U.S. Economy Suffers Lost Decade, The Great Middle Class Poverty

Economics / US Economy Sep 15, 2011 - 04:22 AM GMTBy: EconMatters

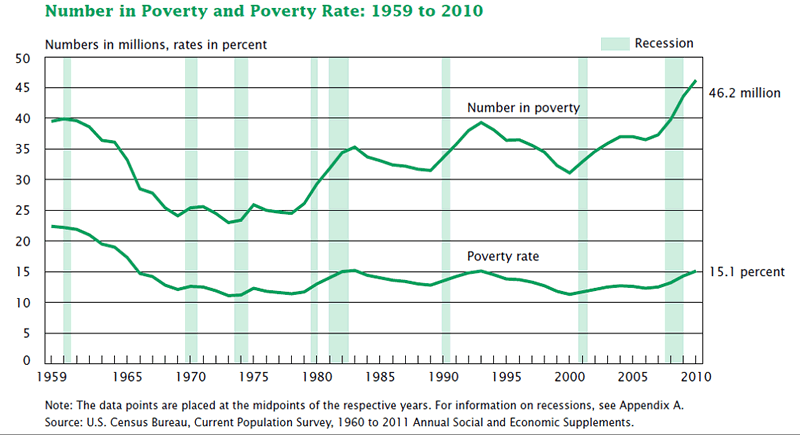

In yet another sign that the Great Recession cuts deep and long--the number of Americans living below the official poverty line reached 46.2 million, the highest in 52 years since the Census Bureau started tracking the figures in 1959.

In yet another sign that the Great Recession cuts deep and long--the number of Americans living below the official poverty line reached 46.2 million, the highest in 52 years since the Census Bureau started tracking the figures in 1959.

The overall poverty rate also climbed to a 17-year high at 15.1%, which means 1 in 6 Americans are living below poverty line largely due to the high unemployment and underemployment rate. The official poverty line for 2010 is defined as an annual income of $22,314 for a family of four, and $11,139 for an individual.

|

| Chart Source: The Census Bureau |

|

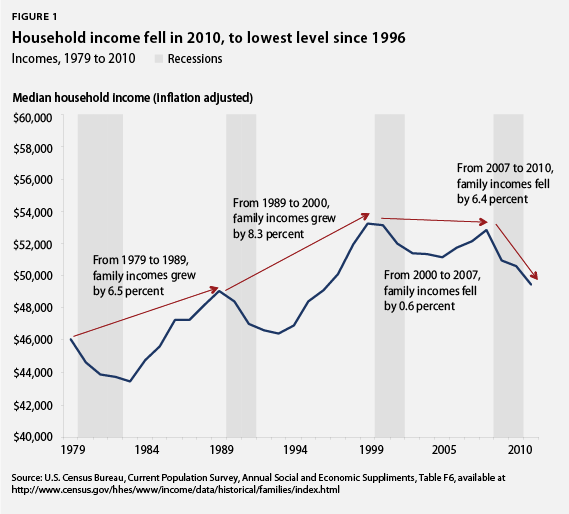

| Chart Source: The Economic Policy Institute |

NYT quoted Lawrence Katz, an economics professor at Harvard University that

“This is truly a lost decade. We think of America as a place where every generation is doing better, but we’re looking at a period when the median family is in worse shape than it was in the late 1990s.”

But the worse news is that experts are saying this year is unlikely to get any better. There are quite a few factors and triggering events that could push even more families and individuals over the poverty edge this year.

The Census Bureau estimated that new unemployment benefits passed in 2009, which extended payment-period up to 99 weeks for laid-off workers, helped 3.2 million stay above the poverty line. Social Security kept about 20.3 million, seniors as well as working-age adults receiving disability payments, out of poverty.

But as the government stimulus money largely dried up, the 99-week unemployment benefit is due to run out this year if not extended. Some in Congress have proposed cutting social programs, while state and local governments are cutting jobs and budgets at an accelerated pace.

The nation's unemployment rate has hovered around 9% for more than two years. The total number of unemployed has grown to more than 14 million as of August 2011. Based on the estimate by the Economic Policy Institute, the jobs gap is estimated to be 11.1 million as of July 2011, and the pace of new jobs came to a screeching halt in August, which basically suggests downward income mobility.

All these events partly supports a separate analysis by the Brookings Institution that at the current rate, the recession will have added nearly 10 million people to the poor by the middle of the decade (which is only about 4 years away).

As if the U.S. has not had enough problems of its own, the potential Euro Zone sovereign debt crisis, if not contained, could pose as a potential threat of another global Lehman-like financial crisis. U.S. Treasury Secretary Geithner already went for an unprecedented meeting with Euro Zone finance ministers as talk of a potential Greek debt default and pressure on Italy could roil Europe's banking sector as well as its economy.

While President Obama is pressing the bloc's big countries to show leadership, the U.S. actually is in dire need of extraordinary leadership with a sharp strategic focus to turn the country around. That, unfortunately, is something we have witnessed neither in the current Administration, nor in the handful of future presidential candidates.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.