Could There Be QE3?

Interest-Rates / Quantitative Easing Jul 13, 2011 - 12:37 AM GMTBy: Paul_L_Kasriel

The minutes of the June 21-22 FOMC meeting released today hinted at the possibility of another round of QE. To wit, "a few members noted that, depending on how economic conditions evolve, the Committee might have to consider providing additional monetary policy stimulus, especially if economic growth remained too slow to meaningfully reduce the unemployment rate in the medium run." A couple more employment reports of similar tone to the June one might cause the wording to change from a "few members" to "most members." But I do not think there will be a serious discussion of another round of QE until the fourth quarter of this year.

The minutes of the June 21-22 FOMC meeting released today hinted at the possibility of another round of QE. To wit, "a few members noted that, depending on how economic conditions evolve, the Committee might have to consider providing additional monetary policy stimulus, especially if economic growth remained too slow to meaningfully reduce the unemployment rate in the medium run." A couple more employment reports of similar tone to the June one might cause the wording to change from a "few members" to "most members." But I do not think there will be a serious discussion of another round of QE until the fourth quarter of this year.

With the resumption of imports of Japanese-produced motor vehicle parts, U.S. motor vehicle assemblies will likely rev up in the third quarter - a time when the seasonal-adjustment factors will be "expecting" a decline in assemblies because of retooling for new models. So, on a seasonally-adjusted basis, industrial production and manufacturing employment is likely to be boosted by this seasonally-atypical increase in motor vehicle assemblies. However, assuming bank credit creation continues to languish and with the termination of QE2, the economy will be starved for credit, which will hold back domestic aggregate demand. This, in conjunction with a slowdown in emerging market demand led by China and continued weak developed market demand, U.S. real economic growth will be muted and the unemployment rate will be inching higher. This will set up the prospects for QE3 either late in the fourth quarter of this year or early in the first quarter of 2012.

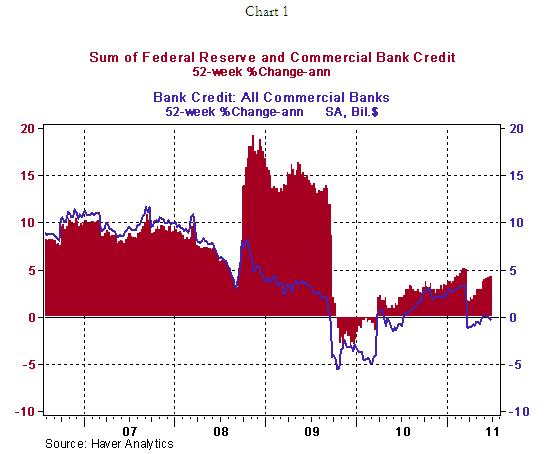

Of course, it was only a few FOMC members that held open the prospects for another round of QE. There also were "a few members [who] viewed the increase in inflation risks as suggesting that economic conditions might well evolve in a way that would warrant the Committee taking steps to begin removing policy accommodation sooner than currently anticipated." I would be willing to bet that these were the same members who were worried about inflation in 2008 and were recommending a hike in the fed funds rate at that time. Combined Federal Reserve and commercial bank credit, the necessary ingredient for sustained higher inflation, did grow during QE2, but not at an excessive rate (see Chart 1). With QE2 having been terminated and bank credit growth still stagnant, this necessary ingredient for higher sustained inflation will become minuscule and the Fishers and Plossers of the Federal Reserve will once again be proved wrong.

The FOMC laid out step-by-step its exit strategy from its recent years' extraordinarily aggressive credit-creation policy actions. What it did not mention was when this exit strategy would commence. In fact, it went out of its way to say that "[p]articipants stressed that the Committee's discussions of this topic were undertaken as part of prudent planning and did not imply that a move toward such normalization would necessarily begin sometime soon." Here is the sequencing of the exit strategy:

- The Committee will determine the timing and pace of policy normalization to promote its statutory mandate of maximum employment and price stability.

- To begin the process of policy normalization, the Committee will likely first cease reinvesting some or all payments of principal on the securities holdings in the SOMA.

- At the same time or sometime thereafter, the Committee will modify its forward guidance on the path of the federal funds rate and will initiate temporary reserve-draining operations aimed at supporting the implementation of increases in the federal funds rate when appropriate.

- When economic conditions warrant, the Committee's next step in the process of policy normalization will be to begin raising its target for the federal funds rate, and from that point on, changing the level or range of the federal funds rate target will be the primary means of adjusting the stance of monetary policy. During the normalization process, adjustments to the interest rate on excess reserves and to the level of reserves in the banking system will be used to bring the funds rate toward its target.

- Sales of agency securities from the SOMA will likely commence sometime after the first increase in the target for the federal funds rate. The timing and pace of sales will be communicated to the public in advance; that pace is anticipated to be relatively gradual and steady, but it could be adjusted up or down in response to material changes in the economic outlook or financial conditions.

- Once sales begin, the pace of sales is expected to be aimed at eliminating the SOMA's holdings of agency securities over a period of three to five years, thereby minimizing the extent to which the SOMA portfolio might affect the allocation of credit across sectors of the economy. Sales at this pace would be expected to normalize the size of the SOMA securities portfolio over a period of two to three years. In particular, the size of the securities portfolio and the associated quantity of bank reserves are expected to be reduced to the smallest levels that would be consistent with the efficient implementation of monetary policy.

Some analysts viewed these minutes as a big yawn. I disagree. These minutes revealed that there remains an appetite for more QE. If queried on the subject of further QE by House members on Wednesday and Senate members of Thursday, it will be interesting to hear Chairman Bernanke's response, especially in light of the very weak June employment report, which was not available at the time of the most recent FOMC meeting.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.