The Outlook for Agricultural Commodities

Commodities / Agricultural Commodities Mar 16, 2011 - 09:35 AM GMTBy: John_Hampson

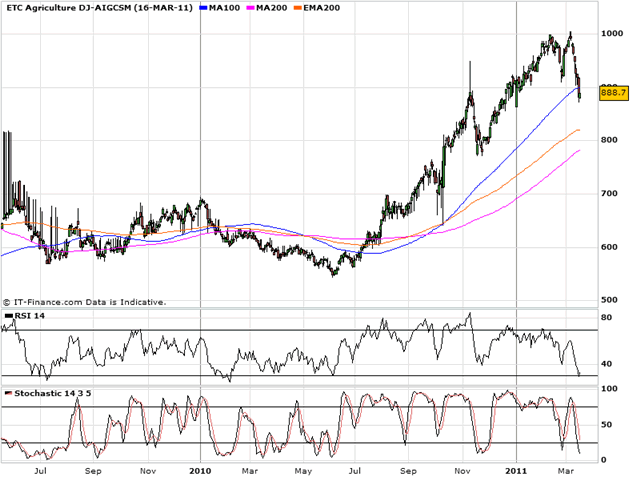

Soft commodities have experienced some steep selling in the days since the Japan disaster, as speculative money has exited more 'risky' assets. But having enjoyed a 9-month stellar run, a pullback was overdue. Considering a broad softs ETF as a proxy, at the time of writing the complex is now nearing oversold levels:

Soft commodities have experienced some steep selling in the days since the Japan disaster, as speculative money has exited more 'risky' assets. But having enjoyed a 9-month stellar run, a pullback was overdue. Considering a broad softs ETF as a proxy, at the time of writing the complex is now nearing oversold levels:

So is this a buying opportunity?

First understand why agricultural commodities made some spectacular gains over the last 9 months. This period was characterised by a long run of forecasts of declining inventories, thanks to extreme and uncommon weather patterns and natural disasters affecting harvests and planting. Agriculture suffers from inelasticity of supply, so price spikes are always a risk, particularly within the broader picture of increasing global demand (from both population expansion and per capita consumption growth). In addition, the tide of monetary liquidity and low interest rates in most of the world's leading economies spurred hot money into commodities. And lastly, the interaction of commodity prices drives lower priced crops upwards (as farmers increase planting of higher priced crops thus reducing supply of the laggards) and the whole complex upwards (as increasing grain and energy prices raise general costs of cultivation, processing, distribution, and so on).

Homing in on the natural phenomena, 2010 was the joint hottest year on record, part of a longer term trend of global warming. Closely linked wth global warming are both increasing trends in natural disasters and extreme weather patterns. In 2010, major droughts in Russia and China impacted wheat production. Major flood in Pakistan impacted cotton production, and other crops. A combination of La Nina, negative Arctic Oscillation and negative North Atlantic Oscillation gave the Northern Hemisphere extreme conditions in winter (reflected in the latest bar in the chart below), adversely affecting winter crop growth in USA and Europe. As a result of these phenomena, some countries imposed export controls and others engaged in panic buying, driving prices higher.

Source: NOAA

Now, forecasts for Spring 2011 make for more normal weather and conditions globally. La Nina should retreat and the two Oscillations have turned positive. This should make for some general recovery in supply forecasts, which may ease prices further. That period is also a seasonally negative time for prices of certain crops, such as sugar, coffee and wheat. And if we use Gann methodology, an important top was made for agricultural commodities between what would be February and June 2011, in the historical rhyme of 1951.

Nevertheless, as things stand now, we have low global inventories of corn, soybeans, sugar, tomatoes and other softs. Normal or average weather conditions in 2011 will only make for inventory stabilisation, in some cases at critical levels. The trends of increasing natural disasters, increasingly uncommon weather patterns, and global warming, remain threats, as do geopolitical developments on energy prices. Plus, increasing global inflation and liquidity conditions will keep commodities attractive to the speculative community.

In summary, I want to continue to hold agricultural commodities whilst global inventories remain low and trends in natural phenomena threaten, and until we see a reversal in inflation, monetary conditions and geopolitical troubles in key energy producing nations. Whilst these remain in place, I expect prices to be underpinned. However, in the near term, I do not want to be a buyer of additional holdings due to more favourable global weather developments and seasonality.

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation / Site launch 1st Feb 2011

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.