientists running our country underestimated the deficit by 31% in the space of one year. I suppose that is considered highly accurate for a government drone. Now let's get some perspective on Obama's projected FY11 deficit of $1.65 trillion. This is the projected DEFICIT. Do you remember back to the Clinton administration? Did you feel like your Federal government wasn't spending enough? In 1998 the TOTAL SPENDING of the Federal government was $1.65 trillion. We now run deficits that equal the entire budget of the United States in 1998, without blinking an eye or questioning how we got here. The politicians have scared the populace into thinking that the country will collapse without the Federal Government spending $3.8 trillion of your money, every year.

Static Age

Can you hear the sound of the static noise?

Blasting out in stereo

Cater to the class and the paranoid

Music to my nervous system

Advertising love and religion

Murder on the airwaves

Slogans on the brink of corruption

Vision of blasphemy, war and peace

Screaming at you

I can't see a thing in the video

I can't hear a sound on the radio

In stereo in the static age - Green Day - Static Age

The politicians prefer their actions be bathed in shades of grey. The corporate payoffs, backroom deals, union arm twisting and selling of votes to the highest bidder are how business is done in Washington DC. They believe that if there is enough static noise being generated by the mainstream media, then the American public will be distracted and not notice they have destroyed the country. When analyzing Obama's budget we need some perspective. Below is a chart showing actual Federal spending and deficits from 1999 through 2010 and projections from 2011 through 2021. My assessment is that the Great American Empire peaked in 1999-2000. The unemployment rate was 4% and 64.4% of the working age population, or 137 million Americans, were employed. Corporate profits were surging, along with the stock market. The Federal government was spending $1.8 trillion and generating budget surpluses of $236 billion. The National Debt of $5.7 trillion was only 57% of GDP.

The decline of the American Empire can be seen in the chart of woe. The unemployment rate today is 9%. Only 58.4% of the working age population is employed. Eleven years after Peak Empire, the working age population has grown by 26 million people and the number of employed Americans has grown by 2.4 million. At least 64.4% of the population would like to be working. This means that there are 14.4 million people who would work if the jobs were available. The Federal government is spending $3.8 trillion and generating deficits of $1.6 trillion. The National Debt is $14.2 trillion, or 94% of GDP. Except for Wall Street banks and mega-corporations, small business profits are weak and the stock market is at the same levels reached in 1999. These are the truths you won't hear from politicians or the mainstream media.

So now let's assess the reality of Obama's ten year budget. If you were to believe the reports in the media, you would think that Obama is cutting deficits and making hard choices. Amazingly, deficits plummet all the way down to "only" $600 billion to $800 billion after 2012. In the chart above, I ignore the revenue side of the equation, because Obama's assumptions are beyond ridiculous. His assumption of the GDP growing from $15 trillion in 2011 to $24.6 trillion in 2021, a 64% increase, is a fantasy. During the last 10 years, GDP grew by only 51%. So, despite mind numbing debt levels, structurally high unemployment, peak oil, and a rapidly aging population, GDP is going to surge over the next ten years? I certainly believe that. Under the Obama budget, tax revenues will grow from 14.4% of GDP in 2011 to 20% of GDP in 2021. By comparison, the historical average is only 18% of GDP. Some of Obama's tax revenue assumptions are as follows:

- Raising the top marginal income tax rate from 35% to 39.6%. This is a $709 billion/10 year tax hike

- Raising the capital gains and dividends rate from 15% to 20%

- Raising the estate tax rate from 35% to 45% and lowering the estate tax exemption amount from $5 million ($10 million for couples) to $3.5 million. This is a $98 billion/ten year tax hike

- Capping the value of itemized deductions at the 28% bracket rate. This will effectively cut tax deductions for mortgage interest, charitable contributions, property taxes, state and local income or sales taxes, out-of-pocket medical expenses, and unreimbursed employee business expenses. A new means-tested phase-out of itemized deductions limits them even more. This is a $321 billion/ten year tax hike

- Massive new taxes on energy, including LIFO repeal, Superfund, domestic energy manufacturing, and many others totaling $120 billion over ten years

- Increasing unemployment payroll taxes by $15 billion over ten years

- Increasing tax penalties, information reporting, and IRS information sharing. This is a ten-year tax hike of $20 billion.

It is an absolute certainty that the Democrats will lose control of the Senate in 2012. Obama will never get any of his tax increases through a Republican controlled Congress. They are DOA. Therefore, his revenue assumptions are overstated by hundreds of billions every year. Even using his optimistic assumptions, the National Debt would reach $18 trillion in 2015. Using real world numbers, the National Debt will exceed $20 trillion in 2015. In what must be a gag, Obama says that interest on the debt will "only" be $500 billion in 2015. Hysterically, this would mean our debt holders will only require a crumbling empire to pay 2.5% on our debt. How about 5% as a minimum and 10% as a more likely rate? This would put interest on the debt between $1 trillion and $2 trillion per year. The collapse of America is a certainty if Obama's budgeted spending and deficits play out. Somehow, the majority of Americans are overwhelmed with indifference.

