While Congress Bickers Gold GLD ETF Remains a Profitable Trade

Commodities / Gold and Silver 2011 Jul 15, 2011 - 03:30 AM GMTBy: George_Maniere

Yesterday morning Dr. Bernanke met with members of Congress again. Yesterday I think Congress heard not what they wanted to hear but instead they heard what Dr. Bernanke actually said. I listened to him on Wednesday and I listened to him yesterday. He sang the same song on both days. He once again emphasized that overzealous cuts to government spending in the short term could derail an already fragile recovery.

Yesterday morning Dr. Bernanke met with members of Congress again. Yesterday I think Congress heard not what they wanted to hear but instead they heard what Dr. Bernanke actually said. I listened to him on Wednesday and I listened to him yesterday. He sang the same song on both days. He once again emphasized that overzealous cuts to government spending in the short term could derail an already fragile recovery.

Dr. Bernanke also said that the FOMC is not currently ready to embark on a third round of quantitative easing or government bond buying to stimulate the economy.

Late on Wednesday Moody's warned that the U.S would lose its top credit rating if a compromise on the debt ceiling was not resolved. Standard and Poor's also told U.S. lawmakers and business groups that it would cut the U.S. credit rating if the government fails to make any of its expected payments on debt or other obligations. To further emphasize the point China, the biggest foreign creditor urged the U.S government to adopt responsible policies to protect investors' interests.

Dr. Bernanke further amplified the warning that a debt default would be a calamitous outcome that would create a severe financial shock that would have effects not only bon the U.S. economy but would have ripple effects throughout the global economy.

The Wall Street Journal reported that Speaker of the House Boehner was quoted as saying "we are in the foxholes" fighting for the people of America. Perhaps he forgot to mention that he has previously voted to raise the debt ceiling five times and this game he is playing is nothing more than the new national pastime of Congress called "Brinksmanship." It is partisan politics' in its' most unseemly form and as middle class Americans suffer he had the audacity to say that he was in the foxholes. I see a lot of people suffering and he looks remarkably well dressed, well groomed and well fed for someone in a foxhole.

As soon as the words came out of Dr Bernanke's mouth that the FOMC was not ready to institute another round of quantitative easing at this point the market dropped like a hot potato. Gold, which was humming merrily at $1590.00 on its way to the key $1600.00 level, sold off a bit and closed the session at 1586.40. To use the Gold ETF (GLD) as a proxy it closed up ½% at 154.54. Not too bad a showing for a market that closed down 54.49 points on the DOW.

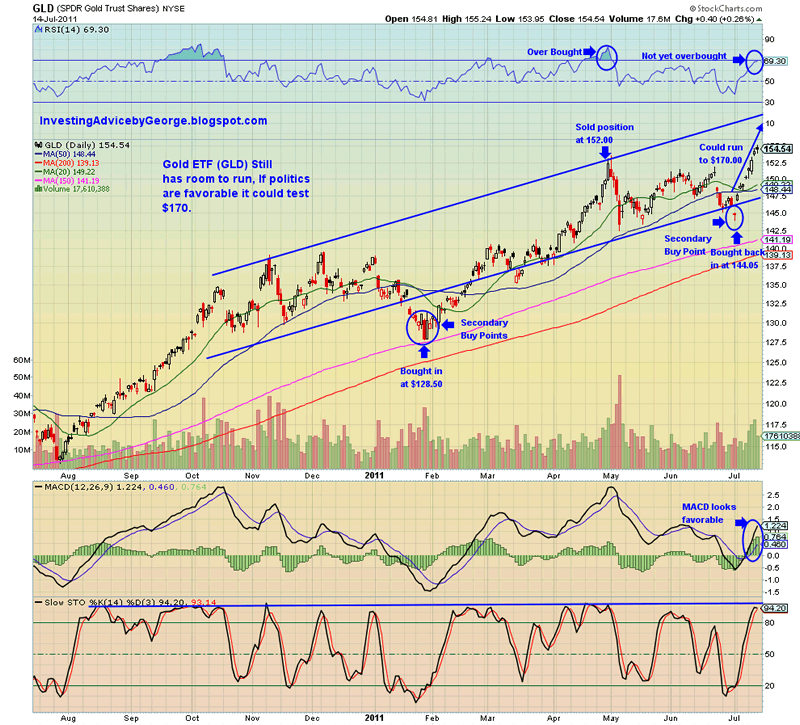

So this begs the question how far can GLD run? Last January I had it pegged to go to 160, which I believe unless there is a complete meltdown in the market it will easily do. However, I am now seeing that it seems to have worked its way up so slowly and steadily that I now see $170 as a realistic goal. Please see the chart below.

A careful study of this chart will show that when GLD has corrected it has pulled back to the 150 Day Moving Average. The time to sell will be when it gets above 70 on the RSI. While a number over 70 is over bought with a very emotional trade like Gold 80 would be the place to start taking profits. If you remember the parabolic silver run up in the last week of April, SLV did not correct until the RSI was at 90. The more emotional the trade the higher the RSI number seems to get because the herd mentality has removed all reason from the trade.

So in conclusion, unless all reason is restored to Congress, which I see as the least likely scenario to play out, we can expect Gold to continue its undaunted run up. Once you sell wait for a correction back to the $141.50 area before reopening the trade. As long as governments continue to debase currencies gold (GLD) and its baby brother silver (SLV) or (PSLV) will remain a profitable trade.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.