Return of the Stocks Bear Market, Do Central Bankers Lead or Follow the Market?

Stock-Markets / Stocks Bear Market Aug 10, 2011 - 07:19 AM GMTBy: Mike_Shedlock

The bear market is back says Australian economist Steve Keen. I agree. Moreover, the recent action, including the rally, offers sufficient evidence. The biggest percentage gains in history have all been in bear market rallies.

The bear market is back says Australian economist Steve Keen. I agree. Moreover, the recent action, including the rally, offers sufficient evidence. The biggest percentage gains in history have all been in bear market rallies.

Let's tune in to The Return of The Bear by Steve Keen.

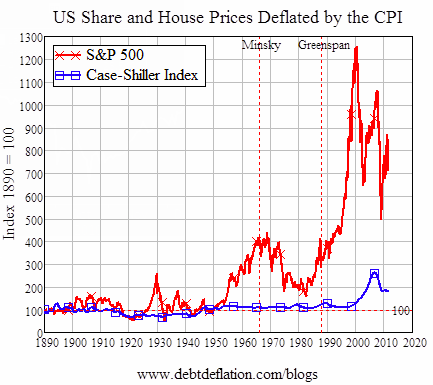

Figure 1: Asset Prices versus Consumer Prices since 1890

Far be it from me to underestimate the stock market’s capacity to pluck the embers of delusion from the fire of reality. However, the crash in the past few days may be evidence that sanity is finally making a comeback. What many hoped was a new Bull Market was instead a classic Bear Market rally, fuelled by the market’s capacity for self-delusion, accelerating private debt, and—thanks to QE2—an ample supply of government-created liquidity.

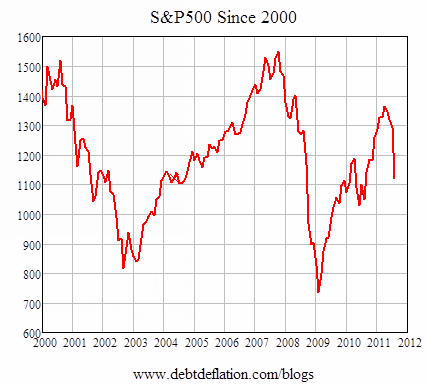

That Rally ended brutally in the last week. The S&P500 has fallen almost 250 points in a just two weeks, and is just a couple of per cent from a fully-fledged Bear Market.

Figure 2: “Buy & Hold” anyone?

The belief that the financial crisis was behind us, that growth had resumed, and that a new bull market was warranted, have finally wilted in the face of the reality that growth is tepid at best, and likely to give way to the dreaded “Double Dip”. The “Great Recession”—which Kenneth Rogoff correctly noted should really be called the Second Great Contraction—is therefore still with us, and will not end until private debt levels are dramatically lower than today’s 260 per cent of GDP.

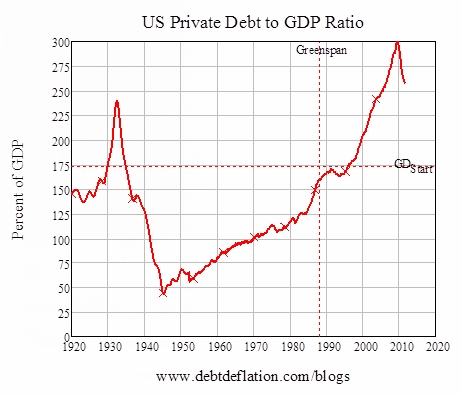

The most egregious cheerleader for asset price inflation was Alan Greenspan. That’s why I’ve marked Greenspan on Figure 1 and Figure 4: if his rescue of Wall Street after the 1987 Stock Market Crash hadn’t occurred, it is quite possible that the unwinding of this speculative debt bubble could have begun twenty years earlier.

Figure 4: US Private Debt to GDP since 1920

Instead, Greenspan’s rescue—and the “Greenspan Put” that resulted from numerous other rescues—encouraged the greatest debt bubble in history to form. This in turn drove the greatest divergence between asset and consumer prices that we’ve ever seen.Debt Deflation vs. Hyperinflation

There is much more to Keen's post, and as usual through the eyes of someone who understands debt deflation. Inquiring minds will want to give his post a closer look.

It is really quite humorous (or do I mean pathetic) to see these repeated calls for hyperinflation when demand for money (the desire to hold it) is soaring.

Negative Interest Rates

Demand for cash is so high that overnight interest rates went negative.

I commented on that demand for cash about a week ago in Bank of New York Mellon to Slap Fees on Big Deposits Following "Global Dash For Cash"; When was Hyperinflation Supposed to Start?

The BNY Mellon apparently does not want money, not to lend, not at all. In a mad dash for cash Mellon has been flooded with it. Overnight lending rates went negative.

Please consider BNY Mellon to Slap Fees on Some Big Deposits Amid Global Race to Cash

Everyone Hoarding Cash

Everyone is looking to hoard cash. Let me ask a simple question.

Does this happen in hyperinflation or does it happen in deflation?

In its grand QE experiment the Fed pushed rates to zero, flooded the world with cash, then expected banks to lend and businesses to expand. Did it work?

