Series of International Crisis Impact on Gold

Commodities / Gold and Silver 2011 Mar 22, 2011 - 02:04 AM GMTBy: Pete_Grant

The first quarter of the new year has been a tumultuous one, marked by geopolitical unrest in North Africa and the Middle East, major natural disasters in New Zealand and most recently in Japan, and of course ongoing economic turmoil throughout much of the industrialized world. This has resulted in rather extreme market volatility, amid fits of risk aversion associated with broad-based uncertainty about the likely impact of recent events.

The first quarter of the new year has been a tumultuous one, marked by geopolitical unrest in North Africa and the Middle East, major natural disasters in New Zealand and most recently in Japan, and of course ongoing economic turmoil throughout much of the industrialized world. This has resulted in rather extreme market volatility, amid fits of risk aversion associated with broad-based uncertainty about the likely impact of recent events.

Most importantly, our hearts go out to the people of the world who are suffering right now; be it due to political repression, natural disaster or economic hardship. However, in this increasingly interconnected world, it is important to remember that events on the other side of the world can indeed have a significant impact right here at home. Faced with the harsh reality that global markets have no sympathy, savers and investors the world-over need to make decisions that protect their interests and their wealth.

As you contemplate the best steps to take to preserve your wealth in light of global events, you may be feeling overwhelmed by all the information and conflicting reports so readily at our fingertips in this modern age. Sometimes its best to step back, take a deep breath and realize that frequently, the most obvious answer is the right answer. But before I delve into how investors are likely to behave in this particularly trying market environment, let me lay a little groundwork.

There is a great deal going on the world right now, all of it is worthy of discussion, but in this issue we will deal with the two major front-burner issues: Japan and the Middle East/North Africa.

Japan

While the immediate situation in Japan is a fluid one -- changing day by day and in some instances hour by hour -- it is above all else a humanitarian disaster. As of this writing, the death-toll is well over 6,000, with more than 10,000 people still unaccounted for. As recovery and rescue efforts continue, Japan is struggling mightily to contain the nuclear disaster that is a by-product of the earthquake and tsunami. We wish them godspeed in those efforts and as we consider potential prudent moves on our own behalves, we encourage our clients and friends to offer what they can to the relief efforts if they are in a position to do so.

When all is said and done, I have no doubt that Japan will rebuild and ultimately recover from the devastation. However, it may prove to be a long and rocky road for a country already saddled with massive debt and an ever-worsening demographic problem. While the country’s debt-to-GDP ratio is in excess of 200%, Japan is a country of savers and the majority of that debt is held internally. In that respect, Japan is probably in as good a position to absorb the negative economic impacts of the earthquake as any industrialized nation. However, a rapidly aging population means the mounting debt burden is going to be shouldered by fewer and fewer working-age Japanese as time progresses.

Additionally, Japan’s export-driven industrial economy is largely reliant on raw materials and energy imported from abroad. More than a third of Japan’s electricity comes from nuclear power, which has been a strategic priority since the oil crisis of the 1970s. In the months and years ahead, the people of Japan are going to have to come to grips with the trade-offs associated with nuclear power. If they decide that their location within the Pacific ring of fire makes nuclear too risky, it will leave their economy overly -- and dangerously -- dependent on the import of carbon-based fuels. Having their future even more dependent than it already is on volatile energy markets is not an enviable position to be in.

|

Meanwhile the crisis in Japan has prompted countries around the globe to review their nuclear policies. Industrial giant Germany vowed to close its seven oldest nuclear power plants, which would reduce its nuclear-powered electricity generation by about a third. Even China, not known for being timid in pursuing infrastructure projects, has suspended all approvals for nuclear power plants. You can imagine the long-term implications for energy prices as competition for increasingly scarce fossil fuels heats up.

