Predicting the Future Gold Price Misses the Point

Commodities / Gold and Silver 2011 May 17, 2011 - 04:44 AM GMTBy: Jason_Kaspar

“Gold bugs” routinely solicit my prediction regarding the future gold price, assuming I must be an “educated” gold bug since my hedge fund happens to maintain large gold exposure.

“Gold bugs” routinely solicit my prediction regarding the future gold price, assuming I must be an “educated” gold bug since my hedge fund happens to maintain large gold exposure.

Where is the gold price headed? It depends on the variable.

-In what time period? The next week? Month? Year? Ten years?

-Compared to what? Dollars? Euros? Real estate? Gummi bears?

Of course, nearly everyone wants a prediction in dollars, which is highly humorous and paradoxical because the purported destruction of the dollar is a primary reason to own gold in the first place. What victory is there if the dollar value declines 50% and the gold price doubles?

This is where I think investors need to make a distinction between “nominal” inflation and deflation and “real” inflation and deflation. (Defining terms: Nominal inflation and deflation is an increase or decrease in the money supply, respectively. “Real” inflation or deflation is an increase or decrease in purchasing power in gold terms.)

Nominally, I feel like my predictions are as good as the next guy’s. However, I believe deflation in “real” terms is one of the highest finance probability themes over the next three to five years. In other words, goods will become cheaper compared to gold despite what happens to the dollar.

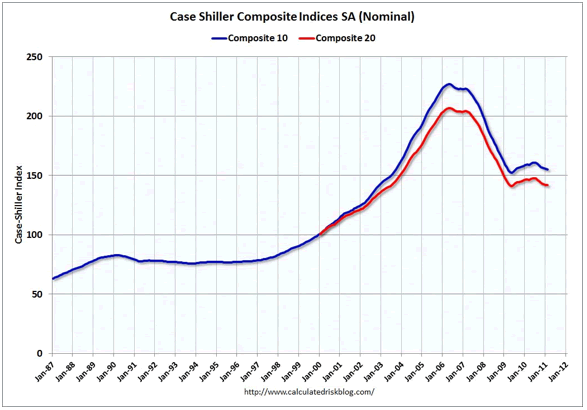

The Housing Market

In dollars, home prices bottomed in 2009, bounced sideways for a while, and now they are resuming their decline. As a result of monumental government effort, housing has been more or less mired in a disinflationary environment. See the following chart.

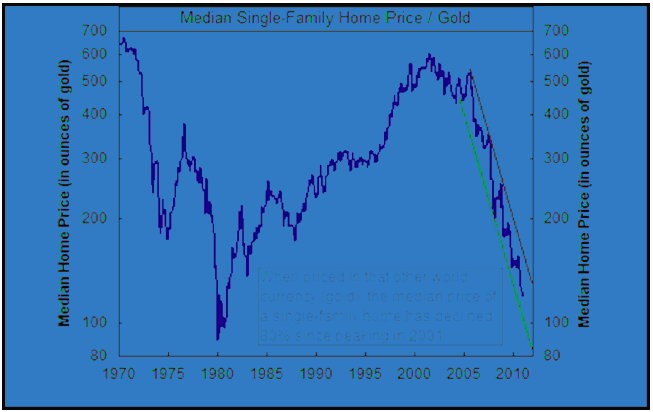

In “real” gold terms, the picture is far more gruesome. Below is the median home price as represented in ounces of gold. This figure is now rapidly approaching the 1981 low.

Median Home Price Compared to Gold, 1970 - 2011

Source: Chart Of The Day, newsletter@businessinsider.com This e-mail address is being protected from spambots. You need JavaScript enabled to view it

Despite all of the government intervention, all of the Fed’s economic central planning, one can buy significantly more house per ounce of gold than one could purchase in March of 2009. And this is the real reason to own gold. Gold is money. Its value is determined by its purchasing power – wholly and exclusively. If home prices fell another 25-50% in gold terms, it may make sense to sell gold and seek out attractive real estate to buy with it.

The Stock Market

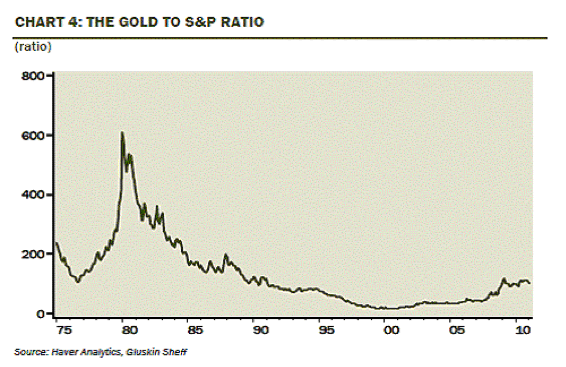

The collapse in the stock market (as valued in gold) has not played out nearly to the extent of housing. In 1933 the Dow Jones Industrial Average declined to 1.9x the value of an ounce gold. The early thirties represented the worst deflationary depression in US history. Conversely, in 1981, the Dow Jones Industrial Average declined to 1.1x the value of an ounce of gold during a highly inflationary time period. In both environments, gold fell below a ratio of 2 to 1 compared to the DJIA. Today this ratio stands at 8.3x (down from 40x+ around 2001).

I see this trend continuing. In gold terms, the stock market has much further to decline – regardless which “nominal” direction it moves – and could easily represent an opportunity for 10x returns over the next several years if trading with the trend.

The graph below inverts this ratio, highlighting a decline in real prices as a rise in the ratio.

[I initially found this graph difficult to interpret. The designer of the graph took the current price of gold, divided it by the S&P 500, and then multiplied it by 100. So the latest point on the chart would be $1500 / 1335 * 100 = 112.36.]

The government has done everything possible to inflate the stock market. Fed Chairmen Ben Bernanke has specifically pointed to equity prices as a barometer of success.

Yet in real terms, deflation continues.

Ultimately, the government has direct control over nominal inflation and deflation. Though I have felt the probabilities have favored nominal deflation for a long time, this has clearly been a bad trade. Those who have invested using this thesis have seen their losses splattered over Wall St.

However, the same deflationary thesis using gold (instead of dollars) as your unit of measure has been a rewarding proposition over the past year, with most likely the bulk of gains still to come.

The government balance sheet is presently highly leveraged (and worsening by the minute). Deflation - in real terms - will likely continue. Maybe gold peaks to $6,000/oz, or maybe plummets nominally to $1,000/oz. I do not know, nor do I really care. I own gold because of its relation to other assets having a high probability of deflating against it. Considering the new bubble that has been created in many assets as a result of the liquidity wave from the Federal Reserve, these opportunities are not hard to find.

Jason Kaspar blogs daily for www.GoldShark.com.

Jason is the Chief Investment Officer for Ark Fund Capital Management, focusing on investment and portfolio management. Jason founded a long/short value fund, Kaspar Investments, LP, in November 2007 along with its investment adviser, Dunamis Capital LLC. Prior to launching his fund, Jason was employed by Highland Capital Management LP, a then $40 billion hedge fund firm. Prior to joining Highland Capital, Jason worked for FTI Consulting, a global business advisory firm. At FTI Consulting, Jason worked within the corporate finance restructuring division and directly with the debtors and creditors involved in FTI's bankruptcy restructurings. Jason has built long lasting relationships with a broad base of private and institutional investors. Jason graduated Summa ***** Laude from Texas A&M with a double-degree in Finance & Accounting, where he was involved in numerous investment think-tanks focusing on investment strategy.

Twitter: www.twitter.com/kasparscomments

Website: www.arkfundcapital.com

© 2011 Copyright Jason Kaspar - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.