Tsunami Accelerates Japan's Economic Meltdown Driven by Debt and Demographics

Economics / Japan Economy Mar 22, 2011 - 09:32 AM GMTBy: James_Quinn

The linear thinkers that dominate the mainstream media and the halls of power in Washington D.C. are assessing the series of disasters in Japan without connecting the dots of history. Their ideological desire to convince people that things will go back to normal in short order flies in the face of the facts. It makes me wonder whether these supposed thought leaders lack true intelligence or whether their ideological biases convince them to lie. At the end of the day it comes down to wealth, power and control. If those in power were to tell the truth about the true consequences of demographics, debt, disasters, and devaluation, their subjects would revolt and toss them out. Before the multiple disasters struck Japan last week, the sun was already setting on this empire. The recent tragic events will accelerate that descent.

The linear thinkers that dominate the mainstream media and the halls of power in Washington D.C. are assessing the series of disasters in Japan without connecting the dots of history. Their ideological desire to convince people that things will go back to normal in short order flies in the face of the facts. It makes me wonder whether these supposed thought leaders lack true intelligence or whether their ideological biases convince them to lie. At the end of the day it comes down to wealth, power and control. If those in power were to tell the truth about the true consequences of demographics, debt, disasters, and devaluation, their subjects would revolt and toss them out. Before the multiple disasters struck Japan last week, the sun was already setting on this empire. The recent tragic events will accelerate that descent.

Japanese Beetle Meet Windshield

Smart financial minds have been expecting a Japanese economic tsunami for the last few years. John Mauldin described Japan's predicament in early 2010:

"I refer to Japan as a bug in search of a windshield. I am not so sure about the timing, however, as the economic and fiscal insanity that is Japan may be able to go on for longer than many think possible. But to me it is not a question of whether there will be a crisis, but when there will be one. This year? 2011? 2012? I doubt Japan makes it to the middle of the decade with a very serious and sad day of reckoning.

The downside to the continuation of running massive deficits is that when the break does come, it will be all the more painful and difficult to deal with as the debt mounts. If there is an upside, it is for the rest of the world to see what can happen to a developed country like Japan when massive deficits are allowed to pile up one after another. It will be a morality play writ large upon the walls, which cannot be dismissed."

Ambrose Pierce-Pritchard expected a 9.0 debt earthquake to strike Japan in 2010:

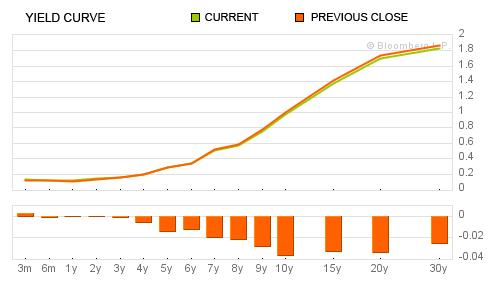

"Weak sovereigns will buckle. The shocker will be Japan, our Weimar-in-waiting. This is the year when Tokyo finds it can no longer borrow at 1% from a captive bond market, and when it must foot the bill for all those fiscal packages that seemed such a good idea at the time. Every auction of JGBs will be a news event as the public debt punches above 225% of GDP. Finance Minister Hirohisa Fujii will become as familiar as a rock star.

Once the dam breaks, debt service costs will tear the budget to pieces. The Bank of Japan will pull the emergency lever on QE. The country will flip from deflation to incipient hyperinflation. The yen will fall out of bed, outdoing China's yuan in the beggar-thy-neighbor race to the bottom."

Mr. Pritchard was either wrong or early, depending upon your point of view.

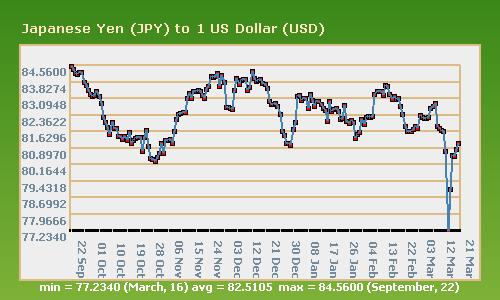

Japan can still borrow for 10 years at 1%. Despite the highest government debt as a percentage of GDP on the planet at 225%, Japan has not felt the wrath of the bond vigilantes. Not only did the Yen not fall out of bed, but it soared to a post-war high against the USD last week after the earthquake/tsunami. Investors drove the value of the yen higher, anticipating a huge rebuilding program in Japan. Japanese financial institutions would need to convert foreign assets into yen to pay for damage claims and construction expenses, a process that would strengthen the currency. In anticipation, investors piled into yen, helping drive up its value. Central banks across the globe intervened and weakened the currency, for the time being. When the world comes to its senses, the Yen will weaken on its own.

