Is Gold a Bubble? 14 Charts, the Facts and the Data Suggest Not

Commodities / Gold and Silver 2011 Aug 03, 2011 - 12:21 PM GMTBy: GoldCore

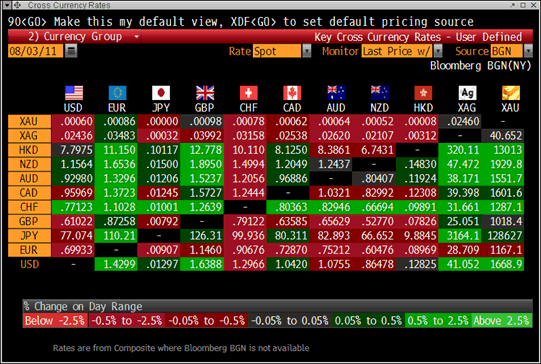

Gold is higher and is trading at USD 1,668.90 , EUR 1,167.10 , GBP 1,018.40 and CHF 1,287.70 per ounce. It is slightly lower in euros but higher in U.S. dollars, Swiss francs, the Japanese yen, and the Australian and New Zealand dollar. Gold’s London AM fix was USD 1,667.50, EUR 1,167.50, GBP 1,016.77.

Gold is higher and is trading at USD 1,668.90 , EUR 1,167.10 , GBP 1,018.40 and CHF 1,287.70 per ounce. It is slightly lower in euros but higher in U.S. dollars, Swiss francs, the Japanese yen, and the Australian and New Zealand dollar. Gold’s London AM fix was USD 1,667.50, EUR 1,167.50, GBP 1,016.77.

Cross Currency Rates

Gold reached new record nominal highs in majors yesterday and remains close to these record highs today and close to record highs in most fiat currencies. Gold surged 4.2% in Australian dollars yesterday – from $1,478 to $1,540 AUD to 1516 AUD. Gold is up nearly 12% in Australian dollars since July 1st – from $1,380 to $1,551 AUD today.

This shows that gold’s rally is broad based and is not solely a U.S. dollar phenomenon. It shows that markets and currency markets in particular are concerned about slowing economic growth, growing inflation pressures and continuing currency debasement.

After all the noise and theatre of the US debt ceiling debate and the botched deal and kicking the mother of all cans down the road, it is important to again focus on the primary fundamentals driving the gold market.

Is Gold a Bubble? 14 Charts, the Facts and the Data Suggest Not

Introduction

For more than 3 years - since gold rose above its nominal high of $850/oz in February 2008 - there has been much talk about gold being a bubble.

Nouriel Roubini, professor of economics at New York University's Stern School of Business, is one of the more prominent financial and economic experts who said gold was a bubble and many other experts internationally echoed his sentiments.

On December 10th, 2009, with gold at $1,100 per ounce, Roubini, said, "all the gold bugs who say gold is going to go to $1,500, $2,000, they're just speaking nonsense". Roubini went on to say ,"I don't believe in gold."

Gold has now risen 50% since then and Roubini has been silent on the gold price.

We believe that he was wrong regarding gold as he, like many in the western world, is simply not aware of the facts and the fundamentals driving the gold market. He also is not aware of gold’s diversification benefits.

The fundamental drivers of the gold market are not appreciated by most and rapidly get forgotten by many due to the daily barrage of noise and fear emanating from the markets.

The facts and charts below strongly suggest gold is not a bubble.

However, even if it were a bubble, those calling gold a bubble should acknowledge the diversification benefits of owning gold and urge diversification rather than vainly trying to predict the future and the future movement of asset prices.

Gold Drivers

The precious metals of gold and silver are driven by a wide variety of factors, including money supply, debt levels, currencies, CDS spreads, interest rates, inflation and fabrication demand from downstream sectors such as jewelry, electronics, and solar applications.

