End of QE2 Could Trigger Blood on the Streets

Stock-Markets / Quantitative Easing Mar 28, 2011 - 01:11 PM GMTBy: Dian_L_Chu

Federal Reserve Bank of St. Louis President James Bullard, when speaking to reporters in France on March 26, stated,

Federal Reserve Bank of St. Louis President James Bullard, when speaking to reporters in France on March 26, stated,

“If the economy is as strong as I think it is, then I think it may be reasonable to send a signal to markets that we’re going to start withdrawing our stimulus, and I’d start by pulling up a little bit short on the QE2 program… We can’t be as accommodative as we are today for too long, we’ll create a lot of inflation if we do that.”

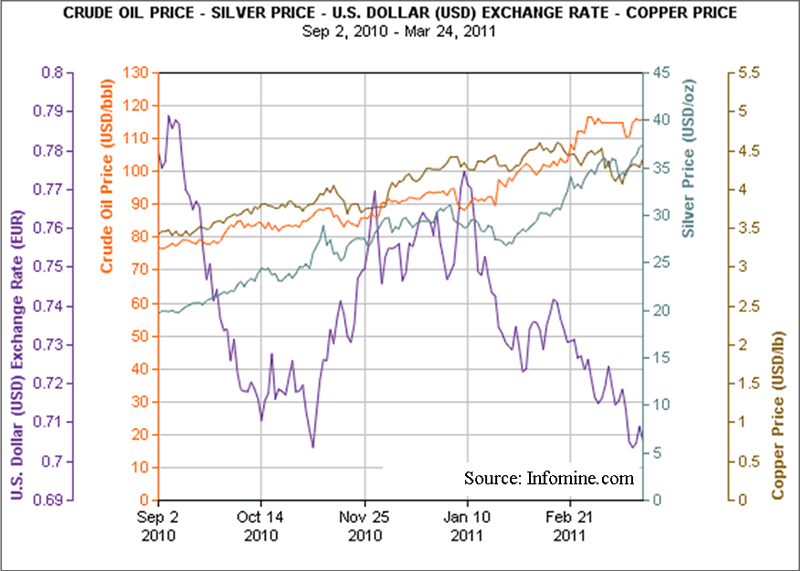

So, it seems that QE2 will get a serious review during the Federal Reserve`s April meeting, and could be cut short by two months in order to send financial markets the message that they will not allow inflation to get out of control (See chart below comparing the Dollar Index to Crude, Silver, and Copper post Bernanke's Jackson Hole Speech on Aug. 28 2010).

The problem is that the current market perception is at odds with the possibility that QE2 could end early.

Wall Street Camp #1 –QE3 Cheerleaders

There is a camp in Wall Street that still believes that QE3 is a distinct possibility, and they have invested accordingly. These investors would be in for a rude awakening if QE2 was cut short – think in terms of Silver investors who bought at the top of the market thinking silver was destined for $50 an ounce.

Wall Street Camp #2 – QE2 Partiers

Another camp in Wall Street believes that QE2 will continue through to its scheduled June conclusion without any hiccups along the way. This is the more moderate camp who have parked capital in Gold, Silver and Oil, who didn`t buy at the top of the market, but had planned to close out positions once QE2 ended in June.

This camp would also be caught off guard if the current asset buying program ended ahead of schedule – this group would include hedge funds, pension funds and money managers who are overly weighted in commodity oriented funds currently, and would start reducing their exposure to reflect the changing monetary policy.

Wall Street Camp #3 – QE2 Front Runners

Now, there’s also the third Wall Street camp that already knew that QE3 was a non starter, and QE2 would probably finish according to schedule, but wanted to front-run the selling by positioning themselves for the inevitable asset realignment by being in position in late April (after April options expiration for example).

Well, this group of investors would also be caught flat-footed and would have to speed up their timetable by getting into position immediately. This would means getting out of any commodity related positions ASAP, and then entering additional short positions, buying puts, and going long the US Dollar.

Biased Towards Commodities

Remember, there are a whole lot of crowded trades in areas all revolving around the QE2 Monetary Program that were initiated as far back as the Jackson Hole Speech. Therefore, an early end of QE2 would bring some considerable unwinding, disproportionately biased towards commodities, as the broader equity market would still have support from increasing corporate profitability, and relatively reasonable valuations, as compared to commodities.

Off Guard Mass Unwinding

In other words, expect significant selling in commodity related funds as a result of major players unwinding large positions – the selling could go on for months if QE2 ended abruptly. This is in large part why the Federal Reserve likes to send signals ahead of time, which Bullard appeared to be doing, to prepare market participants so the unwinding of positions is done in an orderly fashion.

One thing for sure is that nobody on Wall Street is currently positioned for an ending of QE2 in April. If the Federal Reserve through its various communication channels of member speeches, media conduits, and personal interviews starts in the next few weeks reinforcing this notion of QE2 ending ahead of schedule over the next couple of weeks, i.e., sending Wall Street the ‘get prepared’ signal, one could expect a whole lot of market volatility as fund managers try to reposition themselves accordingly.

‘Blood in The Streets’?

Since commodity prices tend to move in unison across the board, there could be some massive selling ahead - the proverbial “Blood in the Streets”, at least for anything commodity related, where large and liquid commodity index linked funds, popular with institutional funds (pension, 401k, etc.) such as Goldman Sachs Commodity Index (GSCI), Fidelity Series Commodity Strategy (FCSSX), could see huge volatility with large liquidation.

Good Jobs Report, Bad news for Commodities

Furthermore, as the U.S. 4th quarter GDP was revised up to 3.1%, there is a fairly good possibility that strong numbers could be coming out of the unemployment report due out on Friday, April 1. Since this is the last major economic data release before Fed’s April meeting, good jobs numbers would actually be bad news for commodities, as that would add to the argument that Fed should end the QE2 early.

Hangovers - Commodities & Producers

For investors, if more hints from Fed officials regarding ending QE2 early start surfacing in the media, coupled with stronger jobs numbers, then take them as a collective indication that the time has come to cash in on some of the profits from commodity related investments.

In addition to the index funds mentioned earlier, this category also includes commodity ETFs such as SPDR Gold Trust (GLD), iShares Silver Trust (SLV), United States Oil (USO), as well as producer stocks like Freeport-McMoRan Copper & Gold Inc. (FCX), Monsanto Co. (MON), Dow Chemical (DOW), Exxon Mobil (XOM), Mosaic Company (MOS) and BHP Billiton (BHP).

Short-term Poppers - U.S. Dollar & Bonds

An early end of QE2 would strengthen the U.S. Dollar in the short term temporary basis, and could bring headwinds to commodity-based currencies such as the Aussie and Canadian dollars.

Ironically, one of the Fed’s objectives that QE2 has failed to deliver – to lower the U.S. long bond interest rate—would likley be achieved after Fed stopped the treasury buying program (QE2). Although interest rate would still likely trend up in the long term, the short-term pop of the U.S. treasury brought on by the unexpected early end of QE2 would make Bill Gross regret not keeping some of the U.S. bond holdings in his Pimco Total Return Fund.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://econforecast.blogspot.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.