Silver Ready to Breakout - Technicals and Fundamentals Suggest $50/oz in Early Autumn

Commodities / Gold and Silver 2011 Aug 31, 2011 - 09:34 AM GMTBy: GoldCore

Gold and silver have fallen after yesterday’s gains due to the very poor consumer confidence data and Federal Reserve murmurings of further monetary easing. Gold is trading at USD 1,792.50, EUR 1,245.10, GBP 1,098.30, CHF 1,471.50 and JPY 137,624 per ounce. While silver is trading at USD 41.21, EUR 28.53 , GBP 25.31, CHF 33.33 and JPY 3,155 per ounce.

Gold and silver have fallen after yesterday’s gains due to the very poor consumer confidence data and Federal Reserve murmurings of further monetary easing. Gold is trading at USD 1,792.50, EUR 1,245.10, GBP 1,098.30, CHF 1,471.50 and JPY 137,624 per ounce. While silver is trading at USD 41.21, EUR 28.53 , GBP 25.31, CHF 33.33 and JPY 3,155 per ounce.

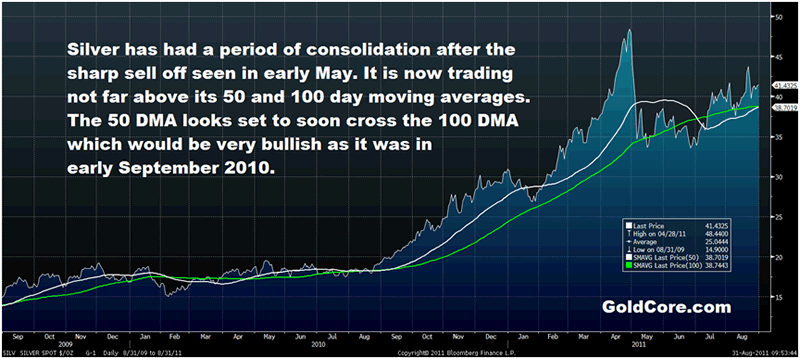

Silver Spot $/oz - G1 Daily 8/31/09-8/31/11, Bloomberg Finance

Gold’s London AM fix this morning was USD 1,826.00, EUR 1,264.19, GBP 1,121.14 per ounce. Gold fix was higher than yesterday’s AM Fix which was USD 1,791.00, EUR 1,243.49, GBP 1,097.56 per ounce.

Gold remains less than 5% from its record nominal high of $1,913.50 per ounce while silver remains nearly 20% below its record nominal high just below $50/oz.

Gold has stolen the limelight from silver in recent weeks with gold reaching a series of new record nominal highs.

But silver has been quietly consolidating after the sharp falls seen at the end of April and in early May when many claimed the silver ‘bubble’ had burst.

Media coverage of silver remains nearly nonexistent which is bullish from a contrarian perspective.

Technically silver is looking better by the day and is now trading not far above its 50 and 100 day moving averages (see chart above).

Today the 50 day moving average is trading at $38.70/oz and the 100 day moving average is trading at $38.74/oz. The 50 DMA is rising after recent price gains and looks set to cross the 100 DMA in the coming days. This will be a bullish technical signal.

Silver’s sell off was very sharp but volatility and a correction was expected and warned of once silver reached the nominal inflation adjusted high of $50 per ounce.

Value buyers continue to accumulate silver bullion. Jim Rogers, one of the most prescient investors of recent times and who arguably has a better track record than Soros in recent years, remains bullish on gold and particularly silver.

A tiny minority of retail investors has begun to look at silver, but it remains largely the preserve of the smart money, a very small amount of people in the United States and Europe concerns about currency devaluation and store of value buyers in Asia.

There are many factors that strongly suggest that silver remains a prudent buy and diversification today.

But there are three key metrics which strongly suggest that silver remains far from a bubble if not undervalued.

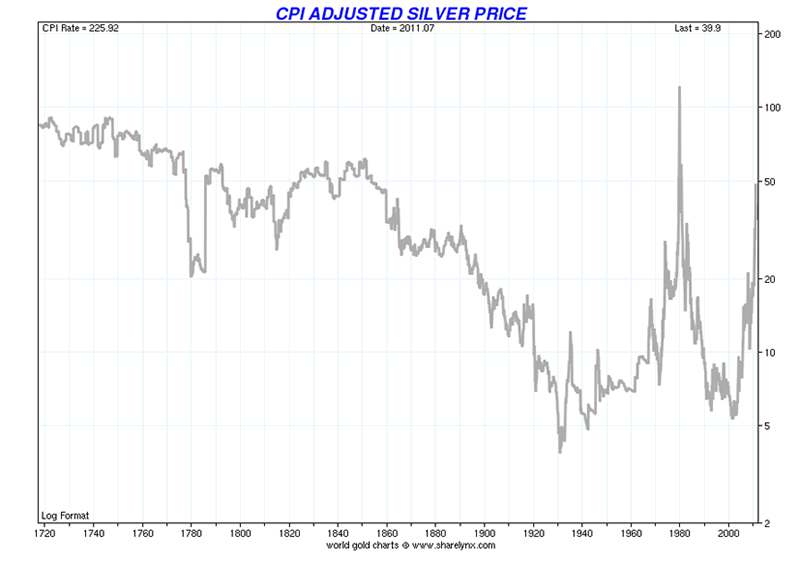

The first is silver’s real price today adjusted for the inflation of the last 31 years. Silver’s real high in 1980 was $130 per ounce – more than double the price today (see chart above).