Debt & Demographics

Japan is a one trick pony that just broke two legs and is waiting to be put down. They have experienced a two decade long recession. Their stock market is still 70% below its 1990 peak. They have no natural resources. They allow virtually no immigration. And their population is in a death spiral. The one and only thing they have going for them is their phenomenal ability to manufacture high quality products and export them to the rest of the world. The earthquake and tsunami that struck Japan severely damaged their just in time manufacturing machine. A surging yen would destroy their export machine by making their products more expensive. Hundreds of high tech Toyota, Honda, and Sony factories are shut. Four hundred miles of ports and harbors have been wiped out. There are rolling blackouts, with one million households without electricity. Over 500,000 people are still homeless.

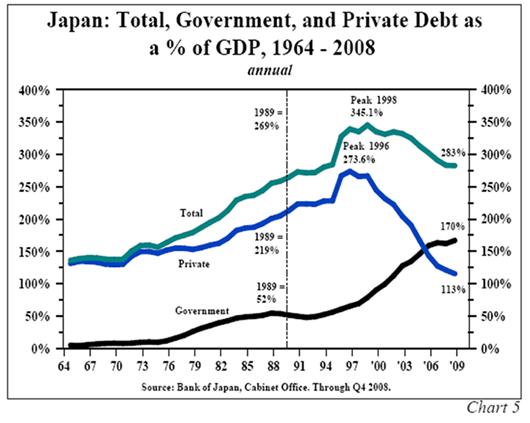

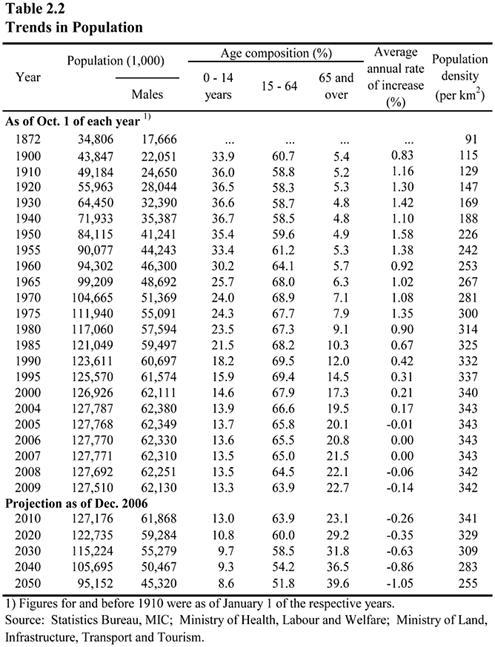

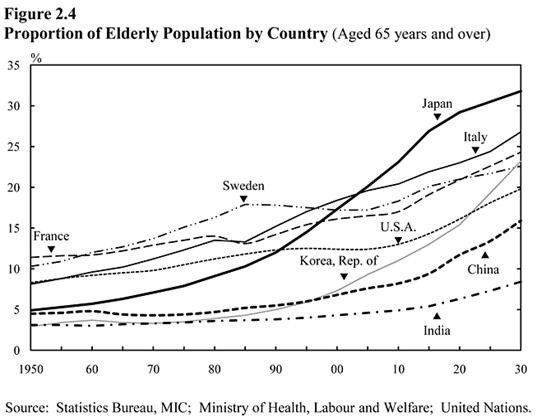

The short-term impact of this disaster will push Japan into recession. The rebuilding efforts over the coming years will create a positive GDP figure, but will not do anything to benefit Japan over the long haul. The billions designated to rebuild will be money not invested in a more beneficial manner. The linear thinkers conclude that over the long-term Japan will be OK. These people are ignoring the double D's - Debt and Demographics. When Japan entered its two decades of recession and experienced the Kobe earthquake in 1995, its government debt stood at 52% of GDP. Today it stands at 225% of GDP. Twenty one years ago, the Japanese population was still relatively young, with only 12% of the population over 65 years old. The population of Japan peaked in 2004 and now is in relentless decline. Over 23% of the population is over 65 and the median age is 45 years old. For comparison, the median age in the U.S. is 37 years old, with only 13% over 65. The projection portion of the chart below paints a picture of death. The population of Japan is aging rapidly and will decline by 4.4 million, or 3.5% in the next ten years.

