Gold and Silver Investors Don't Get Disrtraced by Japan Events

Commodities / Gold and Silver 2011 Mar 22, 2011 - 01:29 PM GMTBy: Jeb_Handwerger

It's very difficult for a trader to stick to a plan and not let news events dictate decisions. But every once in awhile there are news items that come along and attempt to trip investors up, forcing some to take their eye off the big picture. Many of us understand the long-term potential of precious metals and commodities, but the emotions -- either unbridled enthusiasm or gloom and doom -- of the herd often affect our decisions negatively at short-term turning points. This past week the news out of Japan (iShares MSCI Japan Index (EWJ)) affected the majority of investors, who liquidated their positions and ran to the US dollar and to long-term Treasuries as safe havens, which I believe was a mistake as the G-7 came to the support of Japan.

Margin calls were issued and the fire sale intensified due to the hysteria produced by the doom-and-gloom media. It is important not to become influenced and to not allow news-related items to shake one off a long-term trend. Staying the course during times of great fear or news-related reactions is very difficult, but is necessary if one wants to ride a secular bull trend. You must not allow the news background to take your eye off the ball. Already, I heard from some that they want to give up and throw in the towel, and this is normal during sell-offs. When the times are easy and stocks are breaking new highs everyone wants to buy and it is great to be in the stock market, but when there is a sell-off and when companies pull back to key support, many want to throw in the towel and never want to trade again. Be careful of following this behavior as these sell-offs often turn out to be buying opportunities.

I believe the positions that we are in with precious metals and commodities will continue to maintain its two-year trend. The situation in Japan will force them to print yen (FXY), putting more pressure on fiat currencies as deficits soar. I believe the geopolitical issues in the Middle East, combined with the Japanese earthquake relief has pushed off any tightening measures from US Central Banks and may even push Bernanke into expanding QE2 into QE3. The rebuilding efforts and monetary stimulus should be beneficial for gold (UGL), silver (AGQ), base metals (DBB), and commodities (DBC).

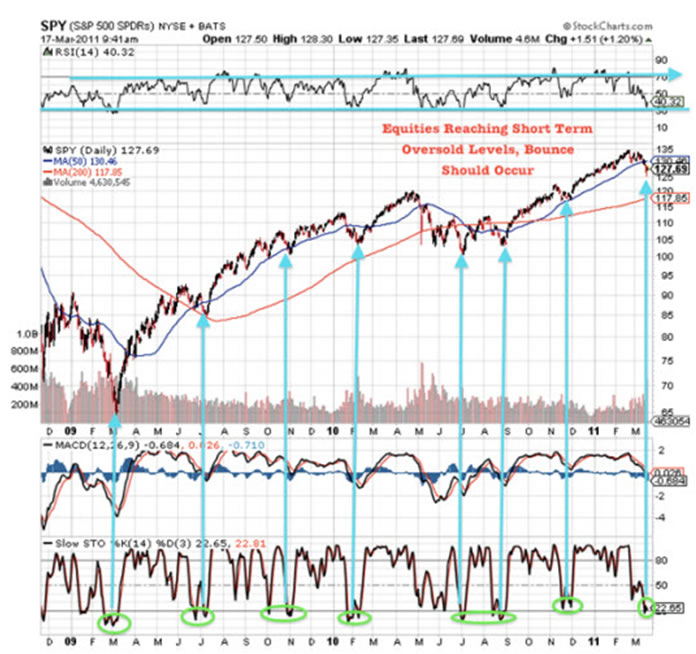

The US equity market (SPY) is reaching oversold levels not seen since my buy signal in August of 2010. The Japanese earthquake correction may be reaching a climax and a point of capitulation. The S&P has reached oversold levels on the RSI and stochastics. Each time it has reached this level a reversal has occurred. This should benefit mining stocks that have seen forced liquidation due to margin calls. (See Time to Buy Uranium Mining Stocks?) As the 200-day moving average is moving higher, one needs to stay the course and trust the trend.

SPDR Gold Shares (GLD) has paused for two weeks as investors cover margin calls. Selling has occurred across the board and this may signal forced liquidation. As the equity markets stabilize so too should gold and a breakout into new highs may occur shortly as it appears to be setting up for a cup-and-handle breakout, which is indicative of a major move.

Beware of trading on fear rather than facts. It is easy to become distracted by news stories around us. A cold day in July does not mean that autumn is here. A 9.0 earthquake doesn’t mean that Japan is over as many are predicting or that secular trends have reversed. Japan will begin rebuilding as it has done repetitively in the past following natural disasters. Do not be incorrectly drawn to the conclusion that the trends in precious metals or commodities are reversing. We must step back and separate the wood from the forest. Pullbacks in precious metals should be times to add to positions.

Grab your free 30-day trial of my Members-Only Premium Stock Analysis Service NOW at:

http://goldstocktrades.com/premium-service-trial

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.