Japanese Nuclear Plant Explosions Trigger Global Stock Market Meltdown

Stock-Markets / Stock Markets 2011 Mar 15, 2011 - 11:41 AM GMTBy: Nadeem_Walayat

Japanese Nuclear power plant buildings exploding virtually every other day has sent a shock wave across the worlds stock markets that effectively crashed the japanese stock market by 11% which set in motion a chain reaction of stock market meltdowns across the world.

Japanese Nuclear power plant buildings exploding virtually every other day has sent a shock wave across the worlds stock markets that effectively crashed the japanese stock market by 11% which set in motion a chain reaction of stock market meltdowns across the world.

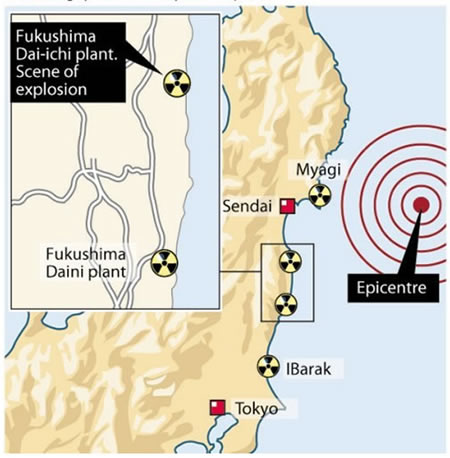

Why Japans Nuclear problem is a Problem for America

Japan in many respects has been lucky in that the winds continue to blow the radioactive clouds away from Japan out across the pacific.

However the nuclear crisis is far from over, with worsening news by the hour of now including partial meltdowns of multiple reactor cores, cracks in the containment vessels and a fire in reactor 4.

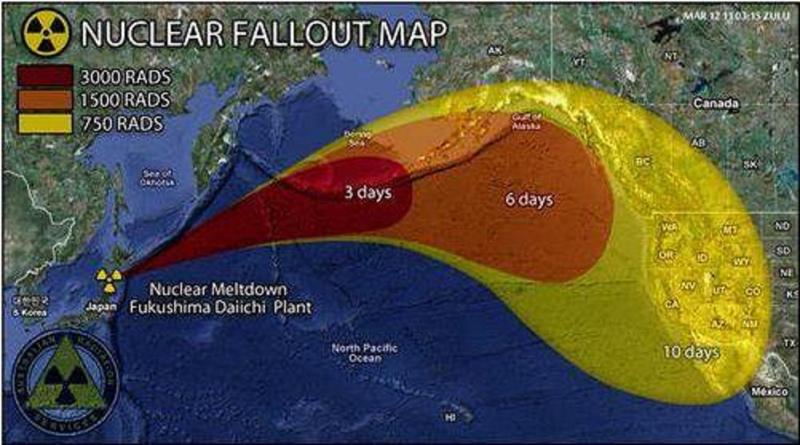

The below graph estimates the consequences of what a full blow meltdown and subsequent explosion of a Fukushima nuclear plant reactors would imply in terms of radiation fallout for western Canada and the United States.

Japanese Stock Market 17% Nuclear Crash

Japan's crippled economy continues to suffer from power cuts, with infrastructure damage estimated costs ranging all the way upto $1 trillion. Whilst the Earthquake was bad, and the Tsunami many times worse, however Japanese nuclear power stations exploding chernobyl style in this densely populated country would be a doomsday scenario that would change the economic equation for Japan for more than a decade, which had already been fighting hard to pull its way out of a 20 year long economic depression.

Japan's stock market crashed by 10.6% to close at 8,605, down 17% over the past 2 days. Japan's central bank responded by pumping in another $90 billion liquidity on top of Monday's $160 billion by means of making loans available to financials and buying of Japanese bonds and stocks.

Japans economic future hinges on the actual outcome of the Japanese nuclear plants crisis, if total meltdown can be averted then ironically Japan's GDP could rebound quite strongly after the initial slump as infrastructure including whole towns are rebuilt. Meanwhile everyone waits and watches the outcome for at least 4 Japanese nuclear reactors.

In terms of the global economy Japan's huge 20% of GDP Loss, is not expected to have any lasting impact as basically Japan after 20 years of stagnation is not as big global player that it once was, therefore at worst this will hit global GDP by 0.2%.

FTSE 100 Index

FTSE opened sharply lower in response to Tokyo's crash, down by more than 3% before beginning the slow climb off of the morning low as the index tracked a more stable Dow into the close to end down 1.4% on the day at 5,615.

Dow Jones Stocks Index

The Dow has continued to show relative strength against other stock indices as it continues to play out a relatively orderly corrective trend following its peak of some 4 weeks ago.

Stock Market Crashes and Panics Breed Opportunities

Will this black swan event impact on long-term western stock market trends ?

My next in-depth analysis will seek to update the trend expectations for the stock market for the rest of 2011, which will now also take into account the implications of the unfolding nuclear and economic crisis coming out of Japan.

Last In-depth Analysis - 18 Oct 2010 - Stocks Stealth Bull Market Dow Trend Forecast into Jan 2011

Last Interim Analysis - 24 Jan 2011 - Dow Stock Market Index Interim Trend Analysis and Forecast Update

The above analysis is concluding towards probability favouring continuation of the trend higher to the Dow 12k target by early Feb, when the market can be expected to consolidate the advance of the past 6 months and enter into a significant correction that at this point suggests a 10% decline, so tighten the stops and take the ongoing rally to bank profits which is the number one AIM of trading / investing!

Ensure you are subscribed to my always free newsletter to get this analysis in your email in box.

Comments and Source: http://www.marketoracle.co.uk/Article26938.html

By Nadeem Walayat

Copyright © 2005-2011 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.