Gold, Stocks and Options

Commodities / Gold and Silver 2011 Jun 08, 2011 - 03:13 AM GMTBy: Bob_Kirtley

A question that we constantly wrestle with is are gold producers correlated to gold prices as gold is their underlying asset, or are they correlated with the stock market as they stocks? Is there safety in gold producers should the stock market in general experience a pull back? If so, why are the gold producers lagging behind the steady progress being made by gold prices at the moment?

A question that we constantly wrestle with is are gold producers correlated to gold prices as gold is their underlying asset, or are they correlated with the stock market as they stocks? Is there safety in gold producers should the stock market in general experience a pull back? If so, why are the gold producers lagging behind the steady progress being made by gold prices at the moment?

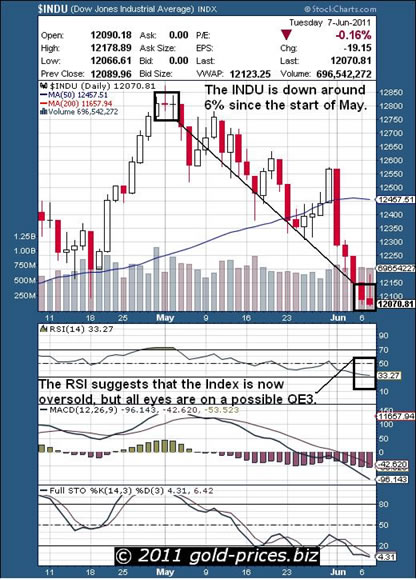

We start with a quick look at the DOW Jones Industrial Average Index, the INDU, where we can see that it fallen by around 6% since the start of May.

Also note that the RSI, currently sitting at 33.27 suggests that the Index is now oversold and could be due for a re-bound. As we see it all eyes are focused on the possibility of a QE3 or further governmental stimulus, without it the stock market would crumble and investors would lose whatever shreds of confidence that they may have in the administrations ability to manage in a proper and professional manner.

The second chart is more commonly known as the golds bugs index or the HUI and it to has fallen by around 17% since mid April 2011, suggesting that it is following the INDU and not gold prices. This is micro analysis and can easily wrong foot us, however, when the financial crash came gold fared reasonable well, but the gold producers were hammered with no stock spared as deleveraging gathered pace.

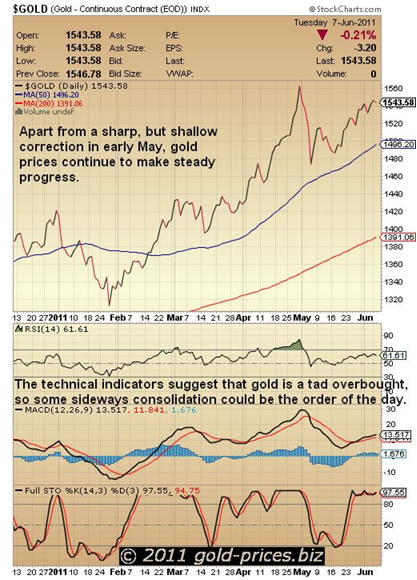

Now compare the HUI to the chart for gold, where we can see that apart from a sharp, but shallow correction in early May, gold prices continue to make steady progress. There now appears to be a disconnect between physical gold and the gold producing miners.

However, the inverse relationship between gold and the USD appears to be intact as the rally by the USD in May has spluttered to a halt and is now heading south, hence golds steady progression. We had expected the USD to rise a little further but it doesn’t appear to the legs this time, so we now anticipate another test of the ‘72′ level. If it breaks through ‘72′ then things will turn ugly quickly. Fortunately the troubled Euro is struggling with a number member states who are incapable of putting their houses into order and are in need of constant financial support in the form of bailouts.

If like us, you are of the opinion that the real financial crash still lies ahead of us, then the flight to safety, should we need one, points to the precious metals themselves and not the producers. A repeat of the Lehman Brothers type of event could see our core holdings of quality stocks take a major haircut. So, what should we do about it.

Going forward we expect the next eight weeks to be characterized by sideways consolidation. For the precious metals sector this is historically a lackluster period of low demand. The holiday season in the western world sees many of the big players leave their trading desks and head for the beach. If we do trade sideways then there may be the opportunity to sell a few covered calls with the expectation that they expire worthless and we would collect the premium.

However, for those who have the patience it may be worth waiting until around mid-August which is when we expect both gold and silver prices to gain some traction as QE2 will have ended and we should know just what is taking its place. We anticipate a QE3, albeit in a hard to spot disguise. Should a further stimulus package materialize then gold and silver prices will take off.

That being the case then our core holdings should recover in rapid fashion and head north. However, acquiring both physical gold and silver and having it in your very own hands is still a good way to be involved in this bull market.

During this summer period we will be looking to acquire a few of our favourite quality gold and silver producers along with the implementation of a number of options plays that could be prove to be very rewarding.

Now, don’t go to sleep, because you think that you have plenty of time to spare, you haven’t. We all need to start developing our strategy right now by selecting a model portfolio for these trades. Then we need to observe their behavior over the coming weeks, noting those stocks that mirror the movements of the underlying asset. If the behavior of the chosen stock is odd and does not mirror the movement of the underlying asset, then don’t try and reconcile it, drop it and move on to your next choice. When you are happy that you have a vehicle that suits your selection criteria, formulate your plan by deciding before hand the following:

1. How much of your hard earned cash are you willing to risk?

2. At what price will you buy?

3. At what price will you sell?

In terms of options trading, our plan is to look primarily at the January 2012 series in most cases, as we anticipate that the lions share of the action will take place between September 2011 and January 2012. The possible vehicles for these trades will be the larger ETFs and a selection of what we perceive to be undervalued stocks. Its important to adopt a spread of positions with exposure to the next up-leg by this bull market, as it is both disappointing and expensive to identify a major move and then make the wrong choice within the market sector and finish up empty handed.

A good test in deciding on the amount of money that you are prepared to put at risk is to ask yourself just how you will feel if you wake up one morning and you have lost the lot. If that feeling hurts then you know that you are placing too much cash into that trade. And don’t get carried away with what if it goes to the moon fantasizes – it seldom does. Having decided on the price that you are prepared to pay for a tranche of options contracts, go ahead a place your order with your price stated as the ‘Limit’ that you are prepared to pay. Now be patient and wait for your order to get filled, do not chase it by upping your bid as your emotions will come into play and you wont be as rational as you were in the cold light of day. Lets assume that your order gets filled and you are now the proud owner of a few options contracts. The next step is to put them up for sale at your per-determined price, again your order should be a limit order and again you should be realistic and patient. If there is a rally and your selling price is triggered be happy, don’t beat yourself up about the amount of money that you think you have missed. A smaller profit in your very own hands is better than a larger one that may or may not materialize.

So chop-chop, it is due diligence time for you and time is of the essence. Also remember to keep some ‘opportunity cash’ on the sidelines as none of us really know just when a bargain might present itself.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.