US Dollar, Making a Case for the Greenback

Currencies / US Dollar Mar 28, 2011 - 02:21 AM GMTBy: Submissions

R.F. Lee writes: The US Dollar has been on a pronounced downtrend since the middle of 2010, and has been threatening its record lows as of this writing at the end of March 2011. In the week of 21 March 2011, the greenback registered new lows against Gold and the Australian Dollar, and also reached a 31-year low against silver.

R.F. Lee writes: The US Dollar has been on a pronounced downtrend since the middle of 2010, and has been threatening its record lows as of this writing at the end of March 2011. In the week of 21 March 2011, the greenback registered new lows against Gold and the Australian Dollar, and also reached a 31-year low against silver.

A casual survey of reports and articles online and off shows a heavy bias towards further USD weakness, recommending shifts into precious metals, commodities, resources or other alternative currencies such as the EUR. In an environment such as this, it may serve us well to take a look at the the other side of the argument, in order to gain a clearer perspective.

US Economic Data

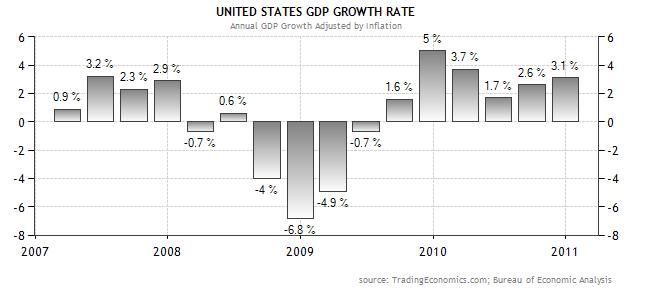

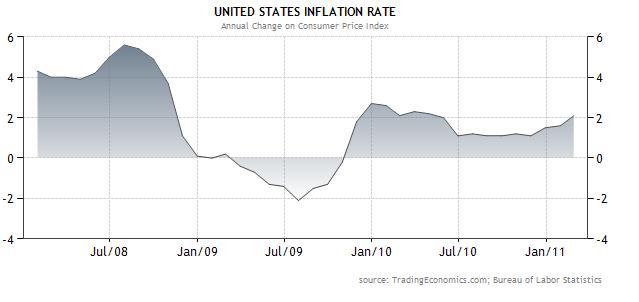

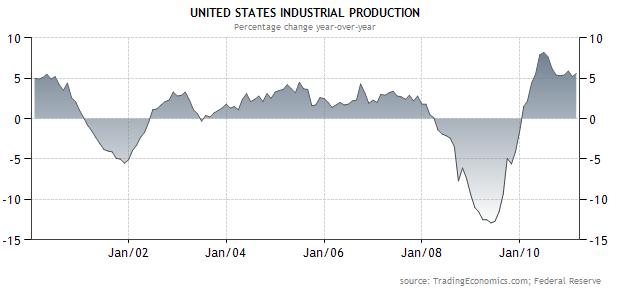

On the data front, we have seen upticks in GDP, CPI and consumer confidence amongst others, while the unemployment rate fell below 9.0% again. Industrial production, while showing no significant increase, is at least showing signs of stability. See the graphs below.

Treasuries and Equities

A circa 300 point dip in the Dow after the Japanese earthquake and tsunami only brought in buyers as all the major US indices closed higher in the week ended 25 March 2011. We have seen a narrowing of the spread between junk bonds and treasuries, and subsequently the beginnings of a shift from treasuries into equities. Also, the swift and sustained decline of the Volatility Index after the Japanese disaster is a telling sign of the confidence returning in the market.

Fed Views and Treasury Actions

Recent comments from Fed officials seem to indicate a more hawkish view developing. While Atlanta Fed President Lockhart reiterated a pledge to keep rates low for an "extended period", St Louis Fed's Bullard (not a voting member) is seemingly uncomfortable with the phrase, warning of a liquidity trap. Chicago Fed's Evans, a known dove, suggested that the Fed is unlikely to extend the current round of bond-buying, while Philly Fed's Plosser said that monetary policy may have to reverse course in the not-too-distant future, pointing to signs of strength in the economy.

The US Treasury recently announced an unwinding of its portfolio of mortgage-backed securities, and while we still have not seen the Fed selling off its massive debt holdings, it may be argued that this is a sign of de-facto tightening.

Market Sentiment

Traders are heavily net-short the USD, not suprising given it's extended decline, but at the same time options data suggests increased hedging against USD upside. While this in itself may not mean much, we note that market turns are usually close by when sentiment is at an extreme.

In summary, although overall fundamentals serve to maintain pressure on the greenback, we should note that an argument could be made for an imminent retracement, if not a turn-around, in the fortunes of the the USD. While we do not suggest going out and buying dollars at this point in time, it will serve us well to keep our eyes and ears open, and be prepared for any changes that may come around.

Rockin' FX!

http://rockinfxpro.blogspot.com/

Trading ideas, strategies, and rants on the FX & Futures markets

R.F. Lee AKA Rock FX, trades the currency and futures markets for fun and profit, managing funds for himself and others. He rants and raves at http://rockinfxpro.blogspot.com/

Copyright © 2011 R.F. Lee - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.