U.S. Businesses Appear to Have Selective Uncertainty

Economics / US Economy Jul 28, 2011 - 03:45 AM GMTBy: Paul_L_Kasriel

I keep hearing that what is holding U.S. businesses back from expanding and hiring is “uncertainty.” Exactly what new types of uncertainty businesses face in the current environment vs. past environments is rarely spelled out. But if, in fact, businesses are paralyzed due to uncertainty, I would not expect them to be stepping up their purchases of capital equipment. After all, capital equipment has a relatively long life. If businesses were unusually uncertain about the long-term outlook, they would be more reluctant to make longer-term commitments, which the purchase of capital equipment is. Rather, if businesses were unusually uncertain about the future, they might be more inclined to hire workers, who, after all, can be dismissed on short notice if conditions were to change suddenly.

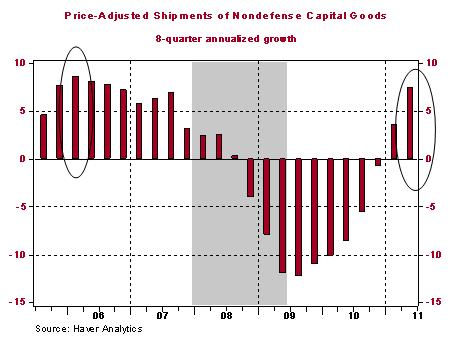

But just the opposite seems to be happening. Business hiring remains weak and business capital spending is robust. The capital spending part is illustrated in the chart below showing the 8-quarter annualized growth in shipments of nondefense capital goods deflated by the PPI for capital goods. In the 8 quarters of the current economic recovery/expansion, price-adjusted shipments of nondefense capital goods have increased at an annualized rate of 7.4%. In the prior economic expansion, when, presumably, there was normal or less-than-normal uncertainty, the fastest 8-quarter annualized growth in price-adjusted shipments of nondefense capital goods was 8.6% -- in the 8 quarters ended Q1:2006. I would think that if abnormally-high business uncertainty prevailed today, there would have been considerably slower growth in price-adjusted purchases of nondefense capital goods than what has occurred.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.