Investment Impact of Primary Stocks Bear Market Trend Since 2000

Stock-Markets / Stock Markets 2011 Aug 19, 2011 - 06:07 AM GMTBy: Brian_Bloom

If you happen to be a retiree, you will understand this is your gut: The Primary Trend of the US equity market has been “down” since 2000. As is clearly visible from the 80 year chart below (courtesy Decisonpoint.com) the market peaked in 2000 – that’s 11 years ago. Any arguments about a pending bull market are just noise. There is no evidence to support the argument being made by stockbrokers and investment funds that the markets will rise to new heights in the foreseeable future. For 11 years they have been talking to their book. Since 2000, the only way to make money on the market has been by trading in an out- which is why the hedge fund industry boomed.

If you happen to be a retiree, you will understand this is your gut: The Primary Trend of the US equity market has been “down” since 2000. As is clearly visible from the 80 year chart below (courtesy Decisonpoint.com) the market peaked in 2000 – that’s 11 years ago. Any arguments about a pending bull market are just noise. There is no evidence to support the argument being made by stockbrokers and investment funds that the markets will rise to new heights in the foreseeable future. For 11 years they have been talking to their book. Since 2000, the only way to make money on the market has been by trading in an out- which is why the hedge fund industry boomed.

But retirees tend to be risk averse. So, assuming you did not put your money into a hedge fund and, everything else being equal, if you had (say) $1,000,000 and you invested it at 6% in 2000, you would have had (ignoring tax) $1.9 million in the bank in 2011.

But everything else was not equal. There were three issues:

- The official US cpi in June 2000 was 178 and in June 2011 was 225.7. (source: http://www.usinflationcalculator.com/inflation/consumer-price-index-and-annual-percent-changes-from-1913-to-2008/ ) This represents an official (if somewhat “cooked”) inflation rate of 2.4% p.a.

- The long bond (30- year) yield has fallen from roughly 6% to 4% (see chart below. Courtesy Decisionpoint.com)

- You probably needed an income to live

Alternative #1

Under this alternative, if we assume that the long bond interest averaged 5% and that you invested your capital on fixed deposit at that rate; and that you needed (say) $50,000 per year to live (adjusted for official 2.4% p.a. inflation) then, ignoring tax, your capital today would be worth $942,963, calculated as follows:

Table 1: $1 million invested at 5% p.a. and $50,000 adjusted for inflation drawn out p.a.

Alternative #2

If you had invested $1,000,000 in the $SPX at its peak of roughly 1,552 then, at yesterday’s level of 1,193, that portfolio would have been worth $768,686. Had you also withdrawn $50,000 a year for 11 years – adjusted for inflation – then you would have withdrawn a cumulative total of 685,982. Therefore, your capital would be worth $82,703, plus whatever it would have been augmented by in the form of dividends. If we assume dividends averaged 2% on an average investment of $500,000 over 11 years, then we can add a (rough) $110,000 to the total.

Alternative #3

If you had bought 30 year bonds with your $1 million, you would have earned an average of 5% p.a. and the capital value of your bonds would have risen also – given that yields have been falling.

Let’s take a rough (back-of-the-envelope) stab at that:

The chart below shows the price of the 30 year bonds rose from roughly 85 to roughly 128 between June 2000 and June 2011 (courtesy Decisionpoint.com). That’s a compound growth rate of 3.8% p.a.

So, if you had bought bonds your net worth would have looked something like this (Author note: For various reasons, the mathematical calculations are not strictly correct. However, the table does serve as a rough guide)

Table 2: Impact of having invested in 30 year treasuries and living off average yield by drawing $50,000 p.a. adjusted for inflation by 2.4% p.a.

Alternative #4

An investment of $1,000,000 in gold in 2000 (at $289/oz as at June 30th) would be worth $5.19 million at June 30th 2011 – from which should be deducted the cumulative drawings of $50,000 p.a. adjusted for inflation ($685,893)

Table 3: Summary comparison, assuming $1 million opening capital, cumulative drawings of $685,893, and ignoring tax

Now, looking forward:

The issue that we need to get to grips with is: what are the probabilities associated with future inflation vs. deflation?