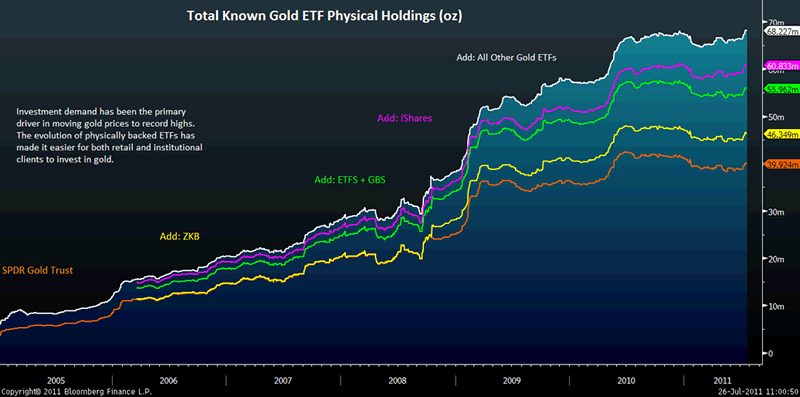

Investment demand has been one of the primary drivers more recently as investors have used precious metals as a store of value in the face of dollar and currency depreciation as well as a general hedge against inflation.

Investment demand includes significant and growing demand from store of wealth buyers in Asia, investment and diversification demand from hedge funds, pension funds and central banks and monetary demand from central banks.

This demand is due to concerns about the global economy, growing inflation risks and the real risks posed by currency debasement being seen globally.

Gold remains the preserve of the smart money, many of whom predicted the current financial and economic travails.

Risk aversion and concerns about wealth preservation due to currency depreciation remain the primary demand drivers.

Demand is due to ‘risk aversion’ hedging and diversification and can be broadly characterized as ‘prudent diversification’ rather than the ‘fear trade’ that some have called it.

There is no irrational exuberance or broad based belief amongst journalists, analysts, experts and the public in general that gold is a one way ticket to being rich. Indeed, there continues to be very little coverage of gold in local media and only the occasional coverage in the non specialist financial press. This is especially the case in the UK and Ireland and in the European Union.

There is no “greed trade” or buying of gold by the general public in the belief that making a return or a profit is guaranteed.

This was seen in the Nasdaq bubble and more recently in the property bubble that afflicted western countries.

Thus, retail demand, contrary to some hype and silly talk of people “piling in”, remains negligible but is gradually increasing from a very small base.

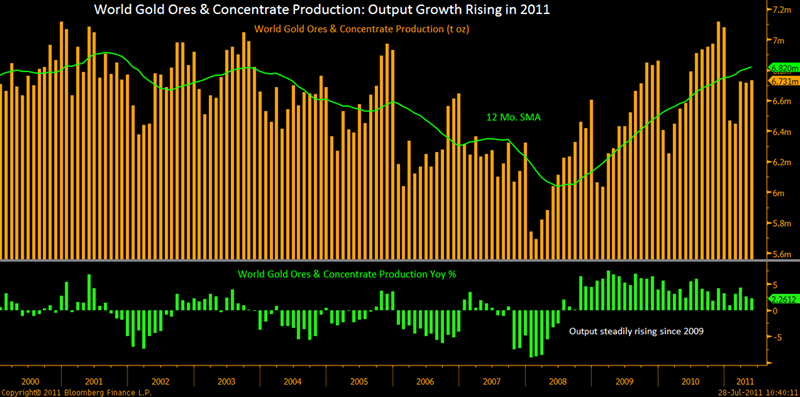

Increasing global demand (especially from Indian and Chinese savers, investors and their central banks) is being confronted with anemic supply as mining supply is marginally lower than the record levels seen in 2001 (see chart below).

This year scrap supply (due to the global ‘cash for gold’ craze) will be much lower than last. Hard pressed consumers internationally, and especially in the western world, have already misguidedly parted with the ‘family gold’.

All of the gold in the world that has ever been mined, if refined (0.9999 pure), would fit into a 21 metre high cube and is very rare. Thus, if even a fraction of flows in global capital and currency markets flows into gold, prices could rise very sharply and go parabolic.

Another factor, not known by most, is the massive concentrated short positions held by a few Wall Street banks.

The Gold Anti-Trust Action Committee (GATA) has gradually amassed evidence of market manipulation and a covert attempt to keep gold and silver prices low. Its London conference is this week and will hear from very astute analysts that there is now the real risk of a massive short squeeze that will lead to a gold cartel losing control of prices and a parabolic surge in the gold price and significant dislocations in financial markets.

GoldCore does not endorse GATA but has always found its work thorough and thought provoking. Indeed, its key contention has never been refuted or rebutted by the banks in question or in the media.

