Stock Market Sentiment At Extreme Panic Levels

Stock-Markets / Stock Markets 2011 Jun 02, 2011 - 03:20 AM GMTBy: Chris_Vermeulen

It was a crazy session as the stock market slid over 2% on heavy volume. This type of price action means fear has taken control of masses and they are unloading (selling their stocks) in anticipation of much lower prices.

It was a crazy session as the stock market slid over 2% on heavy volume. This type of price action means fear has taken control of masses and they are unloading (selling their stocks) in anticipation of much lower prices.

Trading off extreme levels of fear can be very rewarding if done right. That’s because fear is the most powerful reaction we as humans have and it’s somewhat predictable. Fear can make people do crazy and or stupid things and it’s these extreme reaction which investors do in the market that lead to great trading opportunities. Buying into fear and selling into greed is what I focus on.

Gold and Silver Showing Greed and Fear

For example, if we take a look at the 4 hour chart of gold and silver you will see how investments which have a large amount of speculation like Silver move the opposite to what other related investments like gold are doing.

The first chart which is gold, shows how today’s fear had investors moving into this shiny safe haven. Silver on the other hand has been the investment of choice for every Tom, Dick and Harry trying to play the popular headline investment. So on a day like today when prices start to slide in the stock market these speculative holders of silver get scared and dump (sell) their position in stocks and silver. The problem with silver is that the market is still small and its does not take many people hitting the sell button to send it 5% lower which is what took place today. This is one sign which is telling me traders are getting scared of a market selloff.

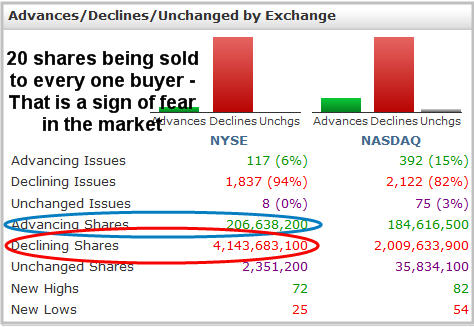

Evidence #2 Showing Signs Of Fear

These data points below clearly show sellers were in control today. I like to look at the NYSE because it holds all the big brand name stocks which the masses like to buy when they feel lucky. So when I see this many traders selling and so few buying I know the masses are dumping shares and going to a cash.

The NASDAQ had 10 shares being sold to every one share being bought which is half the fear level of what the NYSE and that makes good sense. The NASDAQ has many smaller companies which the masses just don’t know about or own so there was not as much selling taking place on that exchange. So brand name stocks getting dumped all at once is another sign of extreme fear hitting the market.

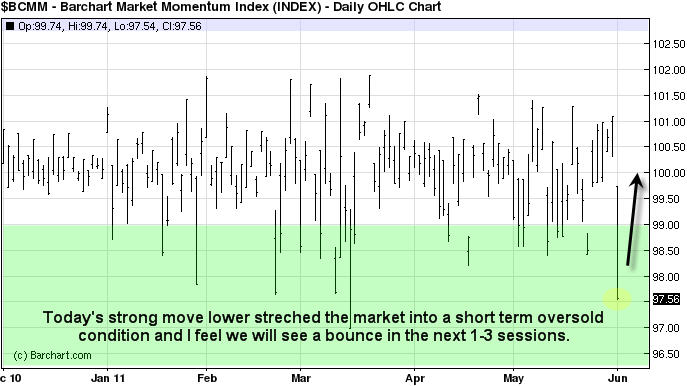

Evidence #3 Showing Signs Of Fear

This chart below provides the momentum of the market. I think of it as the rubber band effect. If the market selling momentum is strong enough then it pulls this indicator down to a level which it cannot go much further before it gives way and moves back a neutral or positive extreme level. This little hidden gem of an indicator can help time entry and exit points with ease once you understand it. Currently its telling us that a pause or bounce is likely to happen tomorrow.

Evidence #4 Showing Signs of Fear and an Oversold Market Condition

Take a look at the 10 minute SPY (SP500) chart below. Simple visual analysis shows that today’s strong selling which has brought the market down into a support zone should provide a pause or a bounce very soon. The question is how big will the bounce or rally be?

Given all the confirming is looking ready for a bounce and I feel we could be nearing not a bounce but an intermediate bottom and higher prices going forward. But if we break strongly below this support level then all bets are off and much lower prices should occur.

Mid-Week Trading Conclusion:

In short, today’s sharp move lower has put the market in a short term oversold condition. Meaning, a bounce is very likely to take place within the next 1-3 sessions. With the masses selling all their positions in stocks and commodities it generally takes 1-3 days after a day like this for the selling pressure to dissipate and for value buyers to step back into the market providing support.

I think both stocks and commodities will strengthen in the next few days and we will see if the market can get some traction and start a new rally. But until everyone has sold out of the market giving their shares to the big money (smart money) at a sharp discount I feel we have a rough road ahead.

If you would like to get more of my daily analysis to join my newsletter at www.GoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.