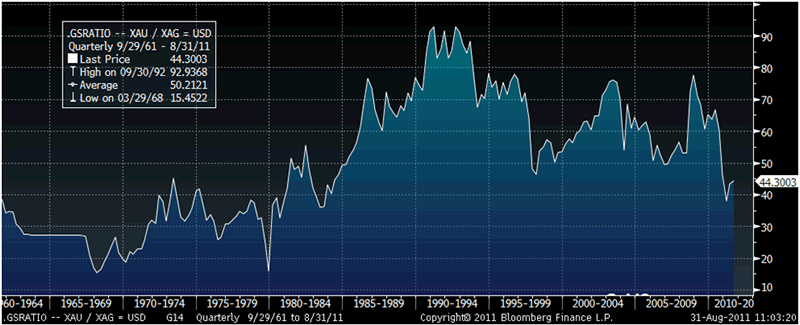

The second is the gold silver ratio which has averaged 15 to 1 throughout history due to geology and the fact that there are 15 parts of silver to every 1 part of gold in the earth’s crust.

Gold Silver Ratio – 40 Year (Quarterly)

Silver, unlike gold, is an industrial metal and a very significant amount of all the silver that has even been mined has been consumed, like oil, since the dawn of the industrial revolution in the 19th century.

Most analysts with a long term view believe that the ratio is likely to revert to the mean of 15 to 1 in the coming years.

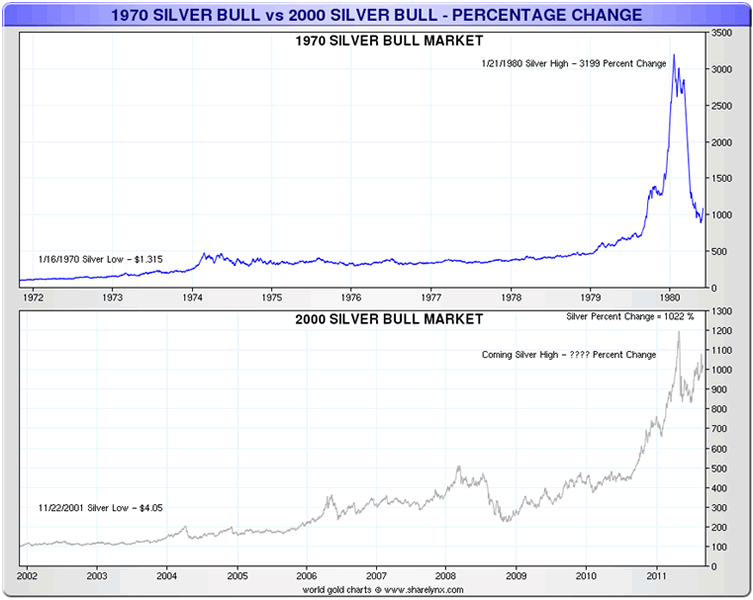

The third metric is comparing silver’s current bull market to that of the 1970s.

Silver has risen by a factor of 10 in the last 9 years – from near $4 in 2001 to over $41 today.

In its bull market from 1971 to 1980, silver rose by over 3,199% or by a factor of more than 32 in just 9 years culminating in the blow off top in 1979.

Today, the physical supply of silver bullion is much less than in the 1970s. Also there is the ‘Asian factor’ and 3 billion people with growing incomes, many of whom see silver as a store of value against currency depreciation.

Demand for silver in Asia has been increasing and in China alone silver demand is increasing from a near zero base. The demand was not present in the 1970s.

Were silver to replicate the performance of the 1970s it would have to rise 32 times or to $130/oz (32 X $4.05).

Interestingly, $130/oz is also silver’s real high from 1980.

Our long held belief that silver could reach the real high, inflation adjusted, of $130/oz remains. However price forecasts should always be taken with a pinch of salt and silver’s value is as financial insurance and a store of wealth that cannot be debased.

For the latest news and commentary on financial markets and gold please follow us on Twitter

SILVER

Silver is trading at $41.31/oz, €28.60/oz and £25.34/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,848.75/oz, palladium at $779/oz and rhodium at $1,800/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.