Should gold go parabolic, it may be time to reduce allocations to gold – but we appear to be a long way from there yet.

This is not the end game which unfortunately looks increasingly like an international monetary crisis – centered on either the U.S. dollar or the euro or both.

Having looked at the reality of supply and demand in the gold market let us now look at some important charts courtesy of Bloomberg Industries.

Gold Charts

These 14 charts from Bloomberg Industries strongly suggest that gold remains far from a bubble.

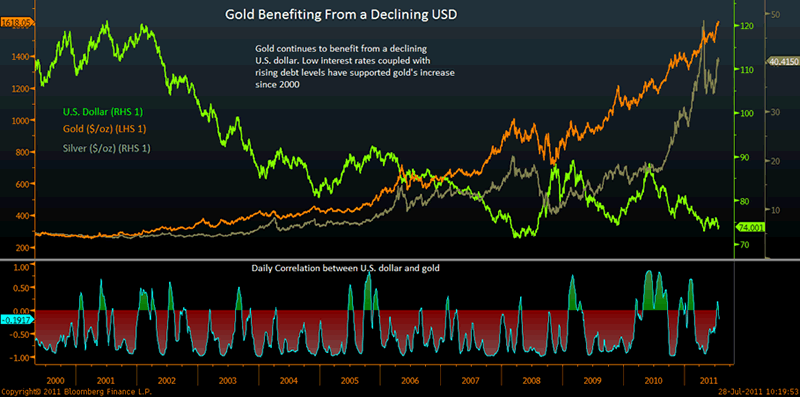

Declining U.S. Dollar Continues to Drive Precious Metals Higher

A declining U.S. dollar has been one of the primary drivers for precious metals. If the historic negative correlation between the dollar and precious metals continues to persist, further dollar declines will ultimately be positive for precious metals.

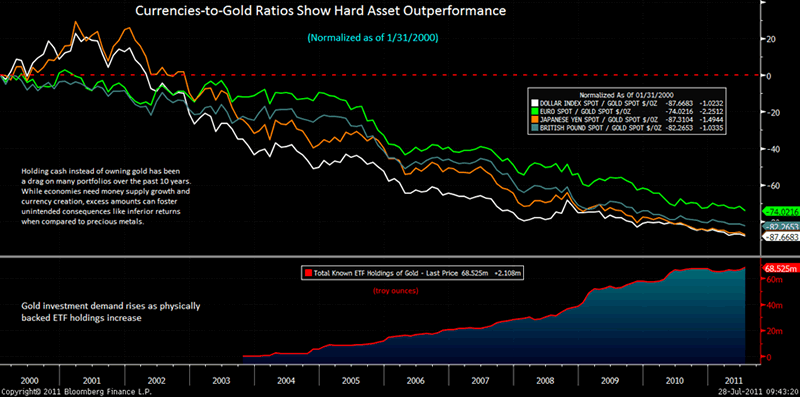

Gold Outperforms Currencies as Demand for Hard Assets Rises

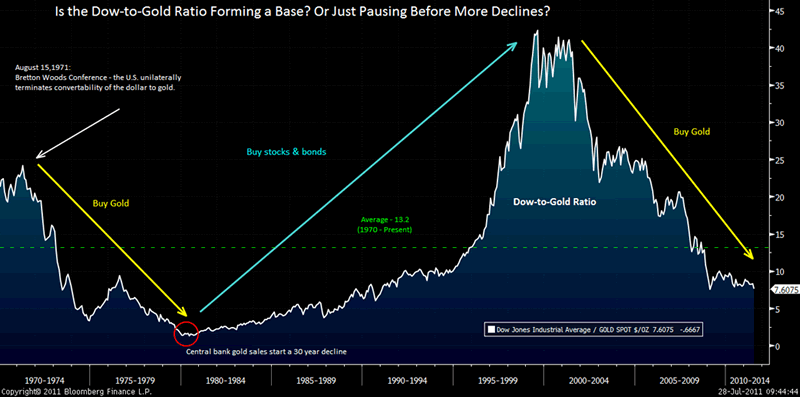

Dow-to-Gold Ratio: Financial Assets vs. Hard Assets

The ratio of the Dow Jones Industrial Average to gold displays the cyclical nature of the battle between paper and hard assets.

