Silver Eagle Coin Sales Best Since 1986

Commodities / Gold and Silver 2011 Jun 01, 2011 - 10:06 AM GMTBy: GoldCore

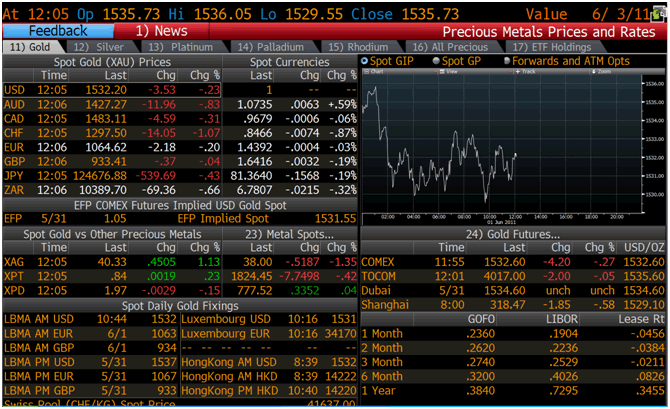

Gold and silver are lower today despite equities being mixed and Eurozone debt markets exhibiting signs of stress again with Portuguese and Greek bonds being sold with yields rising again despite the latest “bail out” speculation.

Gold and silver are lower today despite equities being mixed and Eurozone debt markets exhibiting signs of stress again with Portuguese and Greek bonds being sold with yields rising again despite the latest “bail out” speculation.

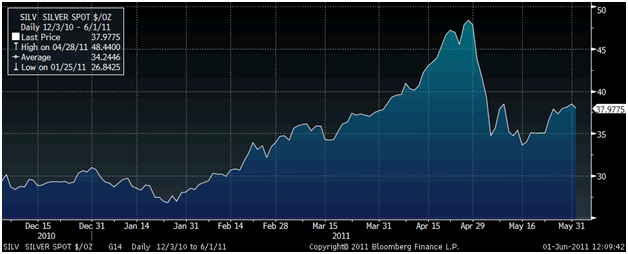

Silver demand internationally remains very high despite repeated, uninformed talk of silver being in a bubble. It is amazing how analysts who were never positive on silver, even when it was trading at $5/oz, are now experts and claim to know the future price movement of silver and know silver is a bubble.

Analysts who never commented on silver before in their life have suddenly come out of the woodwork to proclaim their wisdom about silver being a bubble. Their analysis is superficial at best and almost entirely based on silver’s recent price movement. The actual fundamentals of the market are completely ignored.

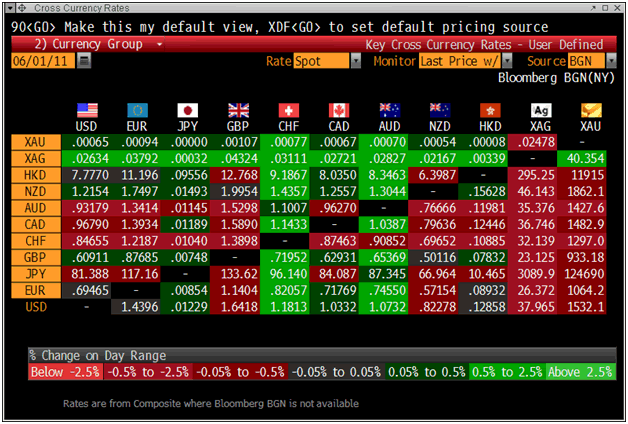

Cross Currency Rates

A little knowledge is a dangerous thing.

Absolutely nothing has changed regarding the fundamentals of the silver market. The physical silver bullion market is a tiny market vis-à-vis the gold market and the equity, bond, currency and other markets.

The recent sell off, far from being the bursting of a bubble was actually due to Wall Street banks with massive concentrated short positions being involved in a short squeeze that propelled prices higher, unprecedented and dubious margin increases and increasing investment and industrial demand for silver internationally.

Bloomberg reports this morning that Turkey imported 25.7 tons of silver in May, up from 61 kilograms in April, the Istanbul Gold Exchange said in a report on its website. This is a huge increase in demand and suggests that Middle Eastern demand for silver, which has not been noteworthy to date, may soon become an important catalyst for higher silver prices.

Silver demand is particularly strong in China and the rest of Asia, and among a minority but increasingly vocal and influential band of silver advocates who believe that silver is a superior form of money and will help protect people from developing problems in the western and global financial and monetary system.

Bloomberg reports this morning that U.S. silver eagle coin sales through May 2011 are the best since 1986 (see news below). 18.9 million ounces have been sold so far in 2011.

While that may seem like a lot, to put that number in context, it is only worth some $661 million.

Ireland, a small country, may need an extra €50 billion to be made available under the EU/IMF programme to allow it to remain out of the markets for a longer period.

The average daily turnover on foreign exchange markets is in excess of US$4 trillion.

The US has monthly budget deficits of over $200 billion.

(Bloomberg)-- U.S. Mint Silver Eagle Coin Sales Through May Best Since 1986

The U.S. Mint sold 3.65 million ounces of American Eagle silver coins last month and had the best January through May sales since 1986 as prices for the metal almost doubled.

Sales of the coins climbed 30 percent from 2.819 million ounces in April, taking the total for the year so far to 18.9 million ounces, the mint’s website shows. That compares with 15.2 million in the first five months of last year and is the most ever, according to data going back to 1986. American Eagle gold coin sales fell 0.9 percent to 107,000 ounces last month.

Silver futures jumped as much as 90 percent to a 31-year high in New York between January and April and gold reached a record in May as concern about Europe’s debt crisis, faster inflation, a weakening dollar and unrest in northern Africa and the Middle East spurred demand for a protection of wealth.

Silver then plunged as much as 35 percent as CME Group Inc., the Comex owner, raised margin costs to curb price volatility.

While silver “is beginning to move from the fringes with a little bit more mainstream demand, we’re still far from everyone piling in,” said Mark O’Byrne, executive director of brokerage GoldCore Ltd. in Dublin. “Some are buying purely for the safe- haven demand and are worried about fiat currencies. “

“There’s trust in silver and gold.”

The mint, located in Washington, D.C., said last week that its San Francisco facility will start producing American Eagle silver coins to meet demand at “unprecedented high levels,” and the plant can produce as many as several hundred thousand coins a week. The mint typically produces bullion coins in West Point, while other coins are made in locations including Philadelphia and Denver.

Demand for physical metal helped silver rise in nine of the past 10 years and gold complete a decade of annual increases, the longest run of gains in at least nine decades in London. Investors in exchange-traded products have accumulated about $122 billion of precious metals, according to data compiled by Bloomberg.

Silver futures for July delivery traded at $38.17 an ounce on the Comex by 8:06 a.m. London time and are up 23 percent this year. Spot prices touched a record $49.79 in London on April 25.

Gold for August delivery was at $1,533.40 an ounce, after reaching $1,577.40 on May 2. It’s up 7.9 percent this year.

The mint sold 514,500 ounces of American Eagle gold coins so far this year. That compares with 521,500 ounces in the same period last year and 554,500 ounces in 2009.

For some people “it’s getting too expensive to buy an ounce of gold,” and they can buy silver more easily, O’Byrne said.

Gold

Gold is trading at $1,532.10/oz, €1,063.15/oz and £933.47/oz.

Silver

Silver is trading at $38.12/oz, €26.45/oz and £23.23/oz.

Platinum Group Metals

Platinum is trading at $1,822oz, palladium at $776/oz and rhodium at $2275/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.