U.S. CPI Inflation - Lower Energy Prices Account for Decline

Economics / Inflation Jul 16, 2011 - 05:39 AM GMTBy: Paul_L_Kasriel

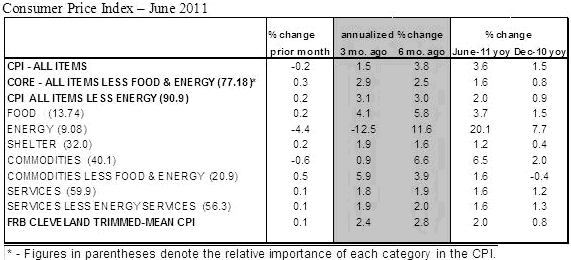

The Consumer Price Index (CPI) fell 0.2% in June vs. a 0.2% increase in the prior month. The 6.8% drop of the gasoline price index accounted for a large part of the decline in the headline number. The food price index moved up 0.2% in June, the smallest increase for the year. The core CPI, which excludes food and energy, rose 0.3% in June, matching the gain posted in May.

Prices indexes of new vehicles (+0.2%), used cars and trucks (+ 1.7%), apparel (+1.4%), shelter (+0.2%), and medical care (+0.2%) moved up to raise the overall core CPI. Lower airfares (-3.0%) and recreation costs (-0.1%) were partial offsets.

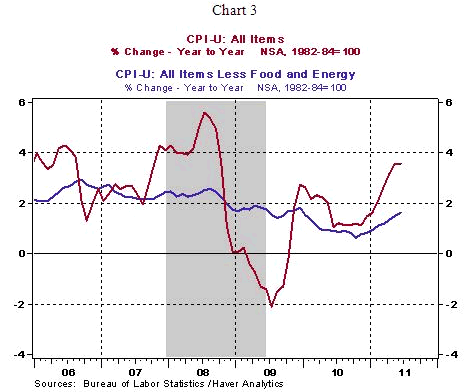

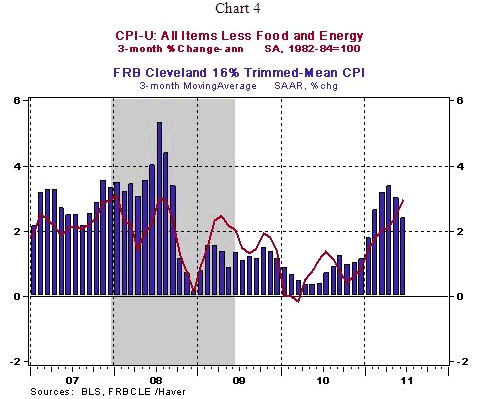

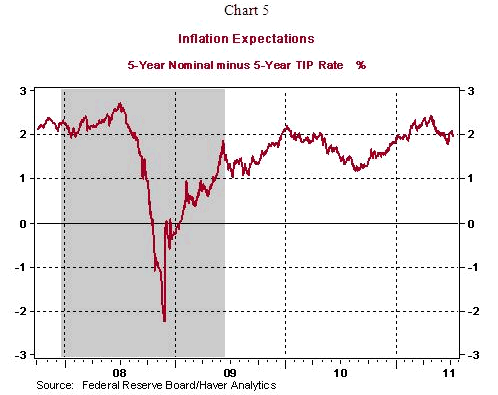

The 1.6% year-to-year increase of the core CPI is approaching the tolerance level of the FOMC with regard to core inflation. A large part of the gradual upward trend has occurred in the first six months of this year. Price indexes of shelter (+1.2% yoy), medical care (+2.9% yoy) and new vehicles (4.0% yoy) account for most of these gains. However, the Cleveland Trimmed-Mean CPI shows a small amount of deceleration (see Chart 4). Also, inflation expectations for the medium term are well-behaved (see Chart 5). The elevated unemployment rate and moderate projections for growth in the second-half of the year imply that economic growth is likely to get the upper hand in the inflation-growth debate at the FOMC in the near term. Moreover, if economic growth falters, the upward trend of the core CPI could be reversed. Therefore, it is premature to expect a tightening of monetary policy; the Fed is on hold in 2011.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.