Paper assets (i.e., financial assets) have excelled when economic growth has been strong. When growth has faltered or the outlook was less certain, hard assets have outperformed.

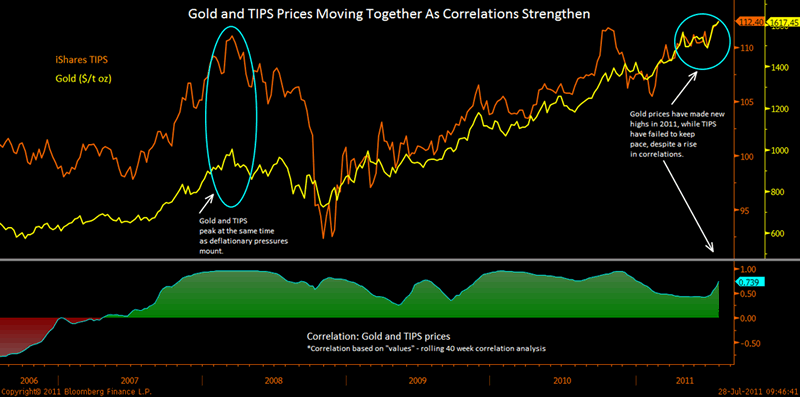

Gold and TIPS Moving in Tandem Amid Record Low Interest Rates

Record low interest rates have moved gold and TIPS higher in 2011. While the correlation between gold and TIPS declined earlier in the year, the recent rise suggests investors are more willing to pay more for inflation protection. New highs in the gold price may be signaling increased TIPS prices and inflation expectations.

World Gold Production – 2000 - 2011

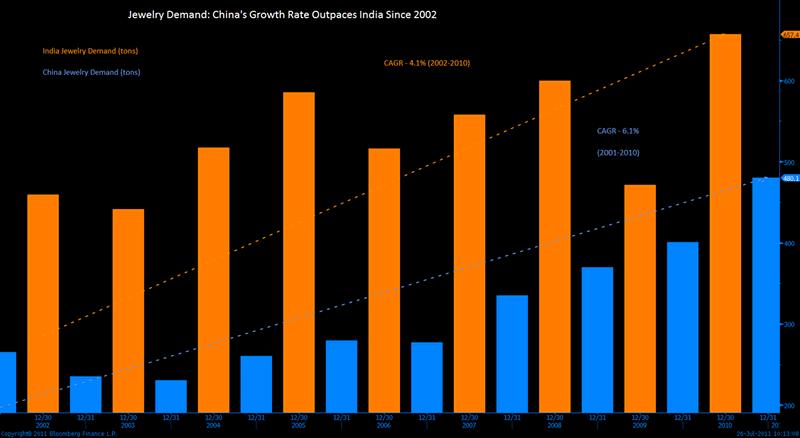

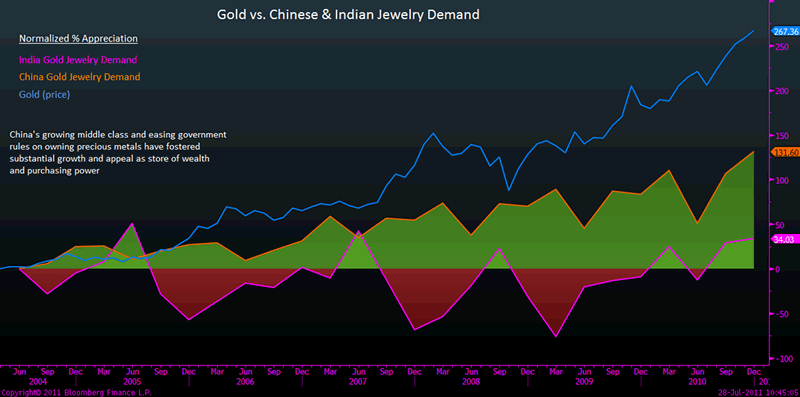

China Consumers Increase Jewelry Purchases at Quickest Pace

China has been the largest buyer of gold jewelry since 2008; its demand has grown rapidly during the past decade, and it has surpassed India, which had been the largest buyer for decades.

