Yen Intervention, What a Manipulated Joke the Markets Are!

Stock-Markets / Market Manipulation Mar 19, 2011 - 11:24 AM GMTBy: PhilStockWorld

Of course, that’s why we love them, right? But, sometimes, even when we’re playing along – the manipulation we see is so sickening, we still feel the need to declare SHENANIGANS!

Of course, that’s why we love them, right? But, sometimes, even when we’re playing along – the manipulation we see is so sickening, we still feel the need to declare SHENANIGANS!

On Wednesday evening, against all possible logic and on no volume at all – the Yen future ROSE (up is down), blowing past the 79.75 record high against the Dollar that had held since 1995, all the way to 76.65 DESPITE the FACT that it had already been signaled that the BOJ was ready to step in to support the Yen at around 80.

On Wednesday evening, against all possible logic and on no volume at all – the Yen future ROSE (up is down), blowing past the 79.75 record high against the Dollar that had held since 1995, all the way to 76.65 DESPITE the FACT that it had already been signaled that the BOJ was ready to step in to support the Yen at around 80.

Why did this happen then? This is what we call a flush and it’s what the manipulators do ahead of reversals to flush out as many stops as they can. By triggering the stops of other bullish betters, they force them to sell – lowering their entry price and by triggering new, lower levels, they also entice short player to take up new positions.

Why is this a good thing? Because this adds two kinds of fuel for the manipulators on the way up. The short players who get tricked into following the move are forced to cover (buy) as their stops get hit in the other direction and also, the buyers who got stopped out on the way down have to scramble to get back in.

This is a very powerful move and keep in mind the advantage - the people who are doing the flushing are not "throwing away money" to make it happen. They can take up a short position of their own and then engage in naked selling or even legitimately sell longs they hold at panic prices – TO THEMSELVES! If an operator buys AAPL for $360 in Company A and then sells it for $335 and buy it again in Company B – what has he lost?

Nothing, he has simply transferred $25 from company A to company B. If they do this well, they can even create tax losses in both companies on alternate years as well as gains whenever they need a good quarter. More importantly, it means you can use a relatively small amount of money – especially in the thinly traded futures markets, to manipulate massive amounts of stocks, commodities or even currencies. We see this kind of manipulation often enough that we don’t even have to wait to analyze it – in this case the timing and severity of the move made it pretty obvious – as I said to Members at 5:15 in Wednesday’s chat:

OMG! What the Hell is the Yen doing? 77.75 – a 2% drop after hours. That is completely unheard of. I think they are just busting on people who made the very obvious trade of Yen weakening ahead of BOJ action but WOW! I wish I had the guts to buy off the 78 line but I’m going out and that could be seppuku!

So we could see that the whole thing was BS WHILE IT WAS HAPPENING – yet no action will be taken against the people who committed this crime – and it is a crime as good people who make legitimate, rational bets that the Yen is likely to strengthen based on solid research and reliable, LEGITIMATE information that they were able to gather in the open market have their money STOLEN from them by people who manipulate the market for their own needs. That is a very sick system people!

So we could see that the whole thing was BS WHILE IT WAS HAPPENING – yet no action will be taken against the people who committed this crime – and it is a crime as good people who make legitimate, rational bets that the Yen is likely to strengthen based on solid research and reliable, LEGITIMATE information that they were able to gather in the open market have their money STOLEN from them by people who manipulate the market for their own needs. That is a very sick system people!

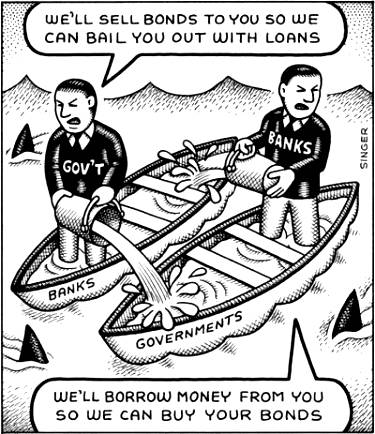

And why doesn’t the government do anything about this? Ha! The government is involved in it’s own massive Ponzi scheme with the very same market manipulators (only work with the best!) who are running rampant over small investors – the ones the government is supposed to be protecting!

