Credit Markets Diverging From Equities Again

Stock-Markets / Stock Markets 2011 Jun 06, 2011 - 03:31 AM GMTBy: Tony_Pallotta

"Don't criticize what you don't understand, son. You never walked in that man's shoes." - Elvis Presley

"Don't criticize what you don't understand, son. You never walked in that man's shoes." - Elvis Presley

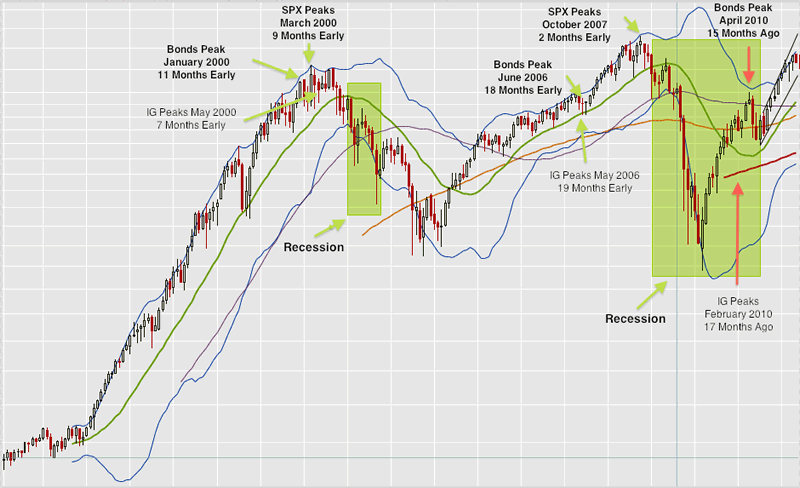

In prior posts I discussed how the equity market has become far less forward looking. Rather than being a proactive pricing mechanism it has become a reactionary trading one. In 2001 the equity market peaked nine months before the recession. In 2008 they peaked two months before.

The credit markets on the other hand continue to be good forecasters of economic contraction having peaked on average about 12-18 months prior to the two previous recession.

The question then becomes who is right and why do they differ so much?

For one few understand the credit markets although its sheer size is almost three times the size that of equities. To many the credit markets are a black box that exists but has no real bearing on their investments within equities. That is one massive misconception and a costly one as well. For starters the credit markets are not for retail investors. In equities an odd lot is anything less than one hundred shares ($1,140 for example in the case of BAC). In the credit markets though an odd lot is anything under $1 million.

Credit markets can also have less visibility in terms of pricing. Corporate bonds are traded through brokers directly versus equities where two individual investors can trade directly with one another. If you want to buy a bond you need to call your broker, give them a price and wait for a phone call back later in the day.

So barrier to entry is one big difference but the other of great significance is that in keeping out the retail investor and trader the market is far less caught up in the short term trade set up. Credit markets need to focus on macro economics. They need to understand where inflation is headed. They need to understand credit risk in terms of return of capital far greater than equity investors do.

You could argue the credit market is the tail that wags the dog. Interest rates for almost everything are set within the credit markets. Interest rates have a direct impact on consumer demand, credit formation and thus capital investment and most importantly inflation.

I still have not answered the question though if credit markets are so important and vital then why are they so ignored. Why does CNBC give Rick Santelli about 10 minutes a day to discuss them yet the remainder of the day goes to the likes of a Jim Cramer. I suspect that answers lies in the simple fact that people ignore what they don't understand. Credit markets seem scary and hard to understand. They use a different language like duration and yield to maturity or par value and slope of the curve. The truth though is they are rather quite simple to understand. Like the options market can tell a lot about the direction of equities, credit markets tell a lot about the direction of the economy.

In closing I will leave you with one simple truth. The treasury market peaked in April 2010 while the investment grade corporate bond market peaked in February 2010. Perhaps "it is different this time." It is far easier to dismiss the credit market than understand them but as Elvis also said.

"Truth is like the sun. You can shut it out for a time but it ain't goin' away."

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.