Libya Crisis and its Energy Industry

Politics / Middle East Feb 22, 2011 - 09:23 AM GMTBy: STRATFOR

Libya’s political strife has already begun to impact its energy production, and this is just the beginning.

Libya’s political strife has already begun to impact its energy production, and this is just the beginning.

Analysis

Unlike energy produced in most African states, nearly all of Libya’s oil and natural gas is produced onshore. This reduces development costs but increases the chances that political instability could impact output — and Libya has been anything but stable of late.

Libya’s 1.8 million barrels per day (bpd) of oil output can be broken into two categories. The first comes from a basin in the country’s western extreme and is exported from a single major hub just west of Tripoli. The second basin is in the country’s eastern region and is exported from a variety of facilities in eastern cities. At the risk of oversimplifying, Libya’s population is split in half: Leader Moammar Gadhafi’s power base is in Tripoli in the extreme west, the opposition is concentrated in Benghazi in the east, with a 600 kilometer-wide gulf of nearly empty desert in between.

This effectively gives the country two political factions, two energy-producing basins, two oil output infrastructures. Economically at least, the seeds of protracted conflict — regardless of what happens with Gadhafi or any political changes after he departs — have already been sown. If Libya veers towards civil war, each side will have its own source of income to feed on, as well as a similar income source on the other side to target. There have not been any attacks on the energy sector yet, but the threats to stability — overt and implied — have been sufficient to nudge most international oil firms operating in Libya to evacuate their staffs.

Those staffs are essential. At 6.5 million people, Libya’s tiny population simply cannot generate the mass of technocrats and engineers required to run a reasonably sized energy sector. As such foreign firms do most of the investing and all of the heavy lifting. The Libyans are hardly incompetent, but even if their skill sets and labor force simply were deep enough (and they are not), the political instability is keeping many workers at home. Within the past 24 hours we have seen the first reductions in output — about 100,000 bpd is now off-line — and more are sure to follow.

This will be the biggest problem for Italian energy major ENI. ENI’s relationship with Libya reflects Rome’s, which has had influence in what is currently Libya literally since the time of the Roman Empire. ENI has had boots on the ground in the North African state since the dawn of its energy industry in 1959 and has never scaled back its operations. Even in the dark days of Libya’s ostracism from the West in the 1980s, when American firms left due to Gadhafi’s backing of various militant factions and U.N. and U.S. sanctions were levied after Libyan agents downed Pam Am Flight 103 in 1988, killing 270 people, ENI drilled on. As such, ENI produces some 250,000 bpd in Libya, which accounts for 15 percent of the Italian firm’s global output. It is also the major power behind the country’s moderate piped natural gas exports.

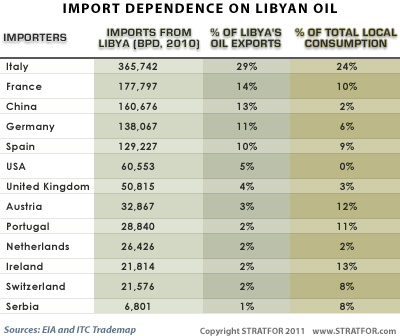

ENI is also a partially state-owned firm and is thus susceptible to inefficiency and a lack of propensity to rise to technical challenges. As such, ENI has simply been unable to secure new energy sources except on terms set by others. Unsurprisingly, it has seen its market share eroded by a more adept private challenger, Edison. All told, Italy has to find about 60 billion cubic meters (bcm) of natural gas a year to cover the country’s natural gas deficit. Despite the drawbacks of partnering with someone like Gadhafi, Libya can provide about 11 bcm — and ENI, fully supported by the central government in Rome, gets all of it. Italy — via ENI — is also Libya’s single largest oil consumer, with most of the rest going elsewhere in Europe.

ENI is also a partially state-owned firm and is thus susceptible to inefficiency and a lack of propensity to rise to technical challenges. As such, ENI has simply been unable to secure new energy sources except on terms set by others. Unsurprisingly, it has seen its market share eroded by a more adept private challenger, Edison. All told, Italy has to find about 60 billion cubic meters (bcm) of natural gas a year to cover the country’s natural gas deficit. Despite the drawbacks of partnering with someone like Gadhafi, Libya can provide about 11 bcm — and ENI, fully supported by the central government in Rome, gets all of it. Italy — via ENI — is also Libya’s single largest oil consumer, with most of the rest going elsewhere in Europe.

Whether ENI loses access to Libyan energy because of safety concerns, supply interruptions or a new government in Tripoli that looks less than favorably upon the company that stuck by Gadhafi through thick and thin, there is much risk and little opportunity ahead in ENI’s future relations with Libya.

By George Friedman

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2011 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.