Buy SPXU, and Watch AGQ, SLV and PSLV for Once in a Lifetime Chance

Stock-Markets / Financial Markets 2011 Sep 26, 2011 - 02:03 AM GMTBy: George_Maniere

Pro Shares Ultra Pro S&P 500 (UPRO) is a triple leveraged fund that seeks a 300% return on the performance of the S&P for a single day. Conversely, The Pro Shares Ultra Pro Short S&P 500 (SPXU) seeks a triple leverage or 300% return on the inverse performance of the S&P 500. If you believe as I do that we are setting up for a leg down on the S&P then SPXU is the best way to profit from this trade.

Pro Shares Ultra Pro S&P 500 (UPRO) is a triple leveraged fund that seeks a 300% return on the performance of the S&P for a single day. Conversely, The Pro Shares Ultra Pro Short S&P 500 (SPXU) seeks a triple leverage or 300% return on the inverse performance of the S&P 500. If you believe as I do that we are setting up for a leg down on the S&P then SPXU is the best way to profit from this trade.

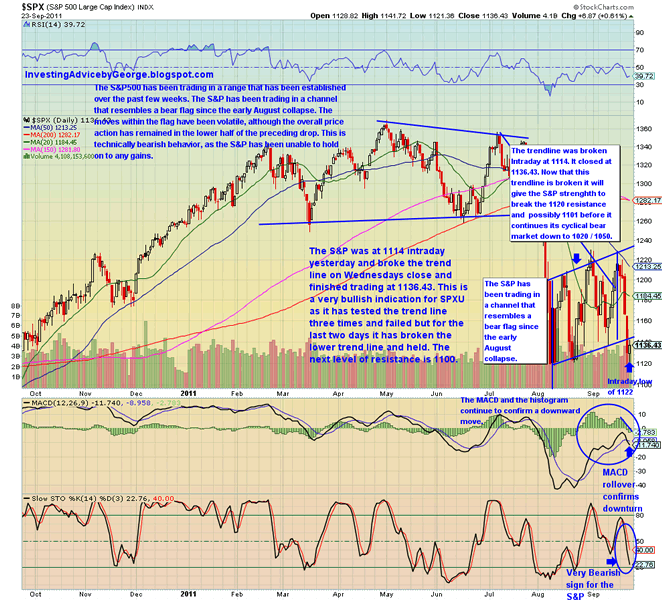

Several weeks ago I made a bold prediction that the S&P would sell off to 1020 / 1050. I was royally roasted on the websites for my call. I received more than my fair share of name calling as the S&P hit the bottom trend line of 1120 and bounced up. I replied to readers that I may have been guilty of being too soon on my call but that in a few weeks I would be right.

I recommended that readers buy SPXU at $17.00 and when the S&P hit the 1020 / 1050 level to sell it all and move into UPRO. Last week we saw the S&P sell off and SPXU move up about 30%. While it did pull back on Friday to close down 1.68% at $20.51 I stand firm in my conviction that we will see the S&P sell off. This week promises to be a very pivotal week. Please see the chart below.

A look at the chart of the S&P from Fridays close shows that while it did pull back 1.68% to close at $20.51 all of the indicators are in place for a test of the 1100 resistance level. This resistance level is very week and once it breaks this level it will go to 1020 / 1050 within three weeks. At this point you will want to sell SPXU and buy UPRO as the S&P will move back to 1200.

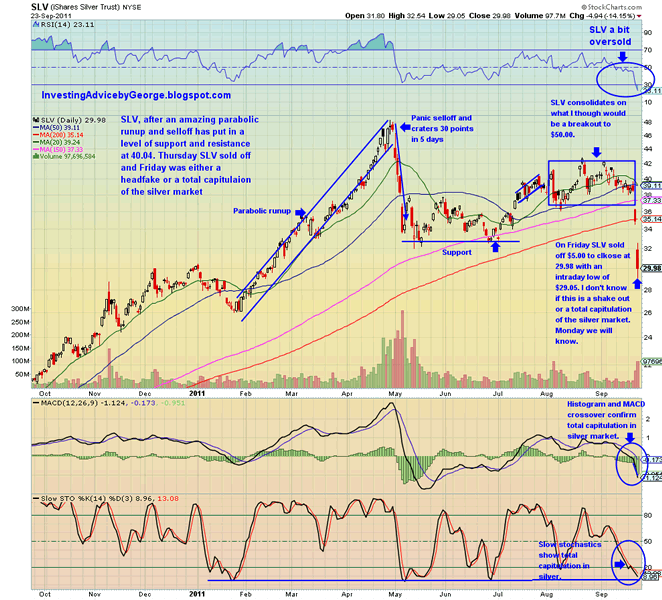

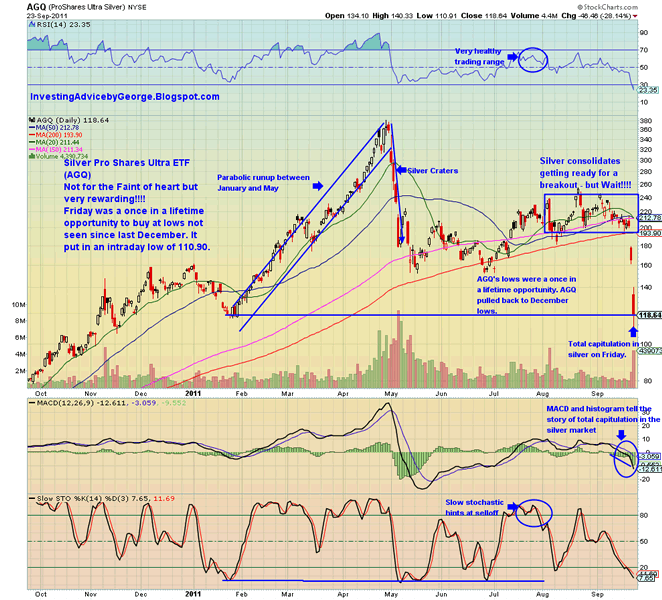

To further illustrate the market’s weakness on Friday I bought AGQ at $120.00 and I also bought puts on AGQ at $110 at the October 3 strike level. AGQ closed at $118.64. Spot Silver closed on Friday at $30.21 and SLV closed at 29.98 and PSLV closed the trading day at 14.52. Meanwhile gold sold off $90.00 to close at $1662.20. Please see the chart of AGQ and SLV below.

Both of these charts show one of two things. Either this is a total capitulation of the silver market which I can only conclude means even weaker global growth as silver has many industrial uses or it is a classic head fake to shake out anyone that had an inkling of going long.

In conclusion, tomorrow will be a very important day. The failure of the IMF and the ECB to take decisive action in Europe, particularly Greece tomorrow will shake the entire global economy. The downgrade of the French banks didn’t help and could well tip Europe into a full blown crisis. This would have a global ripple effect that would push the Western World into an economic recession but significantly worsen the outlook for the global economy.

Before I take my leave, I must say I find it a bit ironical that the contagion in tiny island of Greece could set off this ticking time bomb. Is there any good news? As long as the politicians keep kicking the can down the road, there won’t be any good news for quite a while. It’s like trying to put the fire out after the house has burned down. There is nobody that I have read that believes that another bailout of Greece will work. Greece has already defaulted. It’s just paper work and everyone is waiting for the inevitable, so let’s get on with it. At least that will be a small step in the right direction.

As I write I am long SPXU, SLV, PSLV and AGQ.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.