Central Banks Monetary Policy Week in Review - 9 July 2011

Interest-Rates / Central Banks Jul 09, 2011 - 03:50 PM GMTBy: CentralBankNews

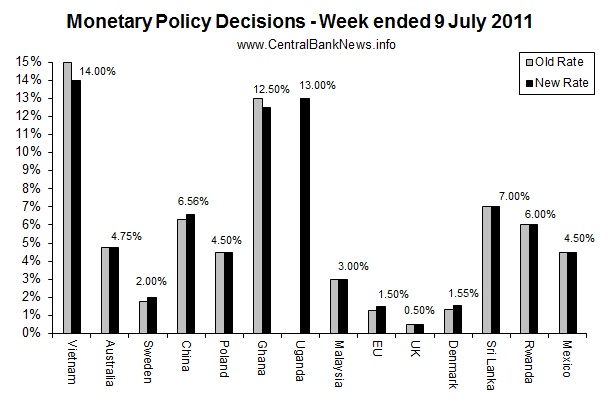

The past week in monetary policy saw interest rate decisions from 14 central banks around the world, of which 7 made changes in their monetary policy settings. Those that increased interest rates were: Sweden +25bps to 2.00%, China +25bps to 6.56%, the EU +25bps to 1.50%, and Denmark +25bps to 1.55%. While those that cut rates included Vietnam, which cut its OMO rate -100bps to 14.00%, and Ghana -50bps to 12.50%.

The past week in monetary policy saw interest rate decisions from 14 central banks around the world, of which 7 made changes in their monetary policy settings. Those that increased interest rates were: Sweden +25bps to 2.00%, China +25bps to 6.56%, the EU +25bps to 1.50%, and Denmark +25bps to 1.55%. While those that cut rates included Vietnam, which cut its OMO rate -100bps to 14.00%, and Ghana -50bps to 12.50%.

Those that held rates unchanged were: Australia 4.75%, Poland 4.50%, Malaysia 3.00%, the UK 0.50%, Sri Lanka 7.00%, Rwanda 6.00%, and Mexico 4.50%. Also, setting monetary policy interest rates for the first time was the Bank of Uganda, which set its new monetary policy rate, the central bank rate, at 13.00%.

One of the themes that stood out was additional monetary policy tightening, or more appropriately - monetary policy normalization, from developed market central banks e.g. Sweden, the ECB, and Denmark. Meanwhile the actions of Vietnam and Ghana show that it's not a one-way street for emerging markets. However the inflation-growth mix still remains a challenge for some key emerging markets, as made clear with China's additional interest rate hike. But while some noted upside risks to inflation, many banks are seeing inflation tracking within their target ranges.

Indeed listed below are some of the key quotes from central banks that met over the past week, particularly around their assessment of the domestic inflation outlook:

Reserve Bank of Australia (held interest rate at 4.75%): "Year-ended CPI inflation is likely to remain elevated in the near term due to the extreme weather events earlier in the year. However, as the temporary price shocks dissipate, CPI inflation is expected to be close to target over the next 12 months."

Sweden's Riksbank (increased interest rate 25bps to 2.00%): "Consumer price inflation is high at present as a result of rising mortgage rates. Underlying inflationary pressures remain low, but are expected to increase as economic activity strengthens."

National Bank of Poland (held interest rate at 4.50%): "In the coming months, the annual CPI inflation rate will continue at an elevated level, mainly due to the strong growth in global commodity prices observed prior to the inflation increase."

The European Central Bank (increased interest rate 25bps to 1.50%): "The underlying pace of monetary expansion is continuing to gradually recover, while monetary liquidity remains ample with the potential to accommodate price pressures in the euro area. All in all, it is essential that the recent price developments do not give rise to broad-based inflationary pressures over the medium term."

Banco de Mexico (held interest rate at 4.50%): "The current levels of inflation are the result of several factors: the declining trend in costs of labor, the fading impact of tax changes last year, the favorable exchange rate (despite the recent episode of volatility in international financial markets) and a significant reduction in agricultural prices."

Bank of Ghana (reduced interest rate 25bps to 12.50%): "Inflation is going down and we don't see the banks responding (to lower interest rates)" and further noted that "the bank is confident that the annual inflation target of 9 percent is achievable".

Next week is set to be dominated by Asian central banks, with monetary policy decisions due from the following central banks:

Japan (Bank of Japan) - expected to hold at 0.10% on the 12th of July

Indonesia (Bank Indonesia) - expected to hold at 6.75% on the 12th of July

Thailand (Bank of Thailand) - expected to hold at 3.00% on the 13th of July

South Korea (Bank of Korea) - expected to hold at 3.25% on the 14th of July

Article source: http://www.centralbanknews.info/2011/07/monetary-policy-week-in-review-9-july.html

Source: www.CentralBankNews.info

© 2011 Copyright centralbanknews - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.