Markets Whipsaw, 2008 Financial Crisis Causes and Consequences

InvestorEducation / Learn to Trade Oct 03, 2011 - 01:38 AM GMTBy: Joseph_Russo

What Does Whipsaw Mean?

What Does Whipsaw Mean?

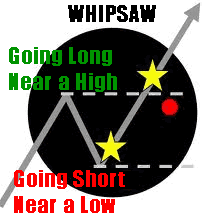

Simply stated, a whipsaw market condition is present when a security's price heads in one direction then reverses sharply and abruptly in the opposite direction.

Derived from the push and pull action used by lumberjacks to cut wood with a type of saw with the same name, the term has become synonymous with large fast-moving head-fake-type swings in the financial markets.

Derived from the push and pull action used by lumberjacks to cut wood with a type of saw with the same name, the term has become synonymous with large fast-moving head-fake-type swings in the financial markets.

Whipsaw is an ever-present challenge in the trading and investment arena. According to one of Jack Schwagers original Market Wizards Ed Seykota, the only way to avoid whipsaw losses is stop trading and investing. Disengagement may work for a time however; I do not believe that Seykota intended for people to interpret his quote as a serious solution.

Seykota, best known for his extremely successful trend-based strategies, concedes that each is subject to whipsaw drawdowns and losses. In addition to being one of the best-in-class trading systems developers, Seykota has musical talents and a rather keen sense of humor as well.

The video below is of Ed Seykota and his blue grass band performing "The Whip-Saw Song." Embedded within the artistic levity are numerous pearls of wisdom. Do enjoy.

If you want to get insight and exposure to successful trend trading strategies like those used by Ed Seykota, subscribe to the NAVIGATOR today.

RELATED NEWS

2008 Financial Crisis Causes and Consequences

John Allison, Retired Chairman and CEO, BB&T Corporation recently spoke to the Harvard Law School Tea Party about the causes and consequences of the 2008 financial crisis.

The hour and a half C-Span coverage of the event is well worth the time. Allison's talk clarifies succinctly all that is going on in the global financial sphere and its impact on regional economies around the world.

Apart from the bounty of illuminating financial and political aspects of Allison's talk, the one thing that also struck a chord were his thoughts and philosophy regarding individuals' sense of purpose and self-esteem relative to their chosen career paths.

Deriving passion from ones chosen field of expertise aligned with a mission to assist others and make the world a better place is the underlying theme of Allison's philosophy.

After soaking in all of the shared wisdom, I asked myself three things:

- Am I passionate about my work?

- Am I assisting others?

- Am I attempting to make the world a better place?

Though there is always room for improvement on every front, to my delight, I was able to answer yes to each of these three essential questions.

Nothing Risked-Nothing Gained

There is no way to avoid regular bouts of occasional and sometimes extended periods of whipsaw.

In a choppy market riddled with whipsaw, the only strategy that may deliver alpha is a successful counter-trend strategy however; they too are subject to their own brand of whipsaw.

Trade Better/Invest Smarter

Elliott Wave Technology provides a suite of Winning Solutions designed to assist those who wish to trade better and invest smarter based upon the practice and deployment of proven trading strategies in concert with expert and unbiased chart analysis.

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.