Japan is the third largest economy in the world, a primary driver of the global economy. Nonetheless, Japan has struggled with anemic economic growth for decades, despite a zero interest rate policy (ZIRP) and quantitative easing (QE). Makes one wonder why the United States is pursuing the very same policies and seems to be expecting different results (more on that later). So the rest of the world is understandably concerned that the disaster will not only lead to a recession in Japan, but may well weigh on the nascent recoveries elsewhere in the world, including the one right here in America.

In an effort to prevent a liquidity crisis and in the hope of mitigating the recession risk, the Bank of Japan (BoJ) acted swiftly and decisively, flooding the market with yen. The BoJ also pledged “powerful monetary easing”, but with interest rates already at zero, further boosts to the money supply and additional asset purchases are really the central bank’s only weapons. Interestingly, despite all the liquidity and loose policy talk, the yen rose dramatically against most currencies amid talk of the carry trade unwind and yen repatriation. In the face of a major catastrophe, the yen surged to a new all-time high against the dollar.

Think about that. A major natural disaster. An ongoing nuclear disaster. The threat of major economic turmoil stemming from both, and the BoJ’s primary concern ends up being yen appreciation. On Friday, March 18 the G-7 intervened jointly in the foreign exchange market for the first time in a decade...and they were selling yen. It pretty much drives home the point about ‘uncertainty’. As governments around the world intervene in various ways in order to override organic market forces, it creates a whole new set of risks in the process -- some known, but many unknowable.

North Africa and the Middle East

What began as a food price riot in Tunisia has grown into unprecedented regional geopolitical upheaval. Long-ruling strongmen in both Tunisia and Egypt were ousted in a matter of weeks by popular uprisings. While it remains to be seen if the new governments in these countries will prove to be an improvement or not, those early successes prompted similar movements throughout the region: in Algeria, Syria, Jordan, Yemen, Bahrain and Saudi Arabia, among others.

Then of course there is Libya, where protests seeking to unseat autocratic ruler Muammar Gadaffi have turned into an all-out civil war. After weeks of dithering, which brought pro-Gadaffi forces to the brink of victory, the international community finally decided to act. On March 17 the UN Security Council authorized "all necessary measures" short of a ground offensive to halt Gadaffi’s attacks on the rebels.

So the question now becomes: Is the West’s action too late? And if we’re not too late, are we actually fostering stability in the region, or are we making things worse? Only time will tell.

The Middle East and North Africa are home to more than 50% of the world’s known oil reserves. It has been noted -- with a fair amount of concern -- that three of the last five global recessions have been the result of energy price spikes stemming from conflicts in the Middle East. Oil prices have been on the rise throughout most of the year, reaching 30-month highs in February. The prospect of ongoing -- and perhaps widening -- instability in the region is likely to keep crude oil underpinned for some time to come.

The Implications

Higher energy prices will drive inflation expectations higher, elevating risks to growth in the process. Higher food prices in particular will further stoke the geopolitical unrest in oil producing nations, increasing the likelihood of disruptions to the crude supply. It becomes a vicious cycle. Japan is particularly vulnerable to energy risks now for reasons we’ve already discussed, but the U.S. remains quite vulnerable as well.

Monetary officials in the United States are undoubtedly playing the same “what if” game we are. Do events in Japan threaten to trod on the latest “green shoots” of a U.S. recovery? If Japanese investors do in fact start repatriating their capital en masse, what are the implications for the U.S. Treasury market? With Treasury holdings of $885.9 bln, Japan remains the second largest foreign holder of U.S. debt. If they reduce participation in bond auctions, or worse yet start selling bonds to raise funds for rebuilding, the Treasury Department is going to potentially have both supply and demand problems that will put upward pressure on rates. The pricing of this risk has likely contributed to the rise in the yen and added further weight to the dollar.

It is likely that only the Fed would step-in to fill the demand void and absorb any excess supply if Japan where to turn inward. In recent months, the Fed has already surpassed both Japan and China to become the largest holder of our debt. Speculation that the Fed will extend its quantitative easing campaign beyond the scheduled end of QE2 in June has escalated in light of the recent events in the Middle East and Japan.

