The Revolving Door Between Washington and Wall Street

Politics / US Politics Apr 12, 2011 - 09:20 AM GMTBy: Trader_Mark

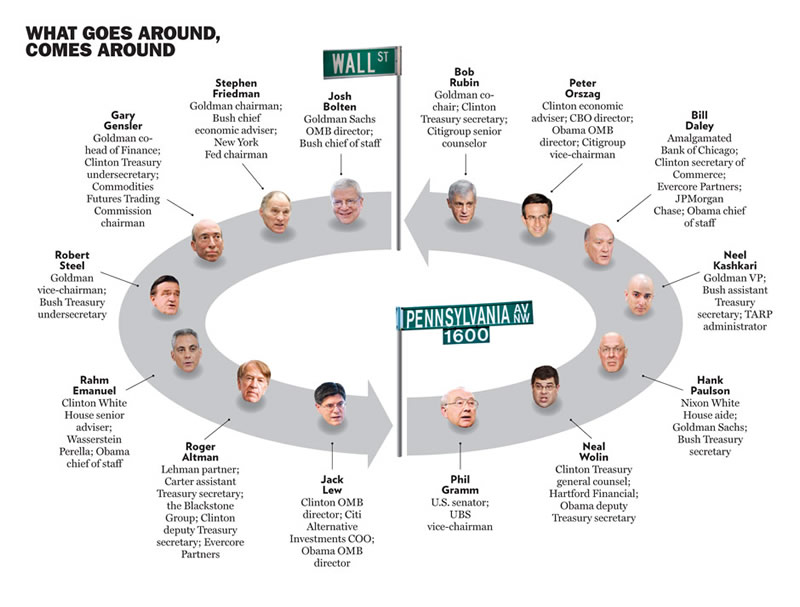

As regular readers know, there is a fast track revolving door between Washington D.C. and Wall Street. All part and parcel with a captured government run for a small cabal of corporations and their leadership. After all corporations are people too - the Supreme Court says so. There is a lengthy but insightful story in New York Magazine on the latest to make the transition from D.C. to Wall Street - Peter Orzag. Actually the piece intertwines the fate of Robert Rubin and Orzag, but really if we're talking Rubin, Orzag, Summers, Daley, Paulson, et al - the names can simply be interchanged.

[Jun 26 2009: Bloomberg - Volcker Marginalized: Our Life of Financial Oligarchy Does not Change] One puts in a few years of doing "God's work" on behalf of the oligarchy in D.C., then goes to get their just rewards in the private sector. Orzag (now proudly wearing a Citigroup name tag) is but the latest in the daisy chain. As an aside if you have never read "The Quiet Coup" article by Simon Johnson from 2009 I consider it a MUST READ (link here). [click to enlarge]

- When Peter Orszag left his post as White House budget director last summer, it made perfect sense, on several levels, that he ended up in an office next to Bob Rubin. Rubin, the Clinton-era Treasury secretary, had the year before resigned his position as senior counselor to Citigroup, a job for which he was paid $115 million, plus options, over nine years. Rubin’s tenure ended shortly after the bank’s near implosion and subsequent $45 billion government bailout.

- When Citi announced that Orszag was joining the bank as a vice-chairman in December 2010, an angry chorus of progressive columnists immediately howled that he was a sellout, cashing in on his Washington connections. Orszag’s critics were animated by their belief that Obama had failed to get tough on Wall Street—and now one of his central economic players was reaping the rewards. Even Orszag’s mentors raised their eyebrows.

- The close alliance among Wall Street and the economics departments of the major universities and the West Wing of the White House is the military-industrial complex of our time. That it has an effect on our governance is beyond question. How pernicious and distorting these effects are, how cynical many of its participants might be, and what might be done to change the system are being fiercely debated in Washington.

- In fact, to the layperson, the most surprising thing might be the degree to which people like Peter Orszag see the government and Wall Street as, essentially, parts of the same industry. Aside from some bad publicity, going from one to the other is not a leap at all, not any kind of sellout, but a natural progression for a member in good standing of the supermeritocracy like Peter Orszag.

- But another way of looking at this is that Wall Street has Washington over a barrel—and the values of one can’t help but be the values of the other. Even in Democratic administrations like the current one, once and future Wall Streeters are in position to pull the teeth out of regulations—for what they see as perfectly sensible, perfectly ordinary reasons. There’s no need to cue the scary music; it’s not a conspiracy. It’s just that having lived in the same worlds, read the same textbooks, imbibed the same maxims, been tutored by the same mentors, attended the same confabs in Aspen and Davos—and, of course, been paid with checks from the same bank accounts—they naturally think the same thoughts.

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2011 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.