Much of the "wealth" in this country (not just this one, of course) is based on Ponzi or Pyramid schemes. As Pentax pointed out in Member Chat yesterday, the operation of a nuclear plant is a Ponzi scheme because the plant operators are using dangerous, deadly materials that are capable of unleashing hundreds of Billions of Dollars worth of environmental damage (not to mention the cost in human life and long-term health consequences) for their fuel source – ignoring the true cost of the operation based on the VERY FLAWED ASSUMPTION that the worst case won’t happen.

On top of this, they totally ignore the cost of disposal of the fuel, which remains toxic for A MILLION YEARS. Do you really believe that the Koch Brothers have paid in advance for 1 MILLION years of storage for their toxic waste or do they simply pay the annual cost out of operations while they reap the current profits against a Ponzi scheme that will one day fold when there is an accident or a change in consumer demand or we run out of new uranium to fuel the plant – all things that will happen long before the million years of storage are up.

We allow these games to be played on so many levels that we are all numb to the consequences. The global currency scam is just another one of those games, where our governments can have completely irresponsible policies and they get away with it because they can simply print money to balance their books. They already tax us but, when they print money, they also decrease the value of the money we do have. And not just the money we earned this year but the value of EVERY SINGLE DOLLAR we have saved or placed into assets that are based in the Dollar, like our homes, cars, bonds and, of course, savings accounts.

NOT though, our stocks! Stocks are priced in dollars so when the dollar goes down, the markets will "rise" simply based on the weak dollars we have to buy the stocks with. The same is true with commodities. So the "investing class" those who are fortunate enough to have so much money that they are able to put some into stocks and commodities – make a fortune while the value of everything the working class slaved their whole lives to scrape together is trashed. Not just trashed, of course, this wealth is being TRANSFERRED from the bottom to the top through this process.

This is not "Commie talk" people. If you are not one of the Forbes 400 you are either a victim or a victim-in-waiting because what do you think the 400 will do when the bottom 90% are bled dry? Do you think they will suddenly develop a conscience and start sharing? Just two years ago we saw what happened when the Investment Banks got so rich that they finally turned on each other and that war wiped out Washington Mutual and Bear Stearns (given to JPM), Indy Mac, Northern Rock, Merrill Lynch (given to BAC), Lehman etc. The fallout from that little spat was the destruction of the Global Economy and another 20% of the bottom 90%’s wealth was transferred up the ladder – just like it was the last time we had a bank crisis – under the Bush I administration.

This is not capitalism folks, this is a Corporate Kleptocracy (as illustrated by William Banzai):

Now, let’s get down to business, though. This is the game as it’s being played and it’s all of our jobs to win the game or at least do as well as we can. I may spout off once in a while in my small attempts to fight the power but when you here the words "fight the power" you are programmed to think that that’s a "radical" idea and that it your job to fight FOR the power and maintain this status quo and when you watch this video – can you relate to what Public Enemy was saying in 1989, at the time of the last Bank Crisis or are these people against you?

I have a feeling there are about 20M Americans who are having a much easier time relating to this song, 20 years later: "No we’re not the same – Cause we don’t know the game - What we need is awareness, we can’t get careless.. Our freedom of speech is Freedom or Death – We got to fight the powers that be." How long will it take before the middle class, who are now the lower class – get as upset as the lower class was about their lot in life? How long can we keep concentrating the wealth of this nation in the hands of the very few before the masses wake up and do more than hold a rally?

Be very thankful that you can’t relate to the people at this rally. We are close enough to the top that we are still benefiting from this transfer of wealth. Like the remora, that attach themselves to sharks and feed well off the scraps, we can benefit by playing along with Goldman’s game but it IS our class, the underclass of the overlords that has to worry about how long this can continue before the bottom falls out. Don’t worry about Goldman Sachs, JP Morgan, Warren Buffett or T Boone Pickens – they’ll be fine. Just like all the top 1%’ers who fled Egypt while Mubarak took the fall – they will just set up shop in another nation – there’s always room for one more when that one more has Billions of dollars, right?

So let’s enjoy the nonsense while it lasts but let’s also think about where this is all going to end. Like all good things, it will come to one…

Have a great weekend

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.