Gold Surges as Yen Falls Sharply and Global Currency Wars Resume

Commodities / Gold and Silver 2011 Aug 04, 2011 - 10:58 AM GMTBy: GoldCore

Gold has surged nearly 4% in Japanese yen this morning as the BOJ entered currency markets overnight selling yen thereby depreciating their currency against the dollar and other fiat currencies.

Gold has surged nearly 4% in Japanese yen this morning as the BOJ entered currency markets overnight selling yen thereby depreciating their currency against the dollar and other fiat currencies.

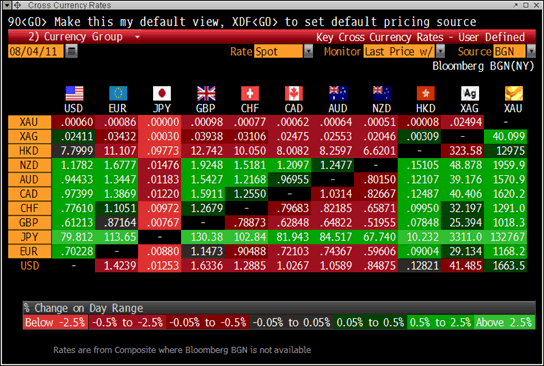

Gold is higher against all currencies and is trading at USD 1,663.50, EUR 1,168.20, GBP 1,018.30, CHF 1,291.00 per ounce and 133,000.00 JPY per ounce. Gold’s London AM fix was USD 1664.25/oz, EUR 1170.61/oz, GBP 1,018.20/oz. Gold reached new record nominal highs in majors yesterday and remains close to these record highs today.

Cross Currency Rates

Japan has followed Switzerland in attempting to stem the rise of their currencies by selling 1 trillion yen in markets, pledging to inject 10 trillion yen ($126 billion) into the economy and the BOJ increased their asset buying programme to 15 trillion yen.

This has led to weakness in the yen but the sharp falls seen in currency markets may also be due to concerns about Japan’s economy and currency in the aftermath of the natural disasters and manmade nuclear disaster. Should the US and global economy enter recession, export led Japan is now very vulnerable.

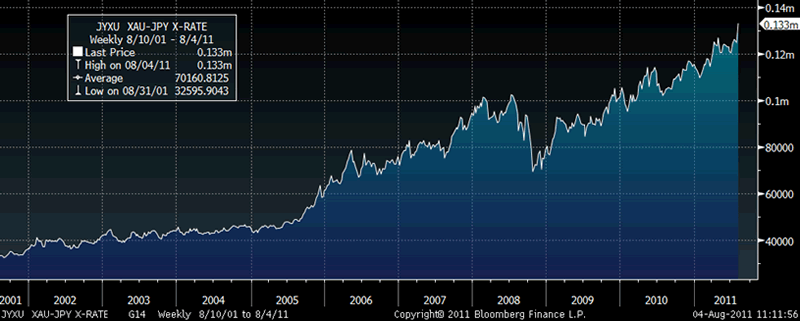

The Japanese yen is no longer a safe haven and this will clearly be seen in the coming months. It can also be seen in the yen’s gradual decline against gold since 2000 (see chart). This gradual decline appears to on the verge of speeding up.

Gold in Japanese Yen – 2 Days (Tick)

Yesterday Switzerland unexpectedly cut official interest rates by 50 basis points to a target range of 0-0.25 per cent and announced money market measures such as purchasing outstanding SNB bills.

Brazil’s Finance Minister Mantega said last November that his nation’s currency, the real, was trading at a reasonable level and announced a “temporary truce” to a global currency war.

Gold in Japanese Yen – 30 Days (Tick)

The truce appears to be well and truly over and the second phase of the global currency war has commenced.

Central bank currency intervention or money printing and competitive currency devaluations have resumed with gusto which is of course bullish for precious metals as they cannot be devalued or debased.

What is extremely bullish is the fact that the yen and franc are not secondary, emerging market currencies rather they, like the dollar, have long been considered safe haven currencies.

Gold in Japanese Yen – 10 Years (Weekly)

The first shots of what looks like the second phase of the global currency war have made UBS become even more positive in their outlook for gold.

“The potential for additional safe-haven flows stemming from central bank interventions in FX markets adds a significant new dimension to our positive outlook for gold” said UBS’ Edel Tully this morning.

“Does central bank intervention have ramifications for gold? Without doubt, as it gives further weight to holding real hard assets over paper assets, which are subject to intervention.”

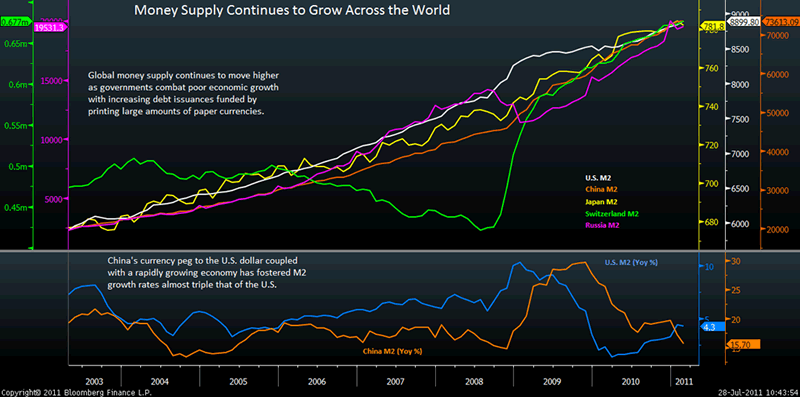

As was seen in one of the 14 charts from yesterday’s update, China’s M2 money supply has been rising by 20%, Switzerland’s by 25%, Russia’s by 30% and the U.S. by a similar amount. Global money supply is increasing by 8%-9%. Japan’s M2 is expected to move higher after recent events.

In order to fight economic and debt issues, paper currency has been printed at historically high levels.

Ultimately, currencies are the stock of individual nations and currency values will be dictated by the health of each country’s economy vis-à-vis other economies.

Value is derived from money supply growth, GDP growth or lack of, demographics, inflation rates, education levels, infrastructure and technology and sound environmental, economic and political policies.

Short term market interventions, be that in stock, bond, currency or gold markets, and artificial manipulation by governments and or central banks will only ever succeed in the short term.

The fundamental laws of supply and demand will in the long term dictate price and value of all assets and currencies.

Stocks or currencies that are diluted or debased more than other stocks will over time gradually lose their value. Today all fiat currencies are being debased which creates an increasing risk of inflation, stagflation and in a worst case scenario – hyperinflation.

While hyperinflation remains an outlier ‘Black Swan’ type macroeconomic scenario - it is imprudent to dismiss it out of hand.

With global electronic fiat currency creation appearing to accelerate it cannot be dismissed.

Property crashes in western economies were not predicted or expected by the majority of experts and the majority of people. Nor were sovereign debt crisis in the US and EU. Those who warned of these likelihoods were largely ignored and dismissed as ‘doom and gloom’ merchants.

The real doom and gloom merchants are the Wall Street and international banks and central bankers who have helped get the world into this mess.

It is often prudent to allow ourselves to think the unthinkable. Real diversification makes us prepared for worst case scenarios.

We should be prepared for worst case scenarios but hope for and strive for more benign scenarios.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.