Fragile State of the U.S. Economy, Bernanke Hints at Additional Monetary Policy Easing

Economics / US Economy Sep 09, 2011 - 01:56 AM GMTBy: Asha_Bangalore

Chairman Bernanke summarized the fragile status of the U.S. economy and indicated that the Fed has tools that it is willing to employ to provide support to the economy. He did not dwell on the specifics of the tools. The key passage of the speech indicating that the Fed is vigilant and will act promptly is noteworthy:

Chairman Bernanke summarized the fragile status of the U.S. economy and indicated that the Fed has tools that it is willing to employ to provide support to the economy. He did not dwell on the specifics of the tools. The key passage of the speech indicating that the Fed is vigilant and will act promptly is noteworthy:

“In addition to refining our forward guidance, the Federal Reserve has a range of tools that could be used to provide additional monetary stimulus. We discussed the relative merits and costs of such tools at our August meeting. My FOMC colleagues and I will continue to consider those and other pertinent issues, including, of course, economic and financial developments, at our meeting in September and are prepared to employ these tools as appropriate to promote a stronger economic recovery in a context of price stability.”

For the hawks concerned about inflation, Bernanke had this to say:

Importantly, we see little indication that the higher rate of inflation experienced so far this year has become ingrained in the economy. Longer-term inflation expectations have remained stable according to the indicators we monitor, such as the measure of households' longer-term expectations from the Thompson Reuters/University of Michigan survey, the 10-year inflation projections of professional forecasters, and the five-year-forward measure of inflation compensation derived from yields of inflation-protected Treasury securities.

It is entirely conceivable that the Fed could put in place additional monetary stimulus at the close of the September 20-21 FOMC meeting. Bernanke concluded the speech as follows:

The Federal Reserve will certainly do all that it can to help restore high rates of growth and employment in a context of price stability

Auto Exports and Imports Dominate July Trade Report

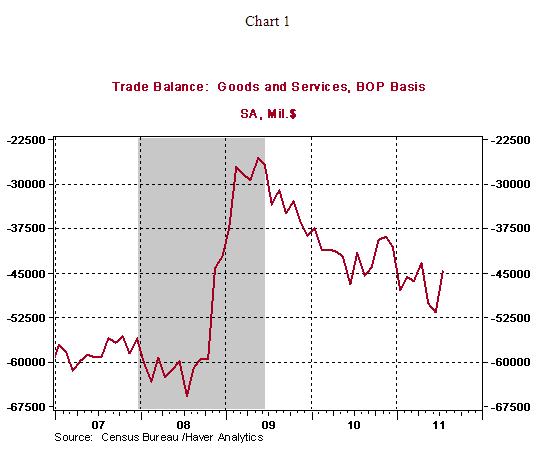

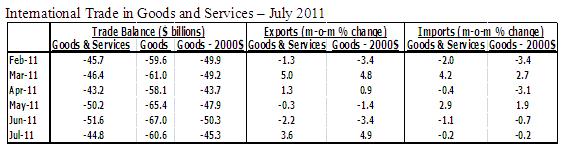

The trade deficit narrowed to $44.81 billion in July from $51.57 billion in the prior month. Exports of goods and services increased 3.6% while imports of goods and services fell 0.2% in July. A narrowing of the trade gap in July is a big plus for third quarter real GDP growth, particularly if it is not reversed in the August-September period.

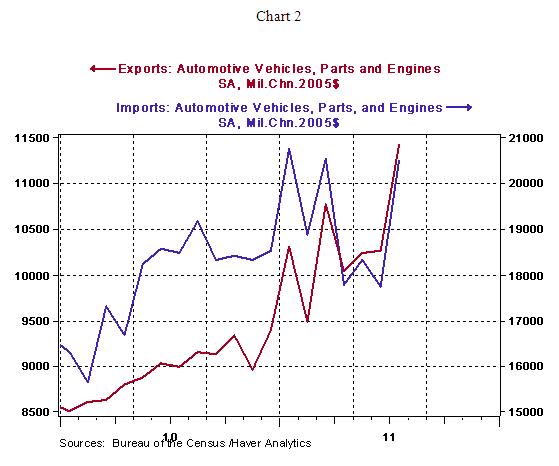

The pickup in exports and imports of autos (see Chart 2) suggests that the supply chain disruption following the Japanese natural disaster in March has been corrected. Exports and imports of autos rose 11.3% and 15.5%, respectively in July.

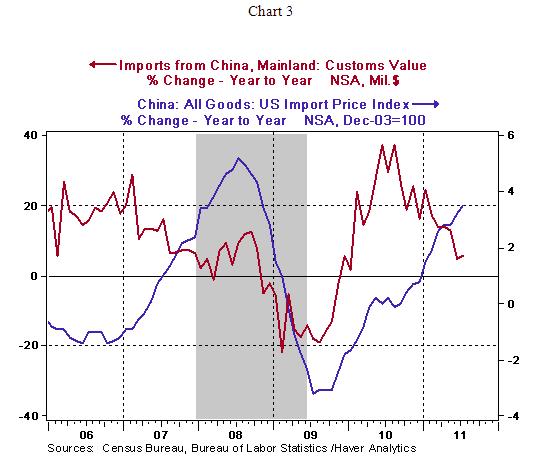

Although the trade deficit vis-à-vis China widened to $26.9 billion in July from $26.6 billion in June, the growth rate of imports shows a significant decelerating trend. Imports rose 5.6% from a year ago in July 2011 vs. a nearly 30% jump in July 2010 (see Chart 3). Slowing economic conditions in the United States and an increase in import prices of Chinese goods are factors holding back the growth of imports from China.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.