The question I pose to the mainstream thinkers is, "How can a country with a rapidly aging population and nearly one quarter of its population over 65 years old generate the necessary dynamic enthusiasm for rebuilding a shattered country?" Youthful enthusiasm and hope for a brighter future is essential to any enormous rebuilding effort. Japan does not have it in them. News reports already indicate a lethargic and seemingly insufficient response by emergency workers. The devastation seems to have overwhelmed this aging country. The psychological impact of this type of natural disaster will likely have two phases. Psychology professor Magda Osman describes the expected human response:

"After a disaster, typically small communities become incredibly co-operative and pull together to help each other and start the rebuilding process. There's an immediate response where people start to take control of the situation, begin to deal with it and assess and respond to the devastation around them. The problem is that we aren't very good at calculating the long-term effects of disasters. After about two months of re-building and cleaning up we tend to experience a second major slump when we realize the full severity of the situation in the longer term. This is what we need to be wary of because this triggers severe depression."

This would be the normal response of a traumatized populace. An aged populace is likely to experience worse depression and not bounce back from this tragedy. Japan is still the 10th most populated country on earth, with the 3rd largest economy. China just passed Japan to become the 2nd biggest economy in the world. India will pass Japan by 2012.

Youthful countries across the world are gaining on Japan. The wisdom of the elderly doesn't cut it in a global economy. Global competition is cutthroat. China, India and the other emerging Asian countries will take advantage of Japan's misfortune by filling the hole left by Japanese manufacturers. The short-term issues of power, supply lines, and reconstruction are minor when compared to a mass die off of the Japanese population that will result in a population that is 25% smaller in 2050 than it is today. Demographics are a *****.

With the amount of debt hanging over the Japanese empire, it might be a good strategy to commit hari-kari. The non-thinking pundits on CNBC contend that since Japan hasn't had any detrimental effects from running their debt to 225% of GDP, running it to 300% won't be a problem. Reinhart and Rogoff studies concluded that once a country breaches the 90% level, growth slows and a debt crisis is likely to ensue. Japan has been stuck in a 20 year recession, as they chose Keynesian shovel ready projects, quantitative easing, currency manipulation, and covering up the true financial condition of its banks over accepting the consequences of a debt bubble. Remind you of anyone? The result is their real GDP is lower today than it was in 1995. The Paul Krugmans of the world would contend that they just didn't spend enough.

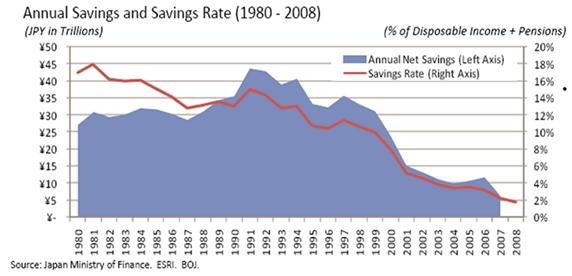

The only reason Japan has not collapsed is due to its homogeneous population willing to buy virtually all of the debt issued by its government for the last twenty years and its prodigious ability to produce high quality products that the rest of the world wants. Japan has maintained a consistent trade surplus, and its government debt has been held mainly by its own people, with 95% of Japanese government bonds in the possession of Japanese, meaning the country was able to finance itself without depending upon fickle foreign investors who might prefer a return greater than 1%. This ain't 1990. The savings rate of the Japanese population had already declined from 14% in 1990 to 2% by 2008. In a recent article, Mike Shedlock explained the situation prior to the recent devastation:

"The Government Pension Investment Fund, which oversees 117.6 trillion yen ($1.4 trillion), in September forecast that it would sell 4 trillion yen in assets in the business year ending March 31 to fund payouts. Sales by the fund, which helps oversee public pension funds for Japan’s 37 million retirees, come as the first of Japan’s baby boomers is set to turn 65 in 2012, making them eligible for pension payments. Japan choices are to default on its debt, print money to fund interest on the debt, raise taxes effectively robbing savers of their money, or undertake huge spending cuts. The dilemma stems from years of Keynesian and Monetarist stupidity."