Overwhelmed By Indifference

Some of my friends sit around every evening

and they worry about the times ahead

But everybody else is overwhelmed by indifference

and the promise of an early bed

You either shut up or get cut up;

they don't wanna hear about it. - Elvis Costello - Radio, Radio

Do you remember when the politicians of both parties were making dire predictions of Great Depressions, economic collapse and 10% unemployment if we didn't pass their "save an investment banker" rescue package and the $800 billion “jobs creation” stimulus package? They assured the American people that these expenditures were temporary and were only being made to save the country. Before the crisis, Federal spending was $2.7 trillion. The talking heads at the Fed and in the White House assure us they saved the world. GDP is growing and Obama told me we've added over 1 million jobs in the last year. Sounds like the emergency is over. The $400 billion per year of emergency spending should now be rolled back, since it was temporary. Therefore, Obama's budget surely must going from $3.8 trillion back down to a pre-emergency level of $3.0 trillion in 2012. Not quite. You see, government spending never goes down. His proposal shows $3.7 trillion of spending in FY12. Emergencies never end for a politician in Washington DC. Spending equals power and control over our lives. There will always be another emergency that requires more spending.

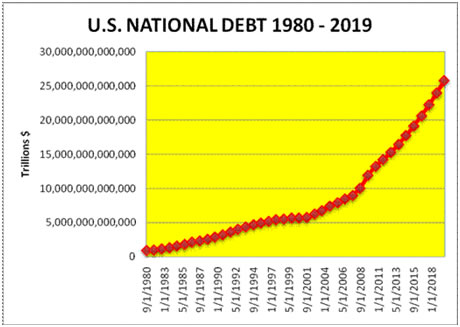

You are now hearing the spin from the ideologues on both sides of the aisle about their cost consciousness and desire to restrain spending. It's all a load of bull. Bush and the Republicans added $4.3 trillion to the National Debt during their reign of error. Obama has matched Bush in the space of 2 1/2 years by adding another $4.3 trillion. There is no effort to cut spending. Obama's budget shows spending rising from $3.7 trillion in FY12 to $5.7 trillion in FY21. The propaganda and misinformation being spewed from these corrupt politicians is mind numbing.

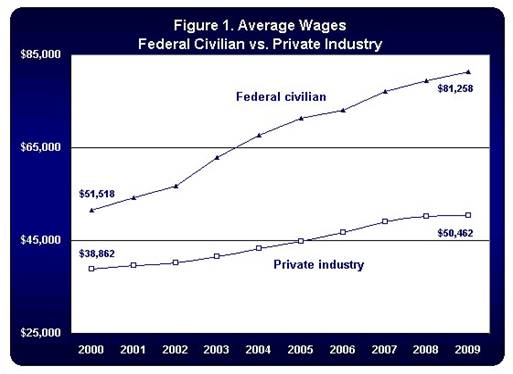

Again, some perspective is needed to realize how out of control our Federal Government has become. According to the BLS, inflation has risen by 33% since 1999. Real GDP has grown by 23%. The population of the U.S. has grown by 10%. The number of employed Americans has risen by 1.8%. The average pay for a Federal drone (aka worker) has risen by 58%, while the average pay for real workers has risen by only 30%. Therefore, the average non-government employee has seen a decrease in their standard of living as inflation has risen faster than wages. As you can calculate yourself, Federal government spending surged by 124% between 1999 and today. Have you noticed a doubling in service level, competence, educational scores, new energy solutions, or safety and security? What did we get for an extra $2.1 trillion of spending?

What we got was exhausting wars of choice, less freedom, less liberties, less safety, more rules, more regulations, more bureaucrats, more corruption, a financial collapse, and a government that has put us on a path to fiscal ruin. We've almost tripled spending on Defense. Are we safer? We've more than doubled spending on healthcare. Are we healthier? We've more than doubled spending on welfare. Are the poor less impoverished? We've more than doubled spending on education. Are our children smarter? The Federal government is out of control. When you hear a politician or pundit detailing the horrors of "spending cuts", please keep in mind they are lying. There will be no cuts until they are forced upon the government by the looming collapse of our economic system.

Now the question is what do we do about it? I know my first inclination would be to do what that Iraqi reporter did a few years ago during a Bush press conference in Iraq. I'd love to throw my shoes at Obama and every lying corrupt politician in America, but the momentary feeling of pleasure would be snuffed out in seconds by a hail of bullets from the Department of Homeland Security thugs guarding these traitors to the American republic.

Below is my CHART OF DOOM. Using real world assumptions, the National Debt will reach $25 trillion by 2019. That level of debt would be 130% of a realistic GDP figure. The interest on this level of debt would likely exceed $2 trillion per year, more than the entire Federal spending budget in 2002. This chart will not come to pass. Our economic system will collapse well before we reach a $25 trillion debt level. This is already baked in the cake. There are not enough politicians willing to tell the truth and not enough citizens that want to hear the truth. The result will be default, insolvency, currency collapse, vaporization of wealth, chaos, and pain.

The only way to avert the coming financial catastrophe is to go Egyptian on their asses. Maybe mobs of Americans surrounding the White House, Federal Reserve building and Wall Street bank headquarters would get their attention. It wouldn't take a majority, but a minority of angry Americans willing to fight for the future of the country. The anger is building. More people are becoming aware. The internet is working its magic, just as it is doing in the Middle East. Those in control can keep pumping out their lies and propaganda, but the truth is plain to see, if you open your eyes.

"It does not take the majority to prevail, but rather an irate, tireless minority, keen on setting brush fire freedom in the minds of men." - Samuel Adams

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2011 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.