One thing we do know from history is that higher energy prices do not bode well for the U.S. economy. In our still-weakened state in the wake of the financial crisis we are especially susceptible: encumbered by huge deficits, high unemployment, a moribund housing market, budget battles, a looming fight over the $14.294 trillion debt ceiling, and the potential for a government shut-down. An oil shock on top of all that just might be the proverbial straw that breaks the camel’s back.

Faced with rising price risks and interest rates already at zero, like the BoJ, the Fed’s options are limited. And the onus is indeed on the Fed as our Representatives in Washington squabble over tens of billions of dollars when we have a multi-trillion dollar problem on our hands. Even the chairman of the Joint Chiefs of Staff, Admiral Michael Mullen has weighed in, calling the growing national deficit the “biggest threat to our national security.”

Where to turn

Historically, in times of uncertainty and turmoil, investors have moved out of risky assets into “safe-havens” like cash, government bonds and of course gold. Arguably some of the traditional safe-havens of the past -- most notably U.S. Treasuries and the dollar -- have been severely diluted due to the proliferation of supplies.

Look at the price action of the dollar index as the Middle East and North Africa became embroiled in unrest. Note the absence of a dollar bid following the Japanese earthquake and tsunami. It would seem that the greenback has lost its safe-haven status entirely, as it hurdles relentlessly toward losing its status as the global reserve currency as well. The long-term downtrend in the dollar appears poised to re-exert itself in the face of a myriad of risks, both foreign and domestic.

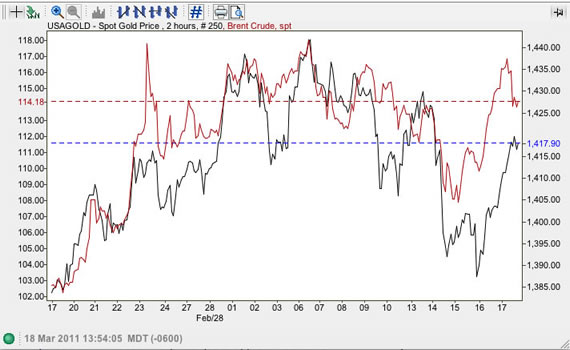

Meanwhile gold has held up remarkably well, save for an initial bout of deleveraging -- primarily associated with the selling of paper representations of gold -- which moved the yellow metal a mere 4% off its recently established all-time high. In a deleveraging event, it is generally physical buying that establishes support. Gold’s safe-haven status is intact and the underlying trend is further supported by gold’s well-established roles both as an alternative currency and the traditional hedge against inflation.

Demand for physical gold so far this year has been described as “explosive” and “voracious”. There is little to indicate the quest for appropriate adjectives will end anytime soon, and in fact recent global events may spur even more robust global demand in an environment of tightening supply.

By Pete Grant , Senior Metals Analyst, Account Executive

USAGOLD - Centennial Precious Metals, Denver

For more information on the role gold can play in your portfolio, please see The ABCs of Gold Investing : How to Protect and Build Your Wealth with Gold by Michael J. Kosares.

Pete Grant is the Senior Metals Analyst and an Account Executive with USAGOLD - Centennial Precious Metals. He has spent the majority of his career as a global markets analyst. He began trading IMM currency futures at the Chicago Mercantile Exchange in the mid-1980's. In 1988 Mr. Grant joined MMS International as a foreign exchange market analyst. MMS was acquired by Standard & Poor's a short time later. Pete spent twelve years with S&P - MMS, where he became the Senior Managing FX Strategist. As a manager of the award-winning Currency Market Insight product, he was responsible for the daily real-time forecasting of the world's major and emerging currency pairs, along with gold and precious metals, to a global institutional audience. Pete was consistently recognized for providing invaluable services to his clients in the areas of custom trading strategies and risk assessment. The financial press frequently reported his expert market insights, risk evaluations and forecasts. Prior to joining USAGOLD, Mr. Grant served as VP of Operations and Chief Metals Trader for a Denver based investment management firm.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.