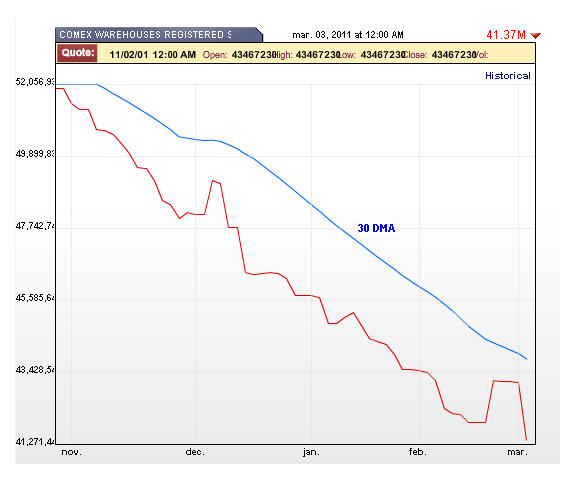

Dwindling Comex Silver Bullion, But Where Is the Gold Coming From?

Commodities / Gold and Silver 2011 Mar 05, 2011 - 03:19 PM GMTBy: Jesse

I wonder how much of this silver being sold is leased out from unallocated accounts and holdings in ETFs.

I wonder how much of this silver being sold is leased out from unallocated accounts and holdings in ETFs.

How unfortunate for the silver shorts that the bankers lack a ready supply of bullion from the central banks. Most national stores of silver in the west have already been depleted.

Special thanks to 24hourgold. This interactive chart can be viewed here.

Gold bullion, however, is still available from those central banks who lease their gold to the bullion banks, where it is then sold into the private market, and is afterward carried on the national accounts as bookkeeping entries.

This scheme has been promoted by some of the TBTF banks for many years as a means of providing a steady income for the central bankers and their Treasuries on their 'idle resources.' Lease us your gold, and we will pay you a percent or two for it in paper.

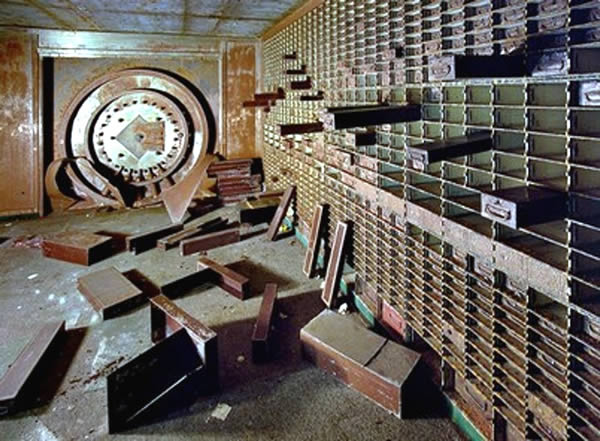

What Mubarak and other dictators in history past have done using cargo planes, trucks and trains, the western bankers may have done over a period of time using computer entries and their cronies in the central banks: plundering the national treasuries of Europe, quietly and over time. And it was not stored in salt mines and lake bottoms, but sold in plain sight.

Won't the people be surprised if they find how much of their gold is gone, and how it was used to deceive them while their other assets were stolen using phony paper. Do you think there will be reparations made, and justice done?

They will most likely try to ignore it and dismiss it, claim that it is not needed and we are better off without it. And then they will buy it back, but at what prices? And what so called patriots will be their willing stooges and accomplices in theft, again.

Watch how they weave their arguments over the misappropriated social trust funds and pensions, bank bailouts, and subsidies to the corporations and monied interests to see what their methods will be. This debt is sovereign, a matter of national interest if not sacred honor, and so must be paid whatever the cost. But that debt to those people, well, the money is gone, so too bad for them. Sacrifices must be made, and we will choose who makes them based not on the law or justice, but on the principles of crony capitalism, which are always for private benefit of the few.

What a scandal! And irony indeed if this banking fraud is exposed not by the virtuous West, but by China and the BRICs, and their unwillingness to go along with the scheme.

But this could not be true. Banks do not do this. It would be like their presenting forged documents, concealing evidence, and committing blatant perjury to take people's homes in their very own courts!

But this is merely rhetorical speculation and conspiracy theory of course, because the theft could never pass undisclosed with all the independent audits, transparency, oversight, and accountability in the central banking system. Surely the people have a good account of the amount, number, and quality of every bar that they own from an impeccable source which they control. Uh, there have been no such audits or accountability, the system is necessarily opaque? Oh. We are shocked, shocked, that the gold is gone and the private banks cannot replace it. The smartest minds told us it was a good plan, an excellent idea. The US pressured us to do it to support the dollar. How could we have known that people would demand these barbarous relics again. Do they not understand monetary theory? They are to be ridiculed1

And now all that is left is running the bluff, and playing for time, looking for an opportunity to deflect the issue to something, someone else.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.