Chinese consumers are fearful of rising inflation, and have diversified into gold.

China and India Jewelry Demand Rises

Demand for jewelry has increased steadily as individuals buy gold and other precious metals as a hedge against inflation.

China, in particular, has had a large increase in jewelry demand, spurred by a change in government rules allowing easier access to precious metals.

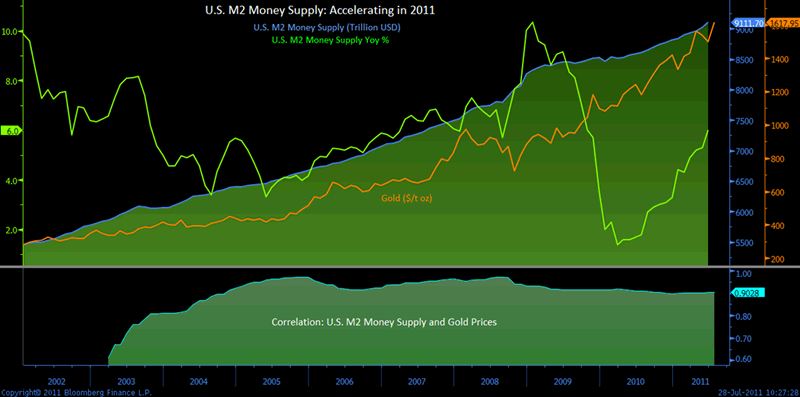

U.S. M2 Growth Expands in June, Correlates High With Gold

The U.S. M2 money supply accelerated in June to a 6.0% yoy pace, the highest reading in 22 months. The U.S. consumer price index (urban consumers) remained at a 3.6% yoy pace in June, in line with May's results. The correlation between the total U.S. M2 and gold has exceeded 0.90 since November 2004.

