Correlation between India and Gold

Commodities / Gold and Silver 2011 Aug 05, 2011 - 07:12 AM GMTBy: Willem_Weytjens

Gold is reaching record highs these days. Who benefits most of high gold prices?

Those who hold a lot of the yellow metal of course. In India, there seems to be a real gold rush these days, as we can read in an article at mineweb.com.

At the end of this article, we will compare the Indian stock market with the Gold price, but first, I would like to say a bit more about the Indian Gold market.

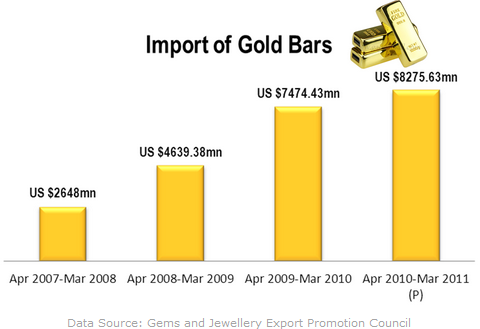

We can see that the nominal value of Gold Bar Imports in India kept rising over the last couple of years, as this chart shows:

Source: iitrade.ac.in

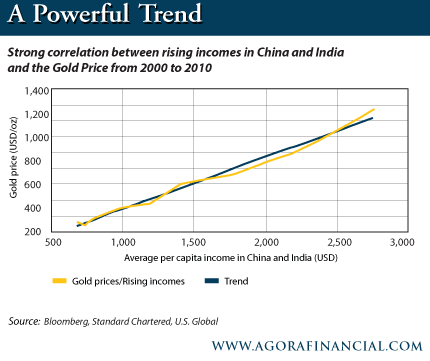

In the next chart, we can see that there is a strong correlation between a rising income in India (and China) and a rising gold price.

The higher the income, the more gold Indian people tend to buy. This leads to more demand for gold, and thus higher prices.

Source: www.agorafinancial.com

From the table below (courtesy TheEconomist),we can see that the savings rate in India is quite high compared to the savings rate of the Western world.

The Indian government seems to be on the right path as well, as the Debt-to-GDP ratio dropped over the last 7 years:

Chart courtesy Tradingeconomics.com

The future looks bright for India, as the population keeps growing at a nice pace:

Chart courtesy Tradingeconomics.com

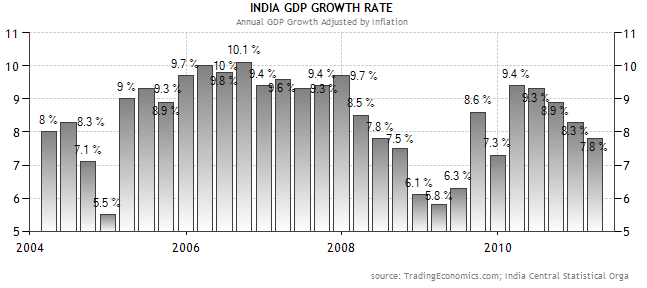

It is expected that the GDP keeps rising over the next couple of years:

Chart courtesy Tradingeconomics.com

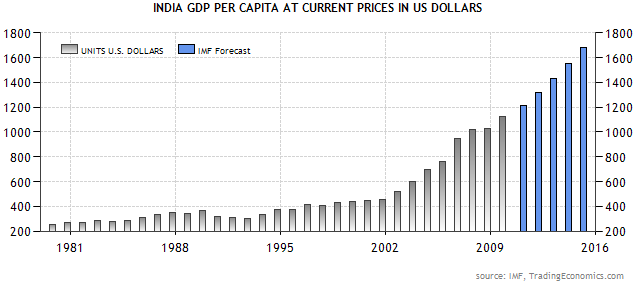

Last but not least, GDP per capita is expected to increase as well over the next couple of years:

Chart courtesy Tradingeconomics.com

Well now, all this looks good for India. Now I was wondering this: ASSUME that the gold price has much further to run, this would have a dramatic impact on Indian wealth, as India is accumulating a lot of gold Bullion. Rising gold prices would mean higher wealth for Indian people. Higher wealth should lead to more consumption. More consumption should lead to more growth. Do you get where I’m going? Higher growth should lead to higher stock prices.

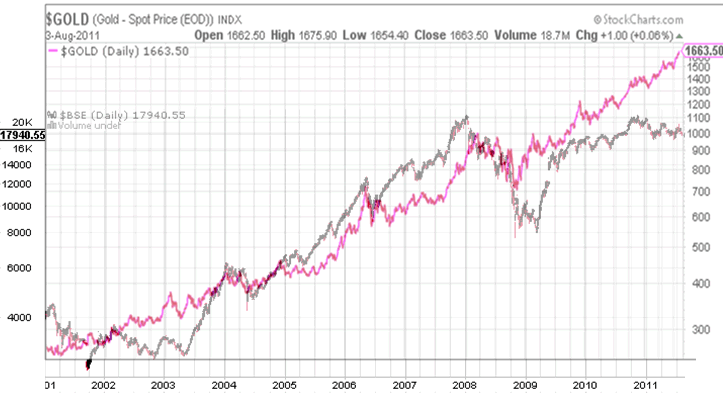

So I therefore compared the Indian Stock market since the precious metals bull market began to the price of gold in the chart below:

Chart courtesy stockcharts.com

Do you see the high correlation from 2001 until 2009? The correlation only broke down over the last 2 years, as the gold price kept zooming higher, while the Indian stock market remained flat. This creates a huge gap between the two lines in the chart above.

If gold keeps going higher, would this mean higher Indian stock markets?

Or is the opposite more of an influence? Is the fact that the Indian stock market didn’t boom in the last 2 years a sign that things are slowing down in India, which will eventually lead to less demand for gold, and thus lower prices?

The future will tell, but I found this an interesting comparison.

For more analyses and trading updates, please visit www.profitimes.com

Willem Weytjens

www.profitimes.com

© 2011 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.