The new tragedy will just accelerate the conversion of Japanese savers into forced spenders. Millions of Japanese savers will be forced to spend their savings on survival, as many have lost their jobs and businesses due to the monumental damage to northern Japan.

Setting Sun - Race to the Bottom

Traders figured out what must happen over the coming years. A large swath of Japanese insurers and companies will begin repatriating assets held in other currencies to begin the rebuilding effort at home, driving the value of the Yen higher. At a time of crisis a stronger Yen would severely damage Japan's export based economy even further. Therefore, Central Banks around the world jointly intervened. The Bank of Japan spent Y2 trillion ($25 billion), while central banks across Europe contributed $5 billion and the Federal Reserve spent $600 million to push down the yen on Friday. The Bank of Japan is doing what they do best - printing money. Quantitative easing is an art form perfected by all Central Banks across the globe. Every disaster over the last twenty years, whether man made (wars, internet collapse, housing collapse, debt meltdown) or caused by nature, are met with the exact same solution - PRINT MONEY.

This method works until it doesn't work. Japan's central bank cannot reverse the demographics. From this point forward the population of Japan will be net sellers of government debt. Japanese insurance companies will be on the hook for $33 billion in claims. They will need to sell government bonds in order to make those payments. The World Bank has estimated the cost of rebuilding to be $235 billion. The government will need to borrow this money. At least 30% of its energy needs are off-line. It already imports 95% of its oil and coal. They will need to increase energy imports to make up for the nuclear energy shortage. Its positive trade balance was already in decline. The clueless CNBC pundits can drone on about how this natural disaster will be good for the Japanese economy because of the substantial rebuilding program, but they are dead wrong. Japan is trapped, with no way out. They will need to issue hundreds of billions in new debt, which cannot be bought by its citizens, pension funds, or insurance companies. How many foreign investors will buy a 10 Year Japanese government bond paying 1%, knowing that Japan wants to weaken its currency? NONE. The only choices are to raise interest rates to attract buyers or print more money. With an already suffocating level of debt, they can't allow interest rates to rise. They would choke on the interest.

The Bank of Japan will follow the same script as Ben Bernanke. They will print new Yen and buy the newly issued debt. What an original idea. Japan is caught in a debt stranglehold and demographic nightmare. Their currency will ultimately collapse like a nuclear reactor after a tsunami. When Japan defaults on their debt, the pain will be intense, as they will be throwing their own aged population under the bus. America, on the other hand, will throw the whole world under the bus when we default.

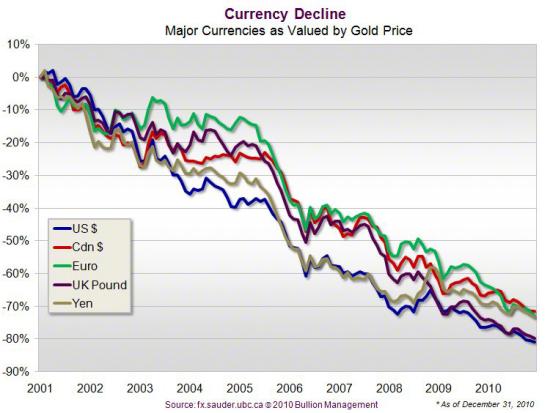

The Japanese own $886 billion of US Treasuries and have bought $256 billion of our debt since October 2008. Timmy Geithner will need to issue $1.5 trillion of new bonds per year. Japan will no longer be a buyer. They will be a seller. This will put upward pressure on U.S. interest rates. Japan's reconstruction needs will put pressure on commodity and energy prices. Production and supply problems for Japanese parts and goods are already creating problems for GM and other car companies in the U.S. Lack of supply leads to higher prices. The great earthquake/tsunami/nuclear meltdown of 2011 will result in more quantitative easing in Japan and the U.S. This will result in even more inflation than we are experiencing today. Once the inflation genie is out of the bottle, the race to the bottom will accelerate. Gold will decide who wins the race. It has been a neck and neck race since 2001. I'm not sure it is a race anyone wants to win. But the destination is certain.

"The endeavors to expand the quantity of money in circulation either in order to increase the government’s capacity to spend or in order to bring about a temporary lowering of the rate of interest disintegrate all currency matters and derange economic calculation." - Ludwig von Mises

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2011 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Berrie Mengerink

05 Apr 11, 16:33 |

Thanks

Hi James, Thank you for all the articles and information, very nice, very good!! Regards Berrie |