Clearly not. No one wants to put that cash to use. If you were a business would you be hiring here? I wouldn't, and neither are businesses. Instead cash sits in banks or short-term treasuries earning zero or even negative percent.

When was hyperinflation supposed to start?

Oh, I just remembered: 2011, a year chosen by at least a couple people. Others expect it next year.

Hyperinflationists simply do not understand the role of credit in a global economy. China has a huge inflation problem and various property bubbles because credit growth is soaring 30% annually.

In the US, banks want credit-worthy borrowers. However, credit-worthy borrowers are parking cash, not asking for more of it.Do Central Bankers Lead or Follow the Market?

Please consider De-mystifying RBA Setting of Interest Rates also on Steve Keen's blog, but written by Phil Williams.

Williams posts a graph that shows "an almost 100% correlation between the cash rate and the 90-day bank bill rates. However the data also shows that in almost every instance the RBA cash rate FOLLOWS the 90-day bank bill rate, rather than leads it."

Williams asks:

- Why do we have the RBA as an interest-rate setting body at all when all they do is follow the market?

- Why does the RBA shroud itself in such mysticism when their actions are so transparent to all?

- What is the quality of our economists, politicians and financial commentators that we have to go through the “Will They or Won’t They” pantomime each month?

- How could any economist get their forecasts wrong, particularly on the up-side?

Regular Mish readers know the answer to this paradox. I covered the paradox in depth in the Fed Uncertainty Principle

Most think the Fed follows market expectations. Count me in that group as well. However, this creates what would appear at first glance to be a major paradox: If the Fed is simply following market expectations, can the Fed be to blame for the consequences? More pointedly, why isn't the market to blame if the Fed is simply following market expectations?

This is a very interesting theoretical question. While it's true the Fed typically only does what is expected, those expectations become distorted over time by observations of Fed actions.

The Observer Affects The Observed

The Fed, in conjunction with all the players watching the Fed, distorts the economic picture. I liken this to Heisenberg's Uncertainty Principle where observation of a subatomic particle changes the ability to measure it accurately.

To measure the position and velocity of any particle, you would first shine a light on it, then detect the reflection. On a macroscopic scale, the effect of photons on an object is insignificant. Unfortunately, on subatomic scales, the photons that hit the subatomic particle will cause it to move significantly, so although the position has been measured accurately, the velocity of the particle will have been altered. By learning the position, you have rendered any information you previously had on the velocity useless. In other words, the observer affects the observed.

The Fed, by its very existence, alters the economic horizon. Compounding the problem are all the eyes on the Fed attempting to game the system.

A good example of this is the 1% Fed Funds Rate in 2003-2004. It is highly doubtful the market on its own accord would have reduced interest rates to 1% or held them there for long if it did.

What happened in 2002-2004 was an observer/participant feedback loop that continued even after the recession had ended. The Fed held rates too low too long. This spawned the biggest housing bubble in history. The Greenspan Fed compounded the problem by endorsing derivatives and ARMs at the worst possible moment.

In a free market it would be highly unlikely to get a yield curve that is as steep as the one in 2003 or as steep as it was just weeks ago when short term treasuries traded down to .21%. In other words we would not be in this mess without the Fed, or if we were, the mess would at least be smaller than the one we are in.

The Fed has so distorted the economic picture by its very existence that it is fatally flawed logic to suggest the Fed is simply following the market therefore the market is to blame. There would not be a Fed in a free market, and by implication there would be no observer/participant feedback loop.

Fed Uncertainty Principle:

The fed, by its very existence, has completely distorted the market via self-reinforcing observer/participant feedback loops. Thus, it is fatally flawed logic to suggest the Fed is simply following the market, therefore the market is to blame for the Fed's actions. There would not be a Fed in a free market, and by implication there would not be observer/participant feedback loops either.The Fed Uncertainty Principle has 4 Major Corollaries.

Interestingly enough I discussed 3 of the four corollaries yesterday in Trichet's Secret "Dragon Transfer" Letter to Italy PM; Watch France CDS Rates as France is "New Italy"; Trichet Illegally Usurps Judge-and-Jury Power

Inquiring minds who have not yet read those posts are encouraged to do so.

Corollary One, Two, Three, and Four apply to the Fed and ECB and in due time the Reserve bank of Australia as well. Indeed, Corollary Number One already applies to the RBA, the Bank of England, and in general all central banks.

Addendum:

In response to the above post, via Email, Steve Keen writes:

Generally I agree with you regarding the Fed Uncertainty Principle. A lot of market action is simply trying to second-guess the Fed--and they're pretty good at getting it right. In Australia's case though, the RBA tends to take too much time before accepting reality, and then over-reacts afterward.

The market is now pricing in a 75 basis point cut next month, when I think they are likely to either keep them on hold or drop them 25 points. Then after a while when the reality of a stagnant economy hits them, they'll cut aggressively, especially if house prices tank.

A Fed is still needed, but only for its clearing house function: banks need a clearing house through which their own debts to each other can be met. But a Fed that tries to fine tune the economy by manipulating the rate of interest is likely to be a disaster, all the more so when it's staffed by neoclassical economists whose fantasy world doesn't include private debt to begin with!Those "Down Under" or interested in housing "Down Under" are encouraged to read Secretly Broke in Australia

Mike

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.