Why I'm Buying Silver at $30

Commodities / Gold and Silver 2011 Feb 23, 2011 - 03:18 AM GMTBy: Jeff_Clark

Jeff Clark, BIG GOLD writes: The silver price has bounced 27% since January 28, a huge advance for a measly 16 trading days. It's already soared past its 2010 high and was selling for less than $16 this time last year, a double in 12 months. So, is it pricy? Or should we ignore the run-up and keep buying?

Jeff Clark, BIG GOLD writes: The silver price has bounced 27% since January 28, a huge advance for a measly 16 trading days. It's already soared past its 2010 high and was selling for less than $16 this time last year, a double in 12 months. So, is it pricy? Or should we ignore the run-up and keep buying?

I've read a few articles that say we should expect silver to drop to the $25 level, and one pinpointed $22. Others, of course, see bullish tea leaves for the near term and believe it's headed higher. Of those that assert silver will decline, most believe it will be temporary, though one writer claims the bull market in precious metals is over (I think he's a holdout from the gold-is-a-bubble camp).

These authors could be right about a near-term decline, but I'm less concerned with what the price does this month or even the next few months, and more focused on where it's likely headed over the next few years. Caution: the chart ahead may cause excitement.

While there are lots of reasons to be bullish on silver, what everyone really wants to know is how high the price can go. Here's one hint, based strictly on historical price performance.

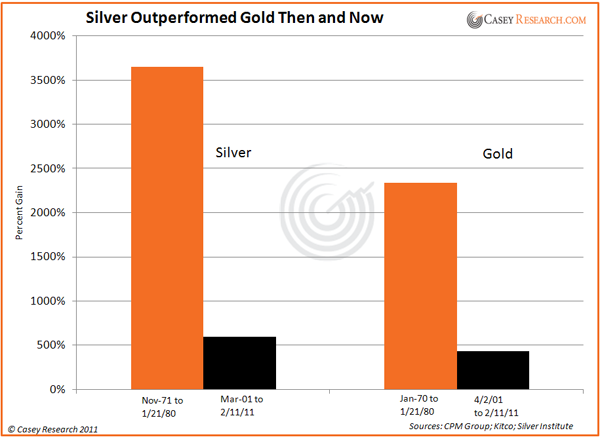

Silver rose an incredible 3,646% from the November 1971 low of $1.32 to its January 21, 1980 high of $49.45 (London PM fix prices). Our current advance, through February 4, is 596%. At $30, silver would have to climb over five times to match the last great bull market. If it did, the price would hit $160.89 per ounce (from its bottom of $4.295 on March 30, 2001).

You'll also notice silver has a record of outperforming gold in these two bull markets. In spite of the price dropping 26.9% in 2008 (while gold gained 5%), the metal has outrun its yellow cousin by 38.6% since their respective lows in 2001.

Gold advanced 2,333% in the 1970s; it's currently up 430%. If it matched the last run, the price would hit $6,227.26 per ounce, a return of four-and-a-half times the gold you buy today.

From solely a historical price perspective, the chart certainly suggests we've got a long way to go with both metals. The question is if the fundamentals support such price advances (show me a healthy dollar and no threat of inflation, and we'll talk), but my point for the moment is that there is an established precedence for the price of these metals to climb much higher. And just as important, to keep one's eye on the big picture.

So, yes, I'm buying silver at $30, in part because I think the potential for enormous gains is high.

However, I'll add that I'm not draining my cash account to do so. I think it's important for the precious metals investor to always be in the game, but given silver's volatility and the precarious nature of most markets right now, prudence suggests we keep some powder dry as well.

Let's say one of the soothsayers noted above is correct and silver temporarily falls to $25. If you snag it at that level, your endgame return would be 543%, vs. the 436% gain from $30 (excluding premiums and storage costs). That's more than another 100% gain on your original investment.

But how does one buy silver not knowing if the price will plummet or soar? For example, silver could take off from these levels, never to see $30 again, leaving those of you waiting for a sell-off out of the market. Or it could sink to $25, making investors who went all in now regret they didn't wait for a better price. Or it could trade sideways until, say, next fall, leaving both parties uncertain and on the sidelines.

In my opinion, there's a one-word answer to the question. It solves all dilemmas - it keeps you in the market, while simultaneously letting you buy at lower prices if that occurs. It lets you build your position bigger and bigger without the worry of whether you're getting a good price.

That one-word verb is, accumulate. Or in the vernacular made popular in the '80s by the financial planning community, dollar cost average. In other words, buy a little now, buy a little next month, etc., until you have a position sufficient in size to fight off inflation and any other economic woe we're likely to encounter over the next few years.

So my advice is, buy, hold, repeat. Because if our silver market ends up looking anything like that left bar in the chart, you may regret not having bought at $30, too.

Where do we buy silver and gold? Get our recommended list of dealers, who have some of the cheapest prices in the industry, along with the silver stocks we think will outperform the metal, with a risk-free trial to BIG GOLD for only $79 per year. To learn how Editor Jeff Clark has boosted his mom’s IRA and his subscribers’ portfolios – and how he can do the same for you – click here.

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.