US Fed Term Auction Facilty to Drive Interbank Rates Lower

Interest-Rates / US Interest Rates Dec 13, 2007 - 12:18 AM GMTBy: Paul_L_Kasriel

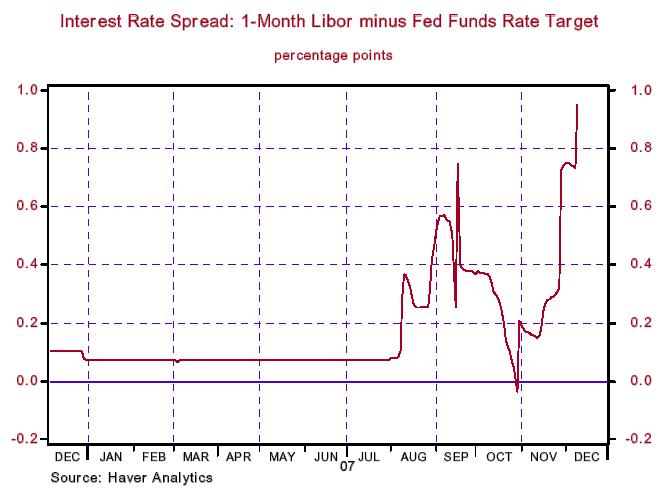

A lot of us were scratching our heads yesterday at 1:16 pm CST as to why the Fed did not reduce the spread between its discount rate and its federal funds rate target so as to alleviate pressures in the term Libor market that have developed since August (see Chart 1 below). Little did we know that the Fed had a little holiday stocking stuffer to give us today - Term Auction Facility.

A lot of us were scratching our heads yesterday at 1:16 pm CST as to why the Fed did not reduce the spread between its discount rate and its federal funds rate target so as to alleviate pressures in the term Libor market that have developed since August (see Chart 1 below). Little did we know that the Fed had a little holiday stocking stuffer to give us today - Term Auction Facility.

Chart 1

TAF is akin to the regular discount window facility except that it will provide Federal Reserve credit to depository institutions (mainly banks) at interest rates lower than what they could obtain from the regular discount window. The regular discount rate is 50 basis points over the FOMC's federal funds rate target. To borrow funds from TAF, banks will participate in an auction, submitting interest rate bids for funds. The minimum bid rate for the auctions will be established at the overnight indexed swap (OIS) rate corresponding to the maturity of the credit being auctioned.

The OIS rate is a measure of market participants' expected average federal funds rate over the relevant term. In other words, if the federal funds rate were expected to remain constant over the next 30 days, the OIS would be approximately at the current level of the federal funds rate. Each TAF auction will be for a set amount of funds, the first two for $20 billion each. As this is being written, we do not know upon what basis the winning bids will be allocated. The same collateral from bank borrowers will be accepted by the Fed under the TAF program as it does under the regular discount window facility. The Fed accepts a wide variety of collateral for discount window borrowing ( http://www.frbdiscountwindow.org/discountmargins.pdf ).

Today the interest rate on one-month Libor borrowings was 5.10%. If the first TAF auction were held today, presumably banks that could borrow one-month funds at 5.10% in the Libor market would bid less than this in the TAF auction. Moreover, today the discount rate is 4.75%. Again, if a TAF auction were held today, banks presumably would bid less than 4.75% for funds.

In recent months, banks have increasingly been tapping Federal Home Loan Banks (FHLBs) as a source of term lending as other funding sources have pulled back due to credit concerns. To simplify the analysis a bit, lenders now purchase the liabilities of the FHLBs rather than the liabilities of the banks, and the FHLBs then lend to the banks. The credit risk is being shifted to the FHLBs. To the degree that funds can be borrowed from the TAF program at a lower rate than from the FHLBs, we would expect to see FHLB lending slow.

As mentioned above, the Fed will accept a wide range of collateral at the regular discount window and under the TAF program. A question arises as to whether the Fed will be taking a large enough "haircut" on some of the collateral being presented to it by successful TAF bidders. If the markets cannot price some of these securities, how does the Fed know what they are worth? If a TAF borrower were to become insolvent, the Fed might not be able to recover the full amount it had loaned the bank. In effect, the TAF program, as well as the regular discount window facility, transfers credit risk to the Fed, which means ultimately, to the taxpayer. Depending on how the Fed prices the collateral presented to it, the TAF program could be construed as a taxpayer subsidy to banks presenting "questionable" collateral. Remember, there is no such thing as a free bailout.

Total reserves in the banking system as of December 5 were $44.4 billion, of which $34.9 billion were vault cash eligible to satisfy reserve requirements. So, a $20 billion injection of reserves via the TAF program would represent almost a 50% increase in total bank reserves. A 50% increase in reserves would drive down the federal funds rate below its 4.25% target level. As a result, the Fed will need to drain reserves from the banking system via open market operations as reserves flood in via the TAF program.

Although the TAF program is likely to alleviate some of the credit stringencies in the money markets, it is unlikely to meaningfully correct the lending errors made in this cycle. There was initial euphoria in the U.S. stock market today when the TAF program was announced. Although the major stock market averages did finish in the black, albeit well off their session highs, indexes of bank and home builder stocks finished in the red, suggesting that, upon reflection, TAF may provide only marginal relief to a major economic headache.

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.