Why Is the Stock Market Plunging?

Stock-Markets / Financial Crash Aug 09, 2011 - 07:13 PM GMTBy: Robert_Murphy

Investors the world over are still reeling from last Thursday's massive plunge in the US equity markets, in which the major indices all gave up more than 4 percent. It was the worst day for the US stock market since December 2008.

Investors the world over are still reeling from last Thursday's massive plunge in the US equity markets, in which the major indices all gave up more than 4 percent. It was the worst day for the US stock market since December 2008.

None of this should surprise those conversant with Austrian economics. The "fundamentals" of the economy have been and remain awful because the government and Federal Reserve are consistently doing the wrong things. The apparent recovery, fueled by Bernanke's sheer money creation, has been bogus all along.

Bubble, Bubble, Bubble

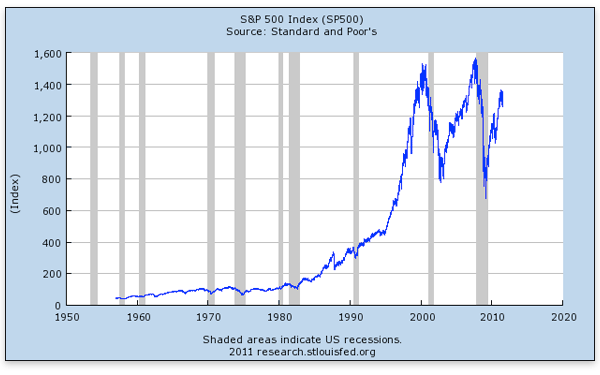

For some reason, people still cling to the vague hope that — at least if we wait long enough — the market always goes up, and "buy and hold" is a great strategy. Let's look at a long-term chart of the S&P 500:

Does the above chart really look like the US stock market is in store for smooth sailing? Just about everyone except Chicago School economists now recognizes, after the fact, that the United States obviously went through a tech and dot-com bubble in the late 1990s and then a housing bubble a few years later. Is it really so difficult to understand that trillions in government budget deficits over the past few years, coupled with unprecedented inflation by the central bank, have set the economy up for yet another crash?

To recapitulate my argument from a previous article: Alan Greenspan's low-interest-rate policy in the wake of the dot-com crash spawned the housing bubble. Greenspan's Fed didn't actually eliminate the need for a recession, but instead postponed the crisis and made it fester. When reality hit in September 2008, Ben Bernanke was in charge of the Fed and implemented his predecessor's failed approach times ten.

No matter how many pundits and famous economists declare otherwise, Bernanke did not save the day with his interventions. He has simply postponed the day of reckoning yet again, and we can expect the final crisis to be much worse than the mere collapse of a few major investment banks. (The short documentary Overdose makes the case in a chilling fashion.)

Ben Bernanke Engineered the "Recovery," All Right

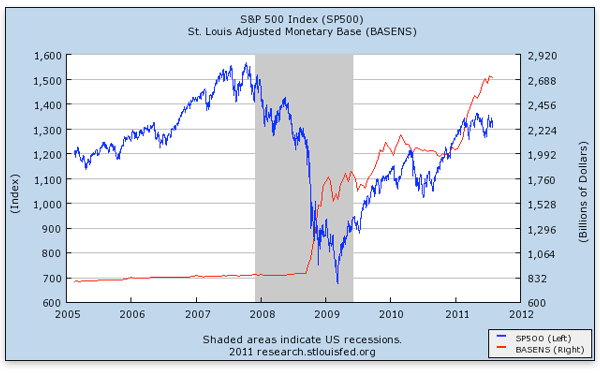

In a perverse way, the pundits are correct in crediting Ben Bernanke's extraordinary programs for "rescuing" the stock market. If we zoom in on the chart of the S&P 500 and superimpose the monetary base, we can see how closely the two have moved since the crisis began.

Although the above chart shows a decent fit, in reality the stock market responded very quickly to changes in the expectations of Fed expansion. Specifically, the sharp upswing in the S&P 500 in March 2009 coincided with the announcement of the Fed's full strategy for (what we now call) QE1, and the market rally in the late summer of 2010 began as knowledgeable Fed officials made it clearer and clearer that QE2 would kick in after the fall elections.

Of course, those economists who believe Bernanke is engaging in a tight-money policy would point to the above as evidence in their favor — the Fed just needs to print more, because it's worked twice already! But if one believes that showering trillions of newly created dollars into the financial sector (with the specific aim of bailing out the very parties who made reckless loans and investments during the housing bubble) is not conducive to a healthy recovery, then the booming stock market of the last few years should have been an ominous sign. Note that this isn't 20/20 hindsight; other Austrians and I have been warning that this "recovery" has been bogus all along, and that the stock market could collapse at any time.

Inflation Lifts All Boats

None of the above analysis implies that investors should dump all equities immediately. It is true that the prospects for real economic growth are terrible — especially in the Western countries — over the next decade, because of increased regulations and swollen government debt loads. But at the same time, various central banks, especially the Federal Reserve, have been all too willing to create new money as an apparent solution to every crisis. (A case in point was the absurd proposal for the Treasury to issue two trillion-dollar platinum coins to evade the statutory debt ceiling.)

In this environment, someone relying on fixed-income investments (such as private annuities or, heaven forbid, government retirement checks) could be wiped out by massive price inflation. As awful as the US real-estate and stock markets might be in the short and medium run, holding a portion of one's wealth in assets not denominated in fiat currency may turn out to be a very wise defensive move. (The problem with shooting the moon on precious metals is that for all we know the dollar will crash next year and Obama will make it illegal to buy and sell gold.)

Conclusion

The US economy still needs to recover from the festering malinvestments that accumulated during the previous two booms. By pushing interest rates down to zero and bailing out the very people who made such bad financial decisions in the first place, the Fed and Treasury are doing everything they can to exacerbate the problem.

In this volatile world economy, investors can expect continued volatility in the stock market. The only thing we can really be sure of is that the government will use each new crisis to justify further extensions of its power. At some point the feds will probably seize the highly volatile 401(k)s and other stock-market holdings from citizens and replace them with "safe" government annuities.

Knowledge of Austrian economics doesn't render someone an expert investor, but it certainly gives advance warning of the major trends in the economy. Those investors who rely on the Keynesians featured at CNBC think that another stimulus package or QE3 might do the trick.

Robert Murphy, an adjunct scholar of the Mises Institute and a faculty member of the Mises University, runs the blog Free Advice and is the author of The Politically Incorrect Guide to Capitalism, the Study Guide to Man, Economy, and State with Power and Market, the Human Action Study Guide, and The Politically Incorrect Guide to the Great Depression and the New Deal. Send him mail. See Robert P. Murphy's article archives. Comment on the blog.![]()

© 2011 Copyright Robert Murphy - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.