Is the World Running Out of Silver?

Commodities / Gold and Silver 2011 Jun 16, 2011 - 03:46 PM GMTBy: Jeff_Clark

(Excerpt from the Casey Research 2011 Silver Investing Guide)

(Excerpt from the Casey Research 2011 Silver Investing Guide)

Silver has been on fire over the last three years -- substantially outperforming its spotlight-grabbing cousin, gold.

Because we believe this bull run is far from over, we advise investors to always maintain exposure to the precious metals markets. Even if you haven't yet participated in the run-up of both gold and silver, I'm glad you're ready to take a look at the investment potential of silver.

The question every investor faces in a bull market is: Do I buy now, anticipating prices will continue higher -- and chance getting clobbered if a correction arrives? Or do I wait for a pullback and possibly miss out on big gains? There's risk either way.

Our goal in this report is to suggest various ways you can invest in silver, while underscoring the importance of patience and discipline. Investors must remain patient to avoid chasing silver, overpaying, and draining their cash. Instead, we recommend that you use temporary price declines to steadily accumulate the best silver stocks and your preferred form of bullion.

Looking back after this bull market has finally run its course, we think gold and silver will have amply rewarded those who bought smart, had meaningful exposure, and stayed the course.

Silver: The Lay of the Land

There is ample data on the silver market to consider, but there are two specific issues regarding supply and demand that are critical to understand.

The first is industrial use. Demand from a number of industries that use silver has been flat or falling. Household demand for silver like cutlery, flatware, and candlesticks hasn't risen in ten years. Jewelry fabrication is up but a blip. With the shift to digital photography and image storing, use in photographic film processing continues to fall. And yet, total demand from industrial users keeps climbing.

So what's driving industrial demand?

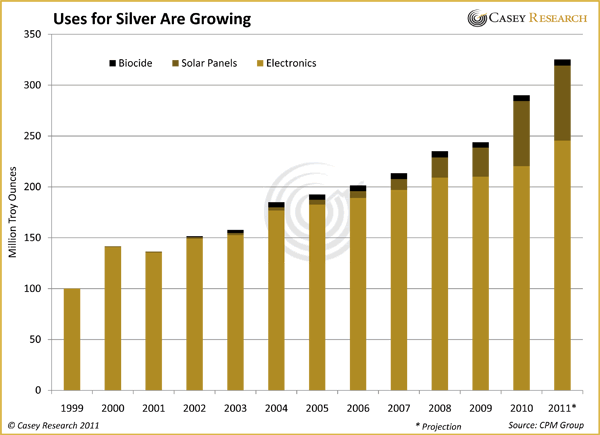

Uses for Silver Are Growing

Since 1999, consumption in electronics has increased 120%. Silver use in solar panels began in 2000, and usage is up 640% since. Silver was first used in biocides (antibacterial agents) in 2002 and, while a small percentage of total silver use, it has grown six-fold.

The point is that not only are the number of uses for silver growing, the demand within each of those applications is rising as well. This is important to keep in mind because, traditionally, the industrial component of silver tends to keep the price soft in a poor economy - and Doug Casey is convinced we're on the cusp of the Greater Depression.

However, these increasing sources of demand are now more likely to keep a floor under the price in the future. In fact, the Silver Institute forecasts that total industrial use of silver will rise by 36% over the next five years, to 666 million troy ounces/year. That's a lot of silver, meaning this portion of demand, which is roughly 60% of all fabrication, isn't letting up anytime soon.

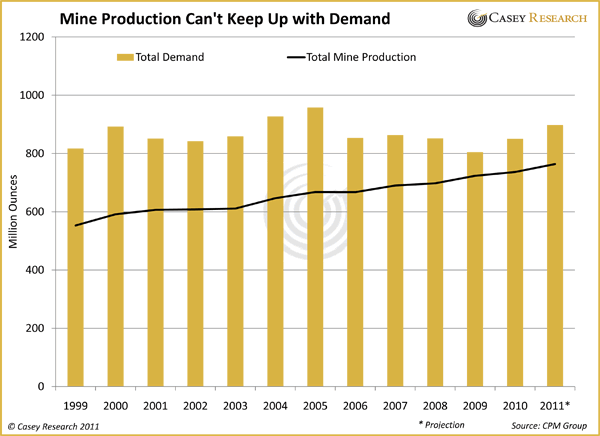

The second issue is mine supply. Silver mine production has been increasing over the past decade, largely due to rising prices, allowing companies to ramp up production and bring more metal to the market. In fact, global mine production is up 33% since 1999. Meanwhile, total demand, as you'll see in the chart below, is also rising.

Mine Production Can't Keep Up with Demand

So what's the concern?

In spite of miners digging up more and more silver, production alone can't meet global demand, and the gap has to be filled by scrap silver coming to market.

And there's a catch with scrap. While scrap metal comprises about 20% of silver's total supply, many of these new applications are difficult to reclaim. Some applications contain such small amounts that they're uneconomic to recapture, such as many biocidal and nanotechnology applications. With others it'll be a long wait. Solar panels, for example, have a 20- to 30-year life. Still others are waiting on more effective recovery programs; more than half of all silver in cell phones, TVs, computers and other electronics, for instance, still ends up in landfills.

In other words, a growing portion of the silver that's consumed won't be returning to the market anytime soon.

[Read and download the entire 17-page Special Report, the Casey Research 2011 Silver Investing Guide, absolutely FREE. Find out which are the best forms of silver to buy and when, plus a bullion expert discusses the looming silver shortage. Click here to read it now.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.