Great Silver Crash of 2011 May Not Be Over

Commodities / Gold and Silver 2011 Jun 13, 2011 - 04:10 AM GMTBy: Ned_W_Schmidt

According to the calendar, Summer doldrums should now be taking hold of the financial markets. Perhaps this year, though, those hot day blues might be replaced with greater than normal excitement. We know some interesting events might take place.

According to the calendar, Summer doldrums should now be taking hold of the financial markets. Perhaps this year, though, those hot day blues might be replaced with greater than normal excitement. We know some interesting events might take place.

First, QE-2 is scheduled to be completed by the end of the month. With no discernable positive effect on the U.S. economy from that program and U.S. Senate wisely blocking the filling of two Board seats at the Federal Reserve, QE-3 seems unlikely.

Second, a significant change will be made in the trend for the deficit of the U.S. government. While the ultimate shape of the deal to raise the U.S. debt limit is unknown, it seems certain to imply some reduction in U.S. government spending growth.

Third, the Obama Regime's nationalization of U.S. healthcare system may be ruled unconstitutional. That possibility, a 60/40, could lead to a substantial lowering of wealth destruction in the U.S. through enforcement of the founding fathers' intentions for commerce clause of U.S. Constitution.

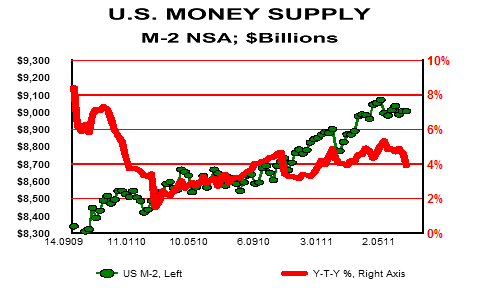

Some other happenings will be important, as they will likely not happen. Among those is hyperinflation in the U.S., the ever popular forecast of the past three years. The graph below is of the U.S. money supply, M-2 NSA. That red line is the year-to-year percentage change in the U.S. money supply. As is readily apparent, U.S. money supply growth has been anemic. Hyper inflation does not sprout from a measly 4% expansion of the money supply. Without QE-3 and some growth in the money supply, hyperinflation in the U.S. is a non issue.

With the end of QE-2 and without QE-3 we can also discard "dollar is going to zero" forecasts. That one alternates, seemingly weekly, with "Euro is going to zero" forecasts. Sometimes we have trouble keeping track of which one is on the way to zero on any particular day. In any event, neither seems likely to happen this Summer.

Where does all that leave investors? Despite sounding somewhat positive on the world in the above discussion, politicians have a tough time shedding their Keynesianism. They simply enjoy too much the power that comes from extracting wealth from the citizens. For that reason, we certainly want to hold onto our existing Gold positions. However, buying $Gold at what might indeed be over extended prices might not be advisable. Exception to that view is with EU-based investors. EU€Gold has recently been over sold and has languished for sometime, suggesting that EU-based investors may want to add to Gold positions on any price weakness in their currency.

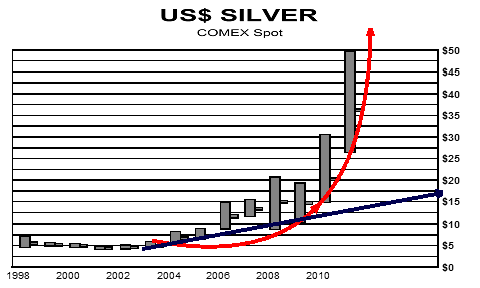

Part of the reason too for the above thinking is that the Great Silver Crash of 2011 may not be over. As it continues to unfold, it could have a seriously dampening effect on investor attitudes toward precious metals. Chart below portrays the price of US$Silver over the years. Annual lows, highs, and closing values are indicated in the chart. The parabolic rise in which Silver had been trading, and is now collapsing out of, is obvious and irrefutable.

How badly Silver suffers for the failure of that pattern is now the only discussion topic of merit. The longer term trend line drawn across the lows suggests a fairly steep correction remains. That view is consistent with the normal penalty extracted by such pattern failures. Silver investors should continue to average out of Silver at current prices. If Silver breaks the recent low of US$32.25 in the cash market, the ensuing penalties could be quite high.

Aside from retaining Gold, despite the strong possibility of a move to US$1,400 this Summer, what other choices might investors consider? Both Rhodium and Chinese Renminbi-denominated deposit accounts offer what seems to be excellent longer term potential. These should be considered investments, with a time horizon more than a "few" weeks.

Finally, we are somewhat excited about our new collaborative research effort with Xinye Management Company of the People's Republic of China. Xinye is a premier new investment consultancy serving precious metal investors in that nation. Their web site is: www.goldxy.com

¹ These estimates are preliminary, and subject to change.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.