U.S. House Price Indexes Stability?

Housing-Market / US Housing Jun 29, 2011 - 02:54 AM GMTBy: Asha_Bangalore

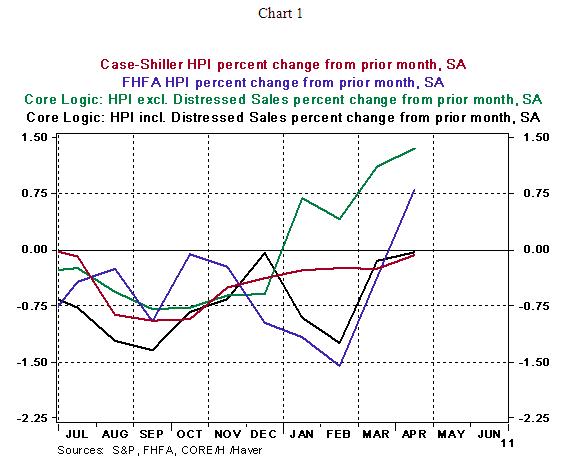

Latest reports on home prices are somewhat encouraging. The Case-Shiller Home Price Index (HPI) of April edged down 0.1% on a seasonally adjusted basis and advanced 0.7% on a seasonally unadjusted basis from March. The seasonally adjusted drop of the Case-Shiller HPI is smallest since July 2010.

The Case-Shiller HPI rose in nine out of the twenty metro areas in April. Other home price measures also suggest that prices are stabilizing. The FHFA HPI rose 0.8% in April, the first since May 2010, while the overall Core Logic HPI held nearly steady and the HPI excluding distressed properties moved up 1.3%, the fourth monthly gain.

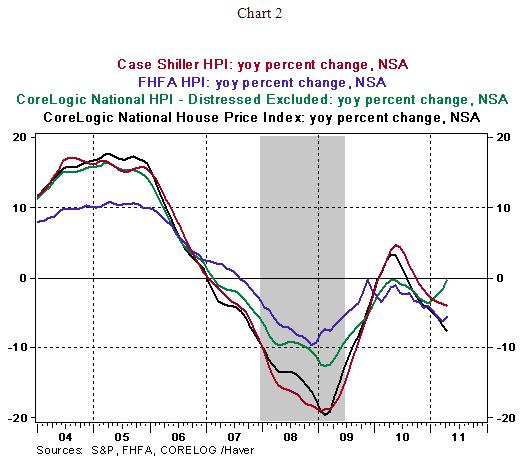

On a year ago basis, the Case-Shiller Home Price Index declined 4.0% in May; the downward trend is consistent with the Core Logic Price Index which includes distressed properties (see Chart 2). However, the Core Logic Price Index excluding distressed properties fell only 0.5% in April. These HPI readings suggest that home prices are stabilizing. Stability of home process implies that net worth of households is not being eroded and households face fewer constraints if they choose to refinance their home mortgage.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.