Let’s look first at deflation:

Clearly, if interest rates are expected to continue falling – which will likely only happen under a scenario of price deflation - then fixed term investment will result in a reduction of your net worth over the next 10 years unless you have multiple millions of dollars to invest.

Treasuries: If treasury yields fall to (say) 2.68% in 11 years time and average 3.3% p.a. ((4% + 2.68%)/2) over the period then we have to take a view as to what will happen to the capital value of treasuries.

Well, in very simplistic terms, if treasury prices rose by 50% when yields fell by 33% - from 6% to 4% - then a 33% fall in yields from 4% to 2.68% should also give rise to a capital growth of 50% - from 128 to 192 (also by 3.8% p.a.). The table below shows that $1 million capital will grow to become worth $1.26 million

Table 4: Investing $1,000,000 in long dated treasuries yielding 2.68% p.a. and drawing $50,000 p.a. adjusted for 2.4% inflation

Equities: Clearly, unless the stock market rises to new heights, index based investing is not the place to put all your capital over the coming 11 years. Nevertheless, a case could be made for investing some of your capital there - in very selectively targeted investments. It is conceivably possible that some corporate dividend yields might rise substantially and there will also be some very fast growing listed companies whose share prices will likely rise concomitantly by way of countertrend.

But the market as a whole seems unlikely to rise to new heights. Equally clearly, if printing of dollars by the Fed gives rise to monetary inflation and this, in turn, translates to price inflation, the velocity of money is very likely to slow as discretionary spending dives. Rampant inflation will not necessarily translate to rampant growth in corporate profits. We can get very complicated in our reasoning – or we can look at the very first chart above. That chart shows that the stock market peaked in 2000 and is now bouncing “down” from the resistance of the upper trend line.

Sometimes, it doesn’t pay to get too complicated. The market seems to be saying that the 2000 peak will not be broken on the upside at any time within the foreseeable future.

In turn, this implies that “inflation” does not appear to be on the cards.

Gold:

The question needs to be asked: Given historical inflation of a “mere” 2.4% p.a. why did the gold price (and other commodity prices) rise faster than the US Dollar fell?

They rose faster than the US Dollar fell because the world economy went through a “sweet spot” – which served to ramp demand for “commodities”. Gold in particular, rose because of this and because of perceived rising risks associated with the US Dollar. China and India had spare capacity and a relatively low wage base. Therefore, increased demand – driven by increased money availability (which was sourced by US consumers borrowing against inflating asset values) – translated to increased volumes (of finished goods) as opposed to increased prices. Even though raw material prices rose, economies of scale were enjoyed. Asian Profit and Loss Accounts boomed even as the US personal Balance Sheets inflated. Inflating balance sheets facilitated increased borrowings. But now we have a situation of excess capacity in Asia and slowing velocity of money in the West (because of the debt overhang). It is therefore unlikely that printing of more US dollars will be matched by continued growth in production output in Asia. It follows that, if the Fed continues to print dollars, the price of the US dollar is likely to collapse.

Also, from the perspective of a US investor, if the Fed continues to print dollars then the level of interest rates is more likely to rise than fall. If this happens then investing in treasuries is likely to be a risky proposition.

However, the fact is that the second chart above shows yields are firmly in a downtrend. “The market” appears to be betting that the Fed will not print dollars.

But, if the Fed is not going to print dollars, then why should the gold price continue to rise?

It might continue to rise because the US economy will not be strong enough to justify the US Dollar being seen as the currency of last resort. Unfortunately, this presents us with a dilemma: Is it certain that the world will move from a dollar based currency to a gold based currency? Why not a basket of fiat currencies?

Well, there will likely always be a segment of the investment market that will want “tangible” assets as opposed to “fiat” assets. Further, industrial applications for gold are broadening and demand for gold will grow for that reason. In any event, the (arithmetic scale) chart below (courtesy kitco.com) is a tad misleading. On a logarithmic scale chart the gold price has not yet entered an exponential blow-off phase. We may still be very far from a top in price.