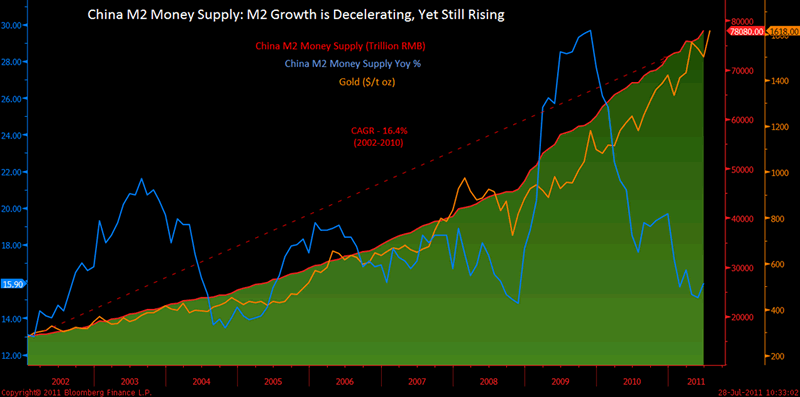

China M2 Money Supply: M2 Growth is Decelerating, Yet Still Rising

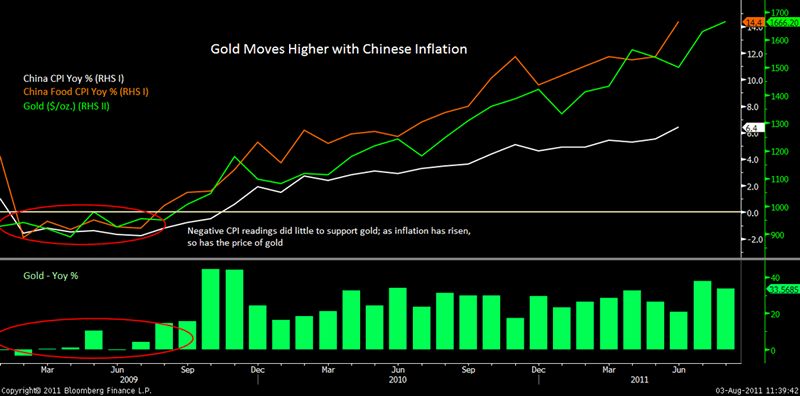

Gold Moves Higher with Chinese Inflation

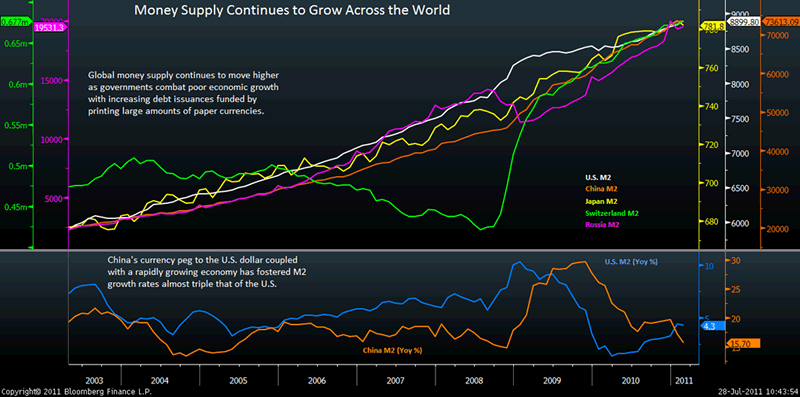

China’s M2 money supply has been rising by 20%, Switzerland’s by 25%, Russia’s by 30%, and the world’s by 8%-9%. Japan’s M2 is expected to move higher after recent events. In order to fight economic and debt issues, paper currency has been printed at historically high levels.

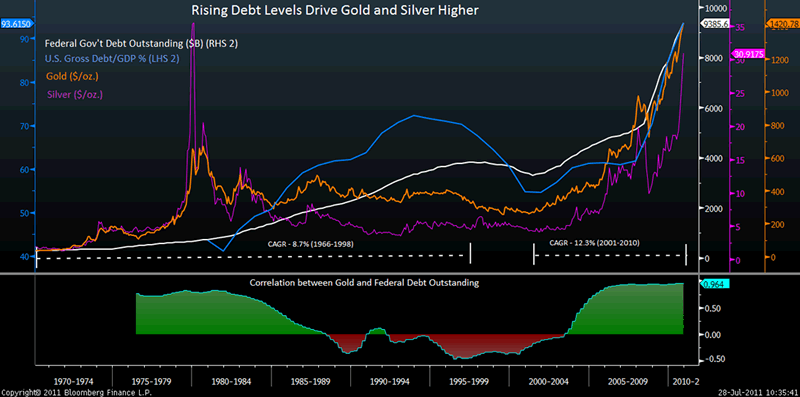

Rising Debt Levels Drive Gold and Silver Higher

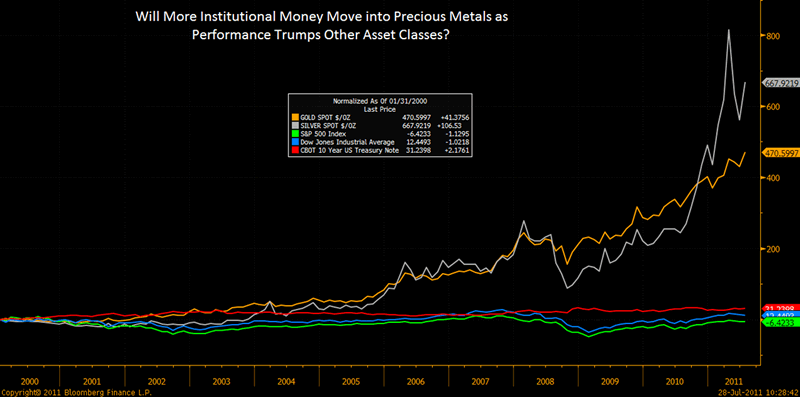

Precious Metals Outperform Other Asset Classes

Institutional investors have avoided precious metals during the last decade. Comparable performance from other assets such as stocks and bonds has been poor and as this gap widens and the need to diversify intensifies, institutional ownership in precious metals could increase driving prices higher.

Conclusion

As a percentage of assets, gold ownership remains negligible vis-à-vis assets such as equities and bonds. Ownership of gold is likely to be less than 2% of global investable assets. This is in marked contrast to the end of gold’s last bull market when gold and gold stocks accounted for over 20% of global assets.

Gold remains badly analysed, under-owned and under-appreciated. This will change in the coming months and years when the importance of gold as an investment and currency diversification and as a store of wealth is appreciated again.

For the latest news, commentary, charts and videos on gold and financial markets follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.