U.S. Consumer Price Index, Dichotomy Between Overall and Core Price Inflation Persists

Economics / Inflation May 14, 2011 - 06:31 AM GMTBy: Asha_Bangalore

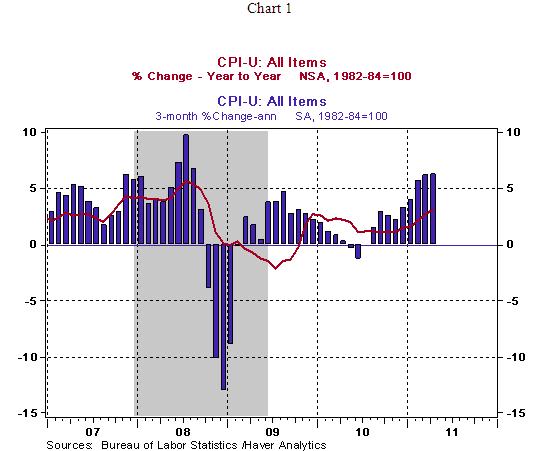

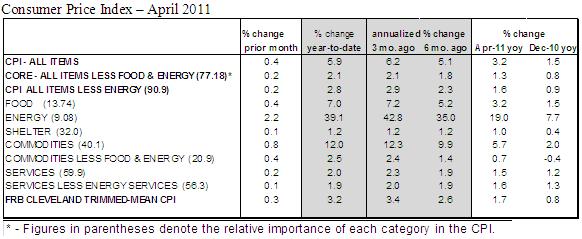

The Consumer Price Index (CPI) rose 0.4% in April after a 0.5% increase in March. The CPI has posted gains between 0.4% and 0.5% for five consecutive months, putting the five month annualized change in the CPI at 5.8%. Under other circumstances the Fed would view the recent readings of overall inflation as severely inflationary and engage in suitable monetary policy actions to prevent further increases in prices. The present situation is different.

The Consumer Price Index (CPI) rose 0.4% in April after a 0.5% increase in March. The CPI has posted gains between 0.4% and 0.5% for five consecutive months, putting the five month annualized change in the CPI at 5.8%. Under other circumstances the Fed would view the recent readings of overall inflation as severely inflationary and engage in suitable monetary policy actions to prevent further increases in prices. The present situation is different.

The energy price index has risen for ten straight months, with the increase in April at 3.1%. Higher gasoline prices (+3.6%) accounted for half the increase of the CPI. Food prices rose 0.4% in April, with the year-to-date increase at 7.0%.

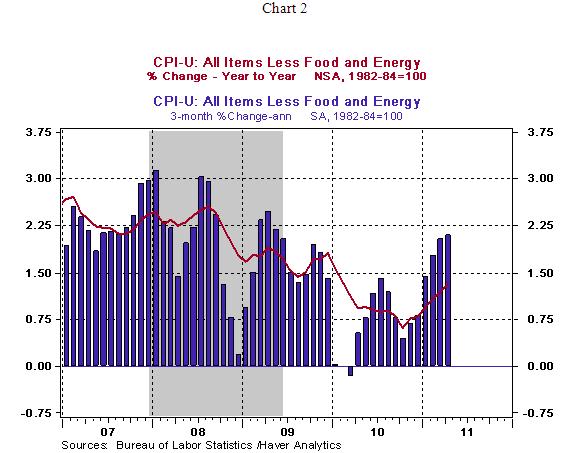

The core CPI increased 0.2% in April, which translates into a 1.3% gain from a year ago. The year-to-year change in the core CPI is not worrisome, but the 3-month annualized increase at 2.1% puts the core CPI at the top of the Fed's watch list. Further gains of the core CPI would imply more than concern at the FOMC.

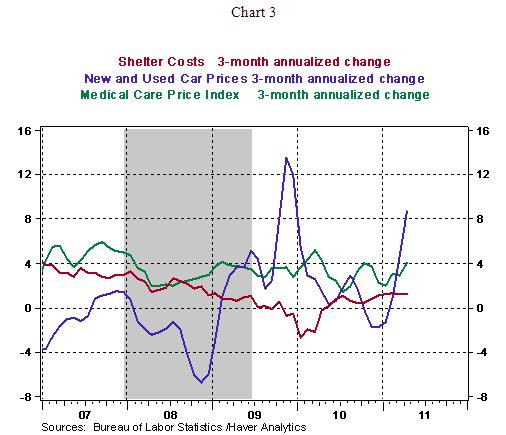

It is noteworthy, that prices of new and used cars have risen sharply in the past three months, while sustained increases are unlikely as these gains appear to be sporadic. Shelter costs, the largest component of the core CPI, show a small increase but it is largely contained. Medical care costs continue to trend up (see Chart 3 for these price trends). These readings suggest that the core CPI is likely to show muted gains in the months ahead unless shelter costs show an accelerating trend.

The Fed is not likely to tighten monetary policy until there are sustained and significant increases in employment. Large increases of the core CPI and an unexpected hike in the policy have a remote chance of occurring in the months ahead. The elevated level of the unemployment rate and soft demand conditions are supportive of this view.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.