Gadaffi and The Hidden Pot of Gold in Libya

Commodities / Gold and Silver 2011 Mar 23, 2011 - 04:19 AM GMTBy: Dian_L_Chu

Speaking through a telephone call to state television, Libyan leader Moammar Gadhafi delivered quite a defiant tirade on Sunday, March 20 vowing a 'long war to victory' and pledged retaliation against the international military action descended upon Libya. Many military experts have suggested that the number of troops loyal to Gadhafi could be fewer than 10,000, and argued that Gadhafi will not last long at all

Speaking through a telephone call to state television, Libyan leader Moammar Gadhafi delivered quite a defiant tirade on Sunday, March 20 vowing a 'long war to victory' and pledged retaliation against the international military action descended upon Libya. Many military experts have suggested that the number of troops loyal to Gadhafi could be fewer than 10,000, and argued that Gadhafi will not last long at all

Moreover, US and European governments have imposed sanctions and frozen Libyan assets worth billions of dollars, including the central bank, sovereign wealth fund and state oil company cutting off funding for further support activities....unless Gadhafi has a hidden pot of gold or two somewhere

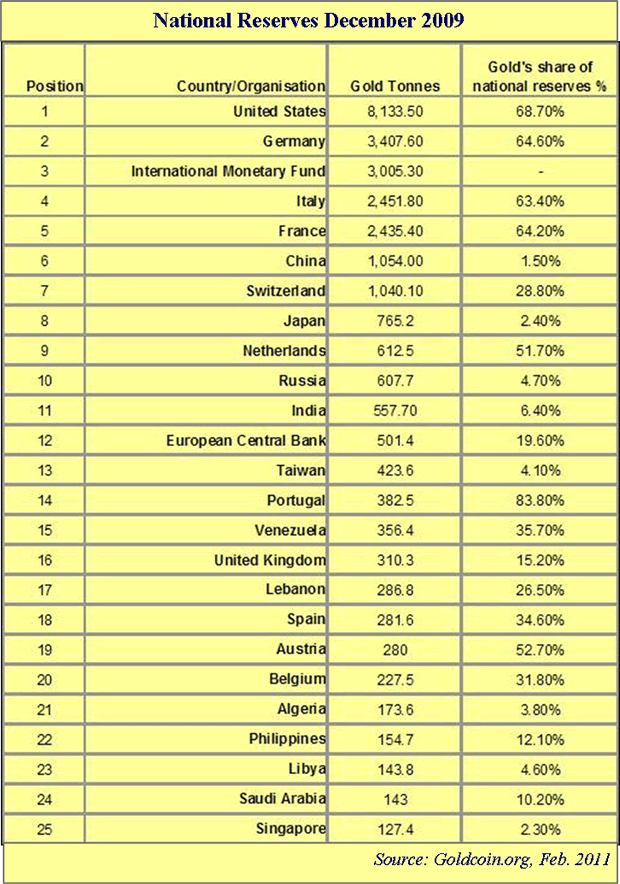

As it has turned out, the 'long war' threat from Gadhafi may not be as emply as some might think. Financial Times on March 21 cited data from the International Monetary Fund (IMF) that the Libya holds 143.8 tonnes of gold (see table), but some say the actual amount could be several tonnes higher.

Instead of vaults in London, York or Switzerland, Libyan bullion is in the country held by its central bank, which is under Gaddafi’s control. However, Financial Times noted some believe that the gold reserves may have been moved from the central bank in the capital, Tripoli, to another location such as the southern city of Sebha, close to the borders with Chad and Niger.

According to FT.com. international banks or trading houses are unlikely to transact anything with Libya at this moment, let along gold, but there still could be other interested counterparties for a swap of arms, or cash. So, Gadhafi could conceivably transport the gold to Chad or Niger, where the gold could be swapped.

Libya's gold reserves, ranked No. 23 in the world, ahead of Saudi Arabia, as of December 2009 (see table above), are worth around $6.5 billion at current prices, enough to finance Gadhafi's defense against opposition and international forces for quite a while, to say the least. Furthermore, Gadhafi may have some other assets stashed in 'untraceable' places.

Gold prices has been rising and hit a record of $1445.70 on March 7 primarily driven by safe haven demand in the midst of continuing chaos in the Middle East, the crisis in Japan, weak dollar and rising inflation. If Gadhafi somehow finds his way to cash in on this pot of gold and make good on his 'long war' threat, it would only further gold and oil’s upward cause. And by the way, Goldman Sachs just put in a fresh gold price target of $1,480 within three months.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://econforecast.blogspot.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.