If, over the next 11 years, gold yields an internal rate of return of 16.2% p.a. (as it did in the past 11 years), then the current price of gold of $1,750 will rise to over $6,500 an ounce. This is conceivably possible if gold is to become viewed as the international currency of last resort. I can express no sensible view on such an outcome. It will be like gazing into a crystal ball. Suffice it to say that the outcome, being possible, justifies some proportion of one’s portfolio to be invested in gold.

But the reader should bear this in mind: If the gold price does rise to over $6,500 an ounce, then this will be pictorially represented by an “exponential blow-off pattern” on the charts; and such a pattern is invariably followed by collapse. If the financial world pins its hopes on gold and the core problem is eventually unmasked as having nothing to do with “currencies” then confidence will implode – and the world economy with it.

Nine years ago, I foresaw the scenario we are now facing. This is not an “I told you so” statement. It is a statement of fact. (See: http://www.gold-eagle.com/editorials_02/bloom080502.html ). The reader is recommended to take the trouble to read this latter article, published in August 2002.

The reason I draw your attention to this fact now is that the cause of the world’s economic problems are not related to currencies. They are related to a slowing momentum of “relevant” wealth creation activity and the accompanying rise in debt levels. Wealth creation activities were replaced by financial engineering. On balance, the Western world lived off capital. Therefore, if the gold price does in fact rise to $6,500 an ounce, this will be a sign that the world’s leaders will have continued to believe in “magic puddings” and instead of feeding off fat, we will be feeding of muscle. Under such circumstances, the probabilities will trend towards “certainty” that the world economy will collapse.

There are two philosophical questions that arise:

- On a global economic level, what can be done to avoid collapse?

- On a personal level, how should we invest to protect our balance sheets and cash flows?

I have been grappling with 1. above since 2005. My first factional novel, Beyond Neanderthal, was published in June 2008 (three months before the GFC) and my second factional novel, The Last Finesse, is now complete and is being prepared for publication. There are two “core” problems which these two novels examine from various angles:

- Energy output per capita stagnated across the planet as we (stubbornly) continued to rely on fossil fuels. Solar and Wind do not represent “solutions” because the energy-return-on-energy invested is (still) less than fossil fuels and these so-called renewable resources are not scalable to provide “base-line” electricity. This is particularly serious in context of climate change which is very real, regardless of what the politicians would have us believe. Looking forward, energy output per capita needs to rise to allow us to cope with climate change.

- The Rule of Law has become dislodged from the foundation of ethics on which it was originally constructed. Unless this is addressed, it is a virtual certainty that civilisation will collapse.

Through the media of their fictional (adventure) storylines, the macro issues are examined in these two novels and some suggestions are made as to how we might claw our way out of the economic quagmire. For example, it may surprise some readers to discover that the “Public Debt” overhang in the USA is not necessarily an insoluble problem.

Anyone interested in acquiring copies of either/both of these novels should please email me at info@beyondneanderthal.com Both novels present well researched facts in the “packaging” of easy to read, entertaining storylines.

Turning now to the second philosophical question: How do we protect ourselves on a personal level?

If deflation is more likely than inflation and if the US market is looking toppy, where else could one invest? Should we be taking a “punt” that interest rates will continue soft? Well, let’s put it this way: If interest rates start to rise, the mountain of sovereign debt will likely implode. The debt can’t just be inflated away. That is a pipe dream. Inflation will be accompanied by rising interests rates which, given the debt mountain, will cause the world economy to implode. Optimistically, therefore, one has to take a view that the authorities will come to their senses and that the Fed will become much more circumspect about printing more money. Logically, by keeping interest rates down they can buy time. Therefore, investment of a portion of one’s portfolio in treasuries looks like a sensible course of action.

What about alternative equity markets?

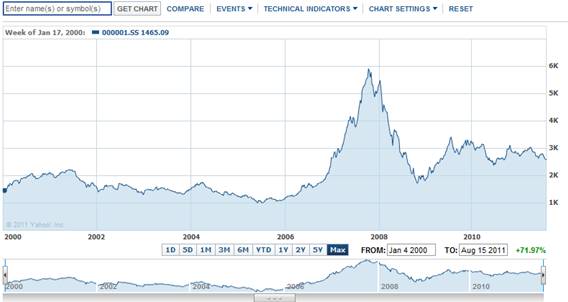

The chart below (courtesy Yahoo.com) shows that the Shanghai market rose by 71.9% from January 2000 – from around 1517 to around 2608. That’s a compound growth rate of 5.16% p.a.

Could it continue to rise at that rate? Of course it’s possible, but the chart above is not showing signs of bullishness. Also, the question of “ethics” is not yet predictable when it comes to dealing with China. For example, that country does not generally respect copyright laws and it is my firm view that future world economic growth will be driven by emerging technologies. In my view, the Intellectual Property associated with technology should not (yet) be transferred to China. Emerging technologies should rather be developed in their countries of origin. For another example, China seems to be prepared to consort with the devil himself – provided it furthers China’s interests. For another example, a “contract” does not seem to mean the same thing in China as it does in the west. It boils down to a question of trust and trust is very subjective. From my personal perspective, if one core objective in the future will be to reconnect the Rule of Law to its original foundation of ethics, then I’m not sure that China is the best place to park your capital – until after that objective has been realised.

Real estate:

This is a possibility, but as has been observed above, the Rule of Law seems to be fraying at the edges. If a tenant doesn’t pay, can he/she be evicted? What about the cost of damage to property by impecunious tenants? And if you don’t have a tenant, real estate is likely to show negative returns. Yes, real estate is “cheap”. But maybe it’s cheap for a reason.

So where does that leave us?

Wealth Creation Activities

It leaves us with genuine wealth creation activities – at both entrepreneurial and corporate level. That is what has changed in the environment, dear reader. The days of financial engineering are gone. Unless you are content to gamble your hard earned capital by allowing some high salaried, bonus driven, computer jockey to play the futures and currency markets with your capital, your portfolio will need to include investments in some wealth creating activities.

In summary, because the risks are rising, the spread amongst conventional investment classes needs to broaden. In particular, it needs to be broadened to include investment in entrepreneurial wealth creation activities.

Overall conclusion

The central bankers’ rules of the game have passed their use-by date. The game has changed. Going forward, building wealth will no longer be about financial engineering. It will be about wealth creation activities. Without investment in wealth creating businesses you can expect your capital – at best – to remain intact and – at worst – to be eaten away.

All this is subject to one over-riding caveat: “Trust”. When it comes to investing in entrepreneurial ventures, the importance of ethics becomes heightened. You will need to be super comfortable with the integrity (and competence) of the management teams in whom you will be investing.

By Brian Bloom

Once in a while a book comes along that ‘nails’ the issues of our times. Brian Bloom has demonstrated an uncanny ability to predict world events, sometimes even before they are on the media radar. First he predicted the world financial crisis and its timing, then the increasing controversies regarding the causes of climate change. Next will be a dawning understanding that humanity must embrace radically new thought paradigms with regard to energy, or face extinction.

Via the medium of its lighthearted and entertaining storyline, Beyond Neanderthal highlights the common links between Christianity, Judaism, Islam, Hinduism and Taoism and draws attention to an alternative energy source known to the Ancients. How was this common knowledge lost? Have ego and testosterone befuddled our thought processes? The Muslim population is now approaching 1.6 billion across the planet. The clash of civilizations between Judeo-Christians and Muslims is heightening. Is there a peaceful way to diffuse this situation or will ego and testosterone get in the way of that too? Beyond Neanderthal makes the case for a possible way forward on both the energy and the clash of civilizations fronts.

Copies of Beyond Neanderthal may be ordered via www.beyondneanderthal.com or from Amazon